IMF Executive Board Concludes 2019 Article IV Consultation with Morocco

July 16, 2019

On May 13, 2019, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Morocco. [1]

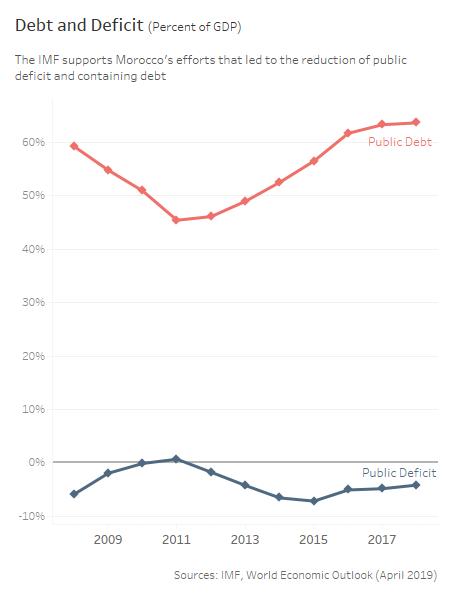

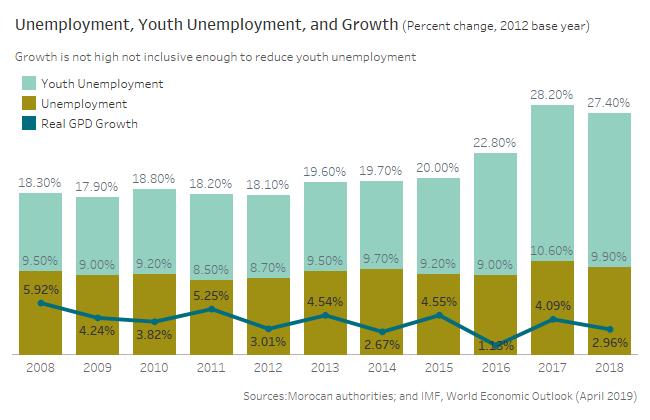

Economic activity weakened in 2018, reaching 3 percent, due to lower growth in the agricultural and tertiary sectors. The unemployment rate remains close to 10 percent and particularly high among the youth. Headline inflation reached 1.9 percent in 2018 in part due to higher food prices.Fiscal consolidation slowed in 2018, with the fiscal deficit stabilizing at 3.7 percent of GDP, due to strong VAT revenues and wage bill containment, which partially offset lower corporate taxes and grants, and higher butane subsidies.

Despite strong export performance in the automobile and phosphate sectors, the current account deficit widened to 5.4 percent of GDP due to higher imports of energy and capital goods, as well as lower remittances, official grants, and tourism receipts. At the same time, net FDI increased substantially to 2.5 percent of GDP. International reserves dropped to US$24.4 billion but remain comfortable, at about 5.2 months of imports.

Bank capitalization is adequate, and the risks to financial stability are limited. Nonperforming loans remain relatively high, but they are well provisioned. Regulatory limits to reduce credit concentration and cross-border supervisory collaboration to contain risks related to Moroccan banks’ expansion in Africa are being strengthened.

Morocco’s medium-term prospects remain favorable, with growth expected to reach 4.5 percent by 2024. However, this outlook remains subject to significant domestic and external risks, including delays in reform implementation, lower growth in key partner countries (particularly the euro area), higher oil prices, geopolitical risks, and volatile financial conditions. On the upside, lower international oil prices could help further strengthen the economy’s resilience and increased regional integration in the Maghreb region could become an added source of medium-term growth for Morocco.

Executive Board Assessment [2]

Executive Directors commended the authorities for implementing sound macroeconomic policies and welcomed the acceleration in reforms that has helped improve the resilience of the Moroccan economy and increase its diversification. Nevertheless, Directors noted the potential impact of global uncertainty and risks on the Moroccan economy and called for continued commitment to sustain sound policies in order to reach higher and more inclusive growth.

Directors encouraged the authorities to continue fiscal consolidation to preserve debt sustainability, while safeguarding priority investment and social spending in the medium term. They welcomed the ongoing control of public wage spending and the outcome of the May 2019 national tax conference, which will inform a comprehensive tax reform targeted at achieving greater equity and simplicity in the tax system. Directors supported further improvements in the efficiency and governance of the public sector through civil service reform, careful implementation of fiscal decentralization, strengthened state-owned enterprise oversight, and better targeting of social spending.

Directors noted that accommodative monetary policy remains appropriate in a context of moderate inflation and subdued economic and credit growth. They welcomed the beginning of the transition to greater exchange rate flexibility last year which will help the economy absorb potential external shocks and remain competitive. They encouraged the authorities to use the current window of opportunity to continue this reform in a carefully sequenced and well-communicated manner.

Directors noted that the banking sector system is sound and resilient, while stressing the need to remain vigilant given its increasing complexity and cross-border expansion. They also called for continued efforts to address weaknesses in the AML/CFT framework. Directors noted that adopting the central bank law and continuing to make the supervisory framework more risk-based and forward-looking will help further improve financial sector soundness. They welcomed the recent adoption of a comprehensive financial inclusion strategy, which will ensure that the financing needs of underserved groups and small and medium-sized enterprises are better addressed.

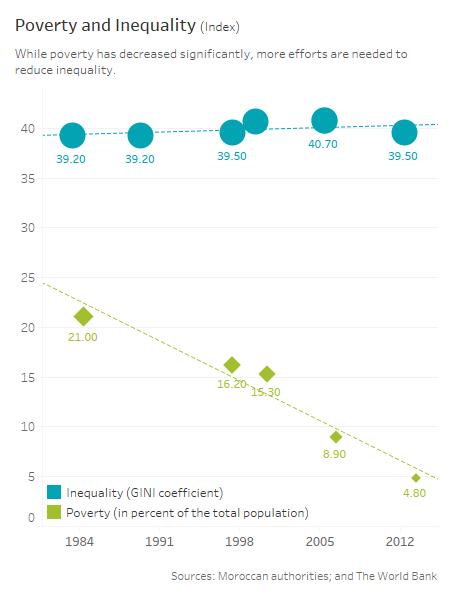

Directors stressed the importance of sustaining the pace of structural reforms to move toward a more private-sector-led and inclusive growth model while reducing inequalities and protecting the most vulnerable. Directors emphasized the need to revamp labor market policies and implement education reforms to help create job opportunities, especially for women and youth. While they welcomed the ongoing improvements to the business environment, Directors encouraged continued efforts to strengthen governance and fight corruption.

|

Morocco: Selected Economic Indicators, 2013–19

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

[1] Under Article IV of the IMF's Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. A staff team visits the country, collects economic and financial information, and discusses with officials the country's economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

[2] At the conclusion of the discussion, the Managing Director, as Chairman of the Board, summarizes the views of Executive Directors, and this summary is transmitted to the country's authorities. An explanation of any qualifiers used in summings up can be found here: http://www.imf.org/external/np/sec/misc/qualifiers.htm .

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Wafa Amr

Phone: +1 202 623-7100Email: MEDIA@IMF.org