The updated database includes central bank legislation information from around the world (image: Roy Scott)

IMF Updates Central Bank Legislation Database

August 16, 2016

- The IMF’s central bank law database has been upgraded

- Most comprehensive collection of legislation from 126 countries and currency unions

- Primarily for central bank and monetary union officials

The International Monetary Fund has updated its Central Bank Legislation Database (CBLD), the most comprehensive central bank law database in the world, to allow informed policy discussions and analysis as central banking rules change.

The IMF database, accessible primarily for central bank and monetary union officials, compiles up-to-date central bank laws and excerpts from the constitutions of 126 IMF member countries and monetary unions. The countries and unions are divided into several categories according to, for example, central bank objectives and powers, monetary policy, central bank organizational aspects, financial provisions (such as central bank capital), foreign exchange policy, and payments system regulations.

The 2016 database update builds on data from central banks and monetary unions in 2014 and 2015. It provides diverse search possibilities for individual countries and groups of countries on the basis of region, income level, exchange rate arrangement, and monetary union. It also includes a law library with central bank laws in English, and contains references to IMF working papers on topics such as central bank independence and accountability, governance, financial provisions, and transparency.

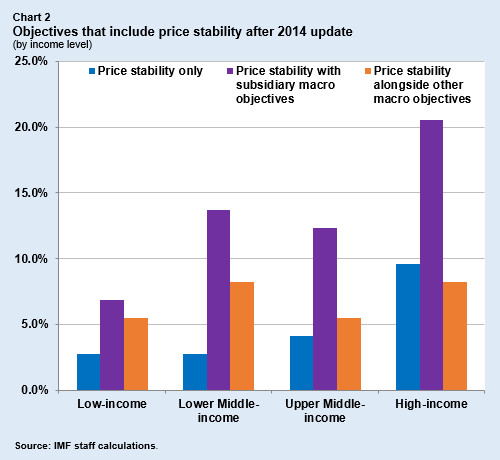

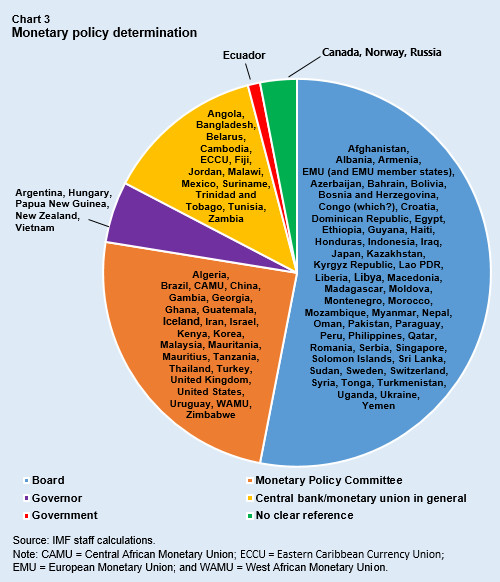

To see how the database can be used for research and policy-making, check out the examples below. The recently updated Charts 1 and 2 show which central bank laws include price stability as a central bank objective, both by region (Chart 1) and income level (Chart 2). A further distinction can be made in price stability only, price stability with subsidiary macro objectives (i.e., where price stability is the primary objective), and price stability alongside other macro objectives (i.e., where price stability is not the single primary objective). Chart 3 shows who is in charge of defining monetary policy within a central bank, varying from the Board, through a Monetary Policy Committee, the Governor, to the central bank as a whole, without a clear allocation of power determined in the law.

More information on the database and its accessibility: IMF Monetary and Capital Markets Department, Central Bank Legislation Database, mcmcbld@imf.org.