World Economic Outlook

Global Recovery Advances but Remains Uneven

January 2011

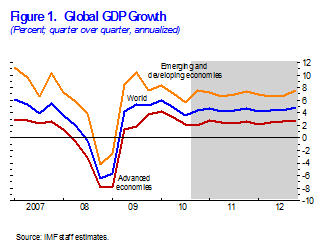

The two-speed recovery continues. In advanced economies, activity has moderated less than expected, but growth remains subdued, unemployment is still high, and renewed stresses in the euro area periphery are contributing to downside risks. In many emerging economies, activity remains buoyant, inflation pressures are emerging, and there are now some signs of overheating, driven in part by strong capital inflows. Most developing countries, particularly in sub-Saharan Africa, are also growing strongly. Global output is projected to expand by 4½ percent in 2011 (Table 1 and Figure 1: CSV|PDF), an upward revision of about ¼ percentage point relative to the October 2010 World Economic Outlook (WEO). This reflects stronger-than-expected activity in the second half of 2010 as well as new policy initiatives in the United States that will boost activity this year. But downside risks to the recovery remain elevated. The most urgent requirements for robust recovery are comprehensive and rapid actions to overcome sovereign and financial troubles in the euro area and policies to redress fiscal imbalances and to repair and reform financial systems in advanced economies more generally. These need to be complemented with policies that keep overheating pressures in check and facilitate external rebalancing in key emerging economies.

The global recovery is proceeding

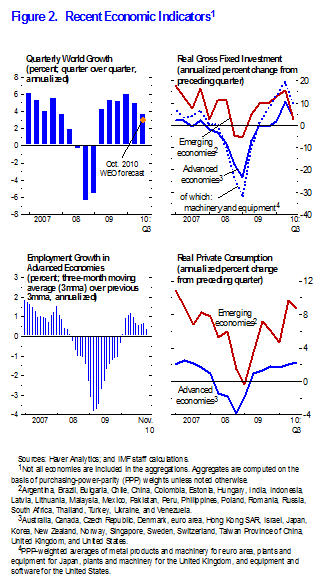

Global activity expanded at an annualized rate of just over 3½ percent in the third quarter of 2010. A slowdown from the 5 percent growth rate of the second quarter of 2010 was expected, but the third-quarter rate was better than forecast in the October 2010 WEO, owing to stronger-than-expected consumption in the United States and Japan. Stimulus measures were partly responsible for the strengthened outturn, especially in Japan. More generally, signs are increasing that private consumption—which fell sharply during the crisis—is starting to gain a foothold in major advanced economies (Figure 2: CSV|PDF). Growth in emerging and developing economies remained robust in the third quarter, buoyed by well-entrenched private demand, still-accommodative policy stances, and resurgent capital inflows.

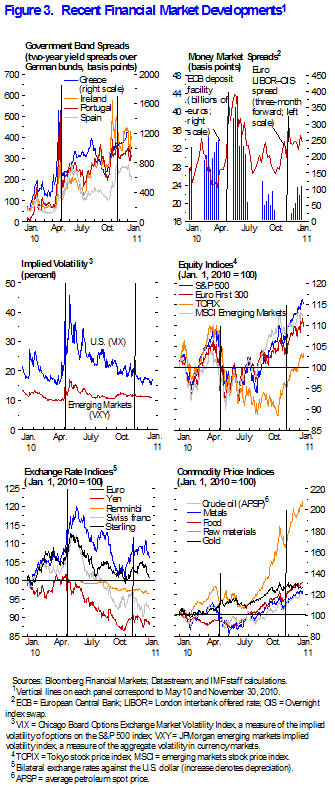

During the second half of 2010, global financial conditions broadly improved, amid lingering vulnerabilities. Equity markets rose, risk spreads continued to tighten, and bank lending conditions in major advanced economies became less tight, even for small and medium-sized firms. Nonetheless, pockets of vulnerability persisted; real estate markets and household income were still weak in some major advanced economies (for example, United States), and securitization remained subdued. And, in an echo of last May’s events, financial turbulence reemerged in the periphery of the euro area in the last quarter of 2010. Concerns about banking sector losses and fiscal sustainability—triggered this time by the situation in Ireland—led to widening spreads in these countries, in some cases reaching highs not seen since the launch of the European Economic and Monetary Union. Funding pressures also reappeared, although to a lesser extent than during the summer. One key difference was more limited financial market spillovers to other countries. The turmoil in mid-2010 led to a spike in global risk aversion and a scaling back of exposures in other regions, including emerging markets. During the recent bout of turbulence, markets have been more discriminating: measures of risk aversion have not risen, equity markets in most regions have posted significant gains, and financial stresses have been limited mostly to the periphery of the euro area (Figure 3: CSV|PDF).

