David Donaldson: Sherlock of Trade

MIT’s Dave Donaldson makes no assumptions about trade that are not based on facts. (photo: Porter Gifford Photography)

In This Episode

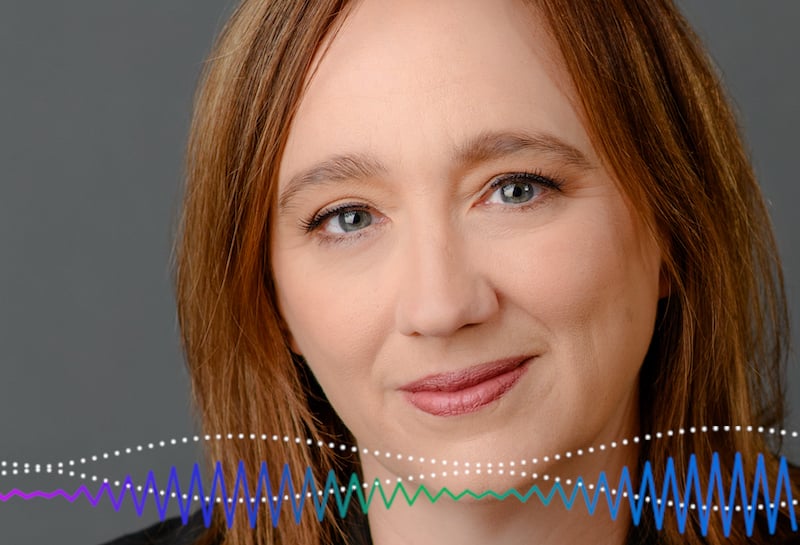

Studying the market for salt in 19th century India and the effects on trade of a railroad built 150 years ago led economist Dave Donaldson to important new findings that are relevant today. Donaldson was the 2017 John Bates Clark Medalist, awarded for the most significant contributions by an economist under the age of 40. In this podcast, Donaldson talks about his work on trade and how it benefits economic welfare.

A profile of Dave Donaldson, Sherlock of Trade is featured in the June 2018 edition of Finance and Development Magazine.

Join Us on Every Major Platform

Latest Podcasts

BEHIND THE MIC

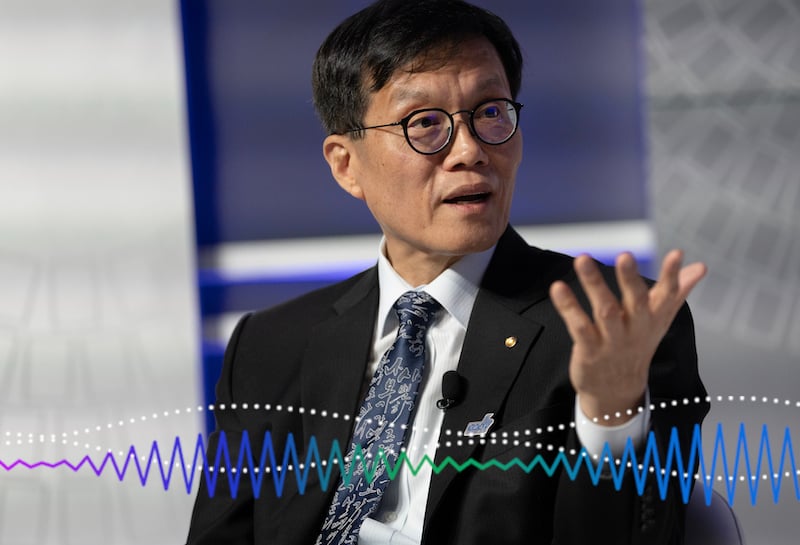

Bruce Edwards

International Monetary Fund

Bruce Edwards produces the IMF podcast program. He's an award-winning audio producer and journalist who's covered armed conflicts, social unrest, and natural disasters from all corners of the world. He believes economists have an important role in solving the world's problems and aspires to showcase their research in every IMF podcast.

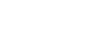

Rhoda Metcalfe

RHODA METCALFE is an independent journalist and audio producer.