People taking photos in Montevideo, Uruguay, where growth is estimated at 2 percent for 2019 (photo: Global_Pics/iStock)

Five Takeaways from Uruguay's Economic Outlook

February 22, 2019

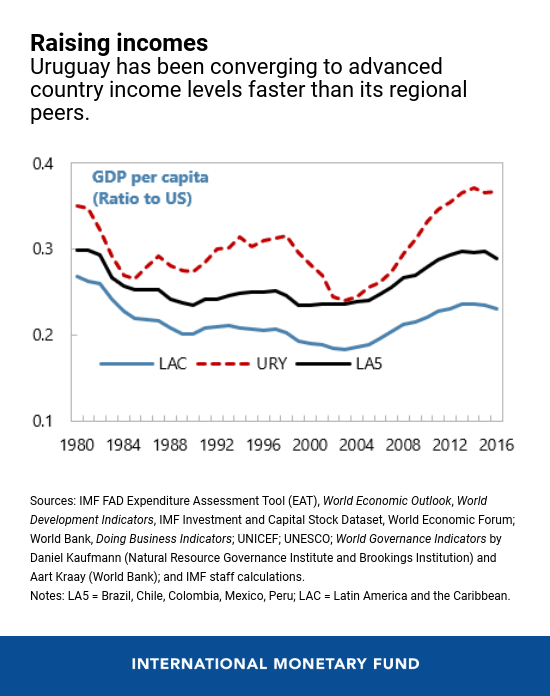

Over the last decade and a half, Uruguay’s economy has been resilient—helping to reduce poverty and raise incomes to one of the highest levels in the region. But recently growth has moderated, and the country faces the challenges of low investment, declining employment, and an uncertain external climate, the IMF said in its annual economic review.

Here are five key takeaways from the latest report that shed light on Uruguay’s economic health, as well as its prospects.

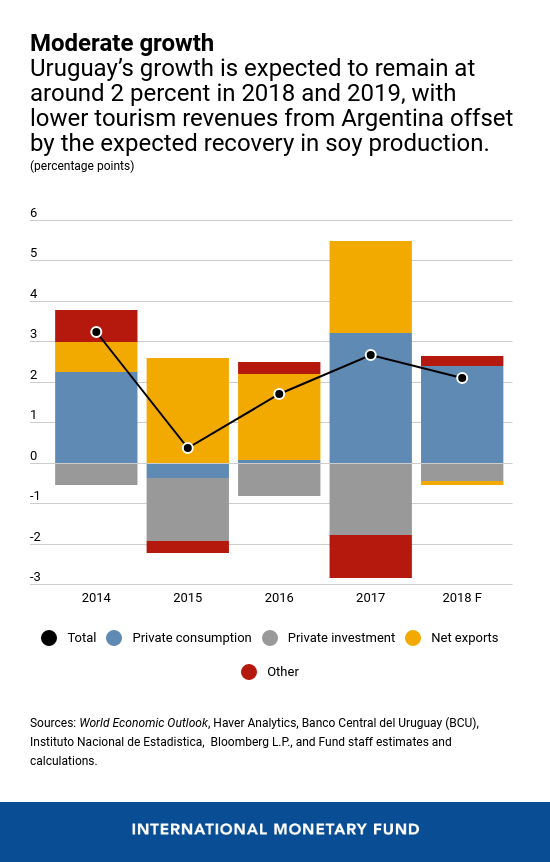

- Growth: Although consumption continued to support domestic demand, private investment has remained sluggish and net exports (the value of a country's total exports minus the value of its total imports) turned negative—weighing on growth.

Furthermore, a severe drought in the first quarter of 2018 led to lower yields of summer crops (particularly soybeans). Growth is projected to be close to 2 percent in 2018 and 2019, reflecting a combination of the weakness in demand from regional partners and the expected rebound in agriculture and investment. It is expected to recover in 2020 to 3 percent. - Strong institutions: Maintaining Uruguay’s strong track record—built on sound institutions and economic policies—will be needed to weather the worsening external environment. As a small open economy, Uruguay is vulnerable to changes in global market sentiment and regional spillovers. Strong economic polices—such as diversifying exports and destinations, prudent debt management, pre-financing of external financing needs, lower banking sector vulnerabilities, and ample reserves—has helped Uruguay to withstand regional shocks.

- Debt: Putting debt on a downward path can help contain fiscal risks. A reduction in the government’s overall budget deficit, which should come from reducing the elevated level of current expenditures, would help to put debt on a firm downward path. In addition, the utility tariffs should be adjusted in line with the cost structure and investment needs of public enterprises.

- Inflation: Bringing inflation down closer to the middle of the target range is important to anchor inflation expectations. Starting in mid-2018, inflation had risen above the target range, reflecting the impact of drought and peso depreciation, and it currently stands at 7.4 percent. Monetary policy stance should continue to be adjusted until inflation and expectations approach the middle of the target range (5 percent).

- Reforms: Structural policies can help to ensure incomes continue to catch up to advanced economy levels. These could include creating more government budgetary spending room to further invest in infrastructure—for example, the recent railways project. Reforming the education sector would also help to equip job seekers for the technology-driven labor market. In addition, private investment can be supported by improving the overall business environment and access to finance.