Table 1. Overview of the World Economic Outlook Projections

(Percent change, unless otherwise noted)

| Year over Year | |||||||||||

| Difference from October 2010 WEO Projections | Q4 over Q4 | ||||||||||

| Projections | Estimates | Projections | |||||||||

| 2009 | 2010 | 2011 | 2012 | 2011 | 2012 | 2010 | 2011 | 2012 | |||

|

World Output 1 |

–0.6 | 5.0 | 4.4 | 4.5 | 0.2 | 0.0 | 4.7 | 4.5 | 4.4 | ||

|

Advanced Economies |

–3.4 | 3.0 | 2.5 | 2.5 | 0.3 | –0.1 | 2.9 | 2.6 | 2.5 | ||

|

United States |

–2.6 | 2.8 | 3.0 | 2.7 | 0.7 | –0.3 | 2.7 | 3.2 | 2.7 | ||

|

Euro Area |

–4.1 | 1.8 | 1.5 | 1.7 | 0.0 | –0.1 | 2.1 | 1.2 | 2.0 | ||

|

Germany |

–4.7 | 3.6 | 2.2 | 2.0 | 0.2 | 0.0 | 4.3 | 1.2 | 2.7 | ||

|

France |

–2.5 | 1.6 | 1.6 | 1.8 | 0.0 | 0.0 | 1.7 | 1.5 | 1.9 | ||

|

Italy |

–5.0 | 1.0 | 1.0 | 1.3 | 0.0 | –0.1 | 1.3 | 1.2 | 1.4 | ||

|

Spain |

–3.7 | –0.2 | 0.6 | 1.5 | –0.1 | –0.3 | 0.4 | 0.8 | 1.9 | ||

|

Japan |

–6.3 | 4.3 | 1.6 | 1.8 | 0.1 | –0.2 | 3.3 | 1.4 | 2.4 | ||

|

United Kingdom |

–4.9 | 1.7 | 2.0 | 2.3 | 0.0 | 0.0 | 2.9 | 1.5 | 2.6 | ||

|

Canada |

–2.5 | 2.9 | 2.3 | 2.7 | –0.4 | 0.0 | 2.7 | 2.7 | 2.6 | ||

|

Other Advanced Economies |

–1.2 | 5.6 | 3.8 | 3.7 | 0.1 | 0.0 | 4.5 | 4.7 | 2.9 | ||

|

Newly Industrialized Asian Economies |

–0.9 | 8.2 | 4.7 | 4.3 | 0.2 | –0.1 | 5.9 | 6.2 | 3.1 | ||

|

Emerging and Developing Economies 2 |

2.6 | 7.1 | 6.5 | 6.5 | 0.1 | 0.0 | 7.2 | 7.0 | 6.8 | ||

|

Central and Eastern Europe |

–3.6 | 4.2 | 3.6 | 4.0 | 0.5 | 0.2 | 4.3 | 3.5 | 3.9 | ||

|

Commonwealth of Independent States |

–6.5 | 4.2 | 4.7 | 4.6 | 0.1 | –0.1 | 3.5 | 4.8 | 4.3 | ||

|

Russia |

–7.9 | 3.7 | 4.5 | 4.4 | 0.2 | 0.0 | 3.4 | 4.6 | 4.3 | ||

|

Excluding Russia |

–3.2 | 5.4 | 5.1 | 5.2 | –0.1 | –0.1 | . . . | . . . | . . . | ||

|

Developing Asia |

7.0 | 9.3 | 8.4 | 8.4 | 0.0 | 0.0 | 9.1 | 8.6 | 8.4 | ||

|

China |

9.2 | 10.3 | 9.6 | 9.5 | 0.0 | 0.0 | 9.7 | 9.5 | 9.5 | ||

|

India |

5.7 | 9.7 | 8.4 | 8.0 | 0.0 | 0.0 | 10.3 | 7.9 | 8.0 | ||

|

ASEAN-5 3 |

1.7 | 6.7 | 5.5 | 5.7 | 0.1 | 0.1 | 5.1 | 6.4 | 5.2 | ||

|

Latin America and the Caribbean |

