Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : IMF Approves $15 Million Loan to Boost Mali’s Recovery

June 10, 2013

- Interest-free emergency loan to back policies assisting economic recovery

- IMF loans help catalyze resumption of donor support of more than $4 billion

- Any setbacks to democratic transition could hit confidence, derail recovery

The IMF’s Executive Board approved June 10 a $15 million interest-free emergency loan for Mali to support the country’s policies aimed at maintaining macroeconomic stability and assisting economic recovery after a decline in 2012.

Produce in Bamako, Mali, where good harvest in 2012 helped moderate impact of country’s security, political crisis (photo: Habibou Kouyate/AFP/Newscom)

WEST AFRICA

The loan is being made under the Rapid Credit Facility, the IMF’s concessional window for countries that have experienced serious economic disruptions and need rapid support.

The new loan for Mali follows another of $18 million that the IMF Board approved in January. Both loans have helped to catalyze the resumption of donor support for the post-conflict West African country totaling more than $4 billion.

In recent years, Mali has experienced one of the most serious crises in its modern history. Following a devastating drought in 2011 and resulting food insecurity that affected close to one-third of its population, the country suffered a security crisis as insurgents took control of the north in early 2012. A military coup in March 2012 further destabilized the already fragile political situation.

The security events had major humanitarian and economic consequences. In the north, about 400,000 refugees fled the fighting and about half of them found refuge in neighboring countries—Burkina Faso, Niger, Mauritania—and the other half became displaced inside Mali.

State finances under pressure

The economy slipped into recession as the deteriorating security situation prompted a sharp reduction of travel to Mali, hitting the commerce, hotel, and restaurant sectors. Government finances came under pressure, as tax revenues weakened and donors suspended budget support pending the authorities’ adoption of a clear roadmap for the return to a democratically elected government.

The compression of public investment—the first line of defense for the government to contain the budget deficit—contributed to a contraction in the construction and service sectors of the economy. Internal and external payment arrears emerged despite the government’s strenuous efforts to keep public spending in line with declining revenues.

Prospects improved in early 2013. French-led military intervention drove the rebels out of the towns in northern Mali and allowed the government to begin restoring control over the entire territory. The roadmap for organizing presidential elections next year was adopted by the transitional government of national unity and the national assembly.

Donor support

The IMF loan disbursement in January, along with the government’s commitment to elections and sound policies, helped catalyze donor support. At a May 2013 donor conference in Brussels, donors pledged assistance of about $4 billion for 2013–14. This will provide a significant shot in the arm for the country in need.

The challenges facing Mali remain daunting. On the political front, the country needs to restore full government operations in the north, organize democratic elections on a tight schedule, and consolidate peace. At the same time, its government is struggling to support a nascent economic recovery and maintain economic and financial stability amid rising public expenditure pressures.

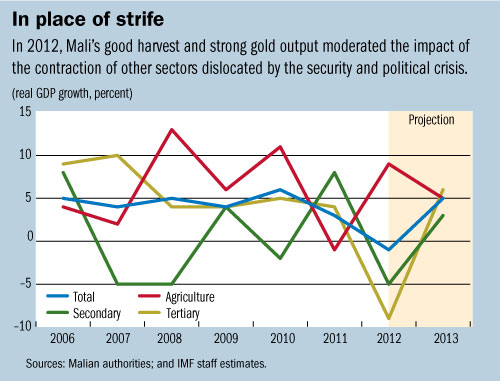

Today, the economy is poised for recovery (see chart). The prospect of resumed large-scale donor support has improved confidence, while associated public spending is expected to boost the sectors affected by the security and political crisis. However, risks remain: agricultural output is subject to climatic conditions, while an increase in social tensions or setbacks on the path of democratic transition could undermine the still fragile confidence and derail the projected recovery.

Prudent fiscal policy is a stabilizing factor. Until now, fiscal restraint has helped maintain macroeconomic stability in difficult times. With the resumption of donor aid, the challenge will be one of maintaining prudent fiscal policy and ensuring effective deployment of the additional resources.

The government’s spending plans for 2013 strike the right balance between the priority of addressing the immediate security and social needs, and clearing arrears. The financing mix, which minimizes the recourse to domestic bank borrowing, should leave more space for bank lending for the private sector—important for restarting economic growth.

Infrastructure investment

In the medium term, harnessing the potential for increasing growth and reducing poverty requires progress on reforms to increase fiscal space and deepen the financial sector. The full development of the vast agricultural land that can be irrigated would make growth more inclusive. This requires more investment in priority spending like road, power, and irrigation infrastructure; modernized agricultural production techniques; and education and health.

To create fiscal space for such spending

• Tax revenue needs to be increased through the reduction of tax exemptions, the elimination of energy subsidies, and the overhaul of the tax and customs administrations)

• Nonpriority spending needs to be reduced through the elimination of transfers to the loss-making state-owned electricity company, housing and development banks, and pension funds, and

• Cash flow management needs to be tightened by implementing a single treasury account.

To foster private sector investment, access to financing needs to be expanded by speeding up the resolution of banks’ nonperforming loans, reforming the land code to facilitate use of land as collateral for bank credit, and strengthening the microfinance sector.