Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Ghana’s Advance to Middle-income Status Requires Firm Policies

June 28, 2013

- Strong growth momentum amid significant short-term vulnerabilities

- Debt sustainability weakened by unexpectedly high fiscal deficit

- Higher borrowing costs, unreliable energy supply risk curbing growth

With robust economic growth of 8 percent, strong democratic institutions, and favorable prospects for oil and gas, Ghana is attracting significant foreign direct investment.

Ghanaian gold prepared for shipment. Export concentration in gold, cocoa, and oil leave economy exposed to terms of trade shocks (photo: Randy Olson/Corbis)

ECONOMIC HEALTH CHECK

However, continued success will depend on strong political will to decisively confront Ghana’s short-term vulnerabilities, the IMF said in its regular review of the West African nation’s economy.

Mining and agriculture dominate Ghana’s exports, but construction and services now account for more than half of the country’s output, while a large majority of jobs remain in the informal sector. Ghana has made great strides in reducing poverty to less than 30 percent of the population and has recently reached lower middle–income status. Offshore oil production started in late 2010, with new discoveries to come on stream over the medium term.

The newly elected government has adopted an ambitious transformation agenda centered on economic diversification, social inclusion and job creation, and macroeconomic stability. It recognizes that better infrastructure, further investment in health and education, and sustained macroeconomic stability will be central for Ghana’s ambition of achieving full middle-income status and raising the living standards of all its citizens.

Risks to growth, stability

A large current account deficit, growing public debt, and a low official reserve buffer all expose the economy to significant stability risks. A rising public sector wage bill and costly energy subsides led to a near tripling of the cash deficit to 12 percent of GDP in 2012.

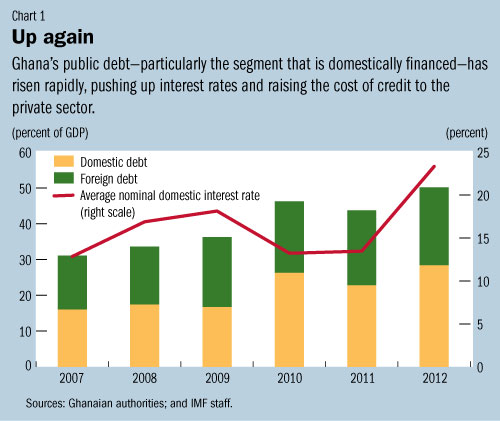

Monetary policy was tightened with some delay last year to halt a rapid currency depreciation, but success came at the cost of double digit real interest rates, raising the cost of credit to the private sector (see Chart 1).

Survey-based inflation expectations remain elevated at above 10 percent, and the current account deficit is projected to stay high at 12 percent of GDP, reflecting a weaker outlook for cocoa and gold exports.

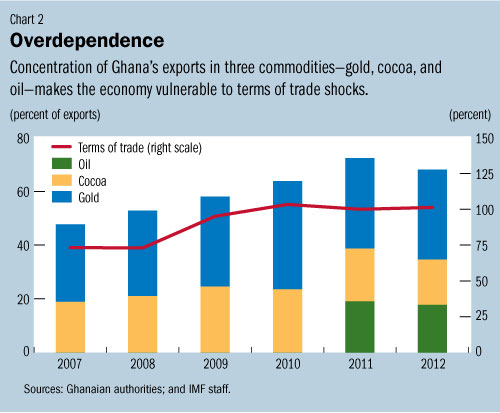

Structural problems in the energy sector also pose risks to growth and economic transformation, while the concentration of exports in three commodities—gold, cocoa, and oil—makes the economy vulnerable to terms of trade shocks (see Chart 2).

In this context, IMF staff identified two principal policy priorities.

First, rebalancing the macroeconomic policy mix: The IMF staff pointed out that safeguarding stability, by rebuilding fiscal and external buffers, is the main immediate challenge.

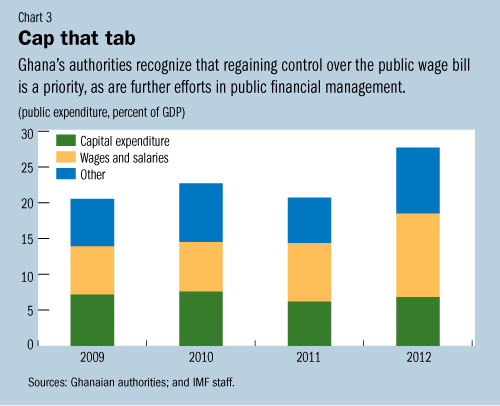

â— Fiscal consolidation: The authorities recognize that regaining control over the public wage bill is a priority and that achieving their fiscal deficit target of 9 percent of GDP in 2013 and 6 percent in 2015 will additionally require further efforts in public financial management and revenue administration (see Chart 3). A new package of revenue measures, aimed at addressing fiscal risks, was announced in May 2013.

The IMF staff recommended additional savings of 3 percent of GDP by 2015 to reduce debt and external vulnerabilities. Without the additional fiscal adjustment, Ghana’s public debt burden would likely remain high, and official reserves would continue to fall short of the authorities’ target of 4 months of imports, leaving the economy exposed to terms of trade shocks and destabilizing shifts in confidence.

Spending priorities

Going forward, successful economic transformation will require a realignment of spending priorities, further advances in revenue mobilization, and structural fiscal reforms to restore policy credibility and build institutional resilience to the political cycle.

â— Maintaining tight monetary policy: There was broad agreement that monetary policy needs to remain tight until fiscal consolidation is firmly established. Subsequent to the mission, during its May 2013 meeting, the Monetary Policy Committee raised the policy rate by 100 basis points to 16 percent. Decisive fiscal consolidation will, in due course, also allow for a reduction in interest rates.

Second, advancing middle-income status and promoting inclusive growth. Lack of access to affordable credit and reliable energy supply are key constraints to growth, presenting a particularly heavy burden for small and medium-sized enterprises. In support of the authorities’ growth and development agenda, the IMF staff recommended

â— A gradual reduction in interest rates through fiscal consolidation;

â— A realignment of spending away from wages and subsidies toward investment;

â— Energy sector reforms, including cost-recovery pricing to improve the financial situation of energy providers; and

â— Further improvements to Ghana’s already strong business environment.