Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Mideast Faces Lower Growth Prospects, Needs Bold Policies

November 12, 2013

- Most oil exporters enjoy solid non-oil growth, but must strengthen budgets

- Outlook of oil importers weakened by political uncertainty, social pressures, conflict in Syria

- Oil importers need to create jobs, restore fiscal order, embark on bold reforms

The near-term economic outlook for the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region has weakened, the IMF said in its latest regional assessment.

Oil refinery, Libya. Domestic disruptions of oil supply have contributed to temporary setback in Mideast growth (photo: Ismail Zitouny/Reuters/Newscom)

Regional Economic Outlook

The IMF’s Regional Economic Outlook for the region, released November 12, projects growth to decline to 2¼ percent this year and to pick up in 2014 as global conditions improve and oil production recovers (see table).

The region’s oil exporters—Algeria, Bahrain, Iran, Iraq, Kuwait, Libya, Oman, Qatar, Saudi Arabia, the United Arab Emirates, and Yemen—are facing a temporary setback in headline growth amid domestic oil supply disruptions and lower global demand, but most continue to post solid non-oil growth, the report says.

Meanwhile, difficult political transitions and increased regional uncertainties arising from the complex civil war in Syria weigh on confidence in the region’s oil importers, in particular, Egypt, Jordan, Lebanon, Morocco, Pakistan, Sudan, and Tunisia.

“Policy priorities for oil-importers include creating jobs, putting fiscal house in order and embarking—without delay—on a bold structural reform agenda,” IMF Middle East Department Director Masood Ahmed told a press conference in Dubai. “In the short run, increased public investment—financed through reallocation of public spending and scaled-up external financial support—can help create jobs and sustain the socio-political transition,” he added.

Oil exporters post healthy economic activity, but face medium-term risks

Notwithstanding a drop in overall growth on account of domestic oil supply disruptions and lower global demand, most oil exporters in the region will continue to see solid growth in the non-oil sector, supported by high levels of public spending and a gradual recovery in private credit growth. A recovery in oil production and a further strengthening of the non-oil economy will likely lift economic growth next year back to levels experienced in the recent past, the report says.

The report cautioned, however, that fiscal positions in this group of countries are eroding (chart 1). In addition, most oil exporters do not save enough of their oil windfalls for future generations. Some countries have started to unwind fiscal stimulus this year. But without further fiscal cuts, the region’s governments will start dipping into their savings by 2016.

A sustained decline in oil prices would leave most oil exporters in the region with fiscal deficits as soon as next year. While most member countries of the Gulf Cooperation Council (GCC) would be able to respond to a short-lived or mild drop in oil revenues, their fiscal space is shrinking, the report noted.

“In this environment, governments will need to find ways to rein in hard-to-reverse current expenditures, especially wages and subsidies, while targeting high-quality capital investments and social programs. High on the agenda is also the need to pursue structural reforms to bolster private-sector growth, diversification of economic activities, and job creation for nationals and women,” Ahmed told reporters.

Oil importers need resolute actions

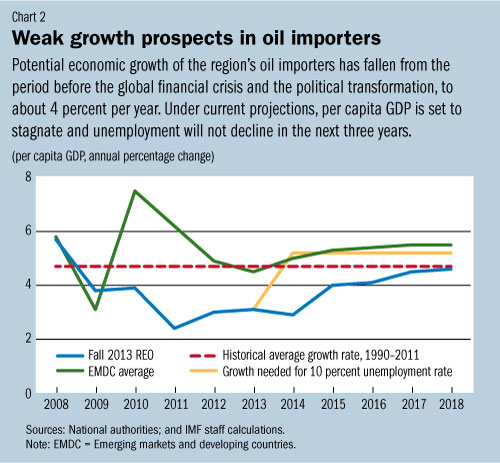

The combination of political uncertainty, social pressures, and regional conflict has further delayed economic recovery. According to the IMF report, oil-importing countries are expected to grow at an average of just 3 percent in 2013–14, which is far below the growth rates necessary to reduce persistent unemployment and improve living standards (chart 2).

“Over the past three years, in response to growing social demands and higher food and fuel prices, governments in most oil-importing countries have expanded spending on generalized subsidies, public employment, and wages, while revenues have fallen due to the economic downturn,” said Ahmed.

Consequently, oil importers have seen their fiscal deficits rise to an average of close to 10 percent of GDP, and their public debt levels rise to close to 80 percent of GDP. In addition, international reserves remain low, the report says.

“The Arab countries in transition face a predicament. Political uncertainty makes it difficult to introduce far-reaching and comprehensive reforms. At the same time, a lack of improvement in economic conditions could reinforce socio-political frictions and deal further setbacks to transitions in many countries, further delaying a broader return of confidence and private investment,” Ahmed said.

In such a challenging environment, the IMF recommends that the region’s policymakers:

• Create jobs to help sustain the socio-political transitions. With private investment stalled, governments need to play a key role in shoring up economic activity over the near term. This calls for a reorientation of spending on generalized subsidies toward public investment, which would help enhance growth. At the same time, there’s a need to put in place better targeted safety nets to protect the poor.

• Put fiscal house in order to restore debt sustainability. In some cases, there may be scope for phasing the fiscal adjustments (lower spending and/or higher revenues) over time to limit its impact on economic growth in the short run. Countries will need scaled-up support from the international community to help strike this balance.

• Embark on a bold structural reform agenda. This includes improving the business climate and improving access to finance in order to create higher levels of sustainable growth and job creation over the medium term.

“Early progress on each of these priorities can help signal government’s commitment to reform, improve confidence, and propel much-needed private sector activity,” Ahmed said, For this, stepped-up support from the international community is needed, not only through scaled-up financing, but also through enhanced trade access and more technical assistance, he added.