–1.8 | 5.9 | 4.3 | 4.1 | 0.3 | –0.1 | 4.8 | 5.0 | 4.3 | ||

|

Brazil |

–0.6 | 7.5 | 4.5 | 4.1 | 0.4 | 0.0 | 5.2 | 5.1 | 4.0 | ||

|

Mexico |

–6.1 | 5.2 | 4.2 | 4.8 | 0.3 | –0.2 | 3.2 | 5.0 | 4.5 | ||

|

Middle East and North Africa |

1.8 | 3.9 | 4.6 | 4.7 | –0.5 | –0.1 | . . . | . . . | . . . | ||

|

Sub-Saharan Africa |

2.8 | 5.0 | 5.5 | 5.8 | 0.0 | 0.1 | . . . | . . . | . . . | ||

|

South Africa |

–1.7 | 2.8 | 3.4 | 3.8 | –0.1 | –0.1 | 3.6 | 3.4 | 4.1 | ||

|

Memorandum |

|||||||||||

|

European Union |

–4.1 | 1.8 | 1.7 | 2.0 | 0.0 | –0.1 | 2.5 | 1.4 | 2.2 | ||

|

World Growth Based on Market Exchange Rates |

–2.1 | 3.9 | 3.5 | 3.6 | 0.2 | –0.1 | . . . | . . . | . . . | ||

|

World Trade Volume (goods and services) |

–10.7 | 12.0 | 7.1 | 6.8 | 0.1 | 0.2 | . . . | . . . | . . . | ||

|

Imports |

|||||||||||

|

Advanced Economies |

–12.4 | 11.1 | 5.5 | 5.2 | 0.3 | 0.1 | . . . | . . . | . . . | ||

|

Emerging and Developing Economies |

–8.0 | 13.8 | 9.3 | 9.2 | –0.6 | –0.1 | . . . | . . . | . . . | ||

|

Exports |

|||||||||||

|

Advanced Economies |

–11.9 | 11.4 | 6.2 | 5.8 | 0.2 | 0.3 | . . . | . . . | . . . | ||

|

Emerging and Developing Economies |

–7.5 | 12.8 | 9.2 | 8.8 | 0.1 | 0.2 | . . . | . . . | . . . | ||

|

Commodity Prices (U.S. dollars) |

|||||||||||

|

Oil 4 |

–36.3 | 27.8 | 13.4 | 0.3 | 10.1 | –4.1 | . . . | . . . | . . . | ||

|

Nonfuel (average based on world commodity export weights) |

–18.7 | 23.0 | 11.0 | –5.6 | 13.0 | –2.4 | . . . | . . . | . . . | ||

|

Consumer Prices |

|||||||||||

|

Advanced Economies |

0.1 | 1.5 | 1.6 | 1.6 | 0.3 | 0.1 | 1.5 | 1.6 | 1.6 | ||

|

Emerging and Developing Economies 2 |

5.2 | 6.3 | 6.0 | 4.8 | 0.8 | 0.3 | 6.5 | 4.7 | 4.4 | ||

|

London Interbank Offered Rate (percent) 5 |

|||||||||||

|

On U.S. Dollar Deposits |

1.1 | 0.6 | 0.7 | 0.9 | –0.1 | –0.5 | . . . | . . . | . . . | ||

|

On Euro Deposits |

1.2 | 0.8 | 1.2 | 1.7 | 0.2 | 0.4 | . . . | . . . | . . . | ||

|

On Japanese Yen Deposits |

0.7 | 0.4 | 0.6 | 0.2 | 0.2 | –0.2 | . . . | . . . | . . . | ||

|

Note: Real effective exchange rates are assumed to remain constant at the levels prevailing during November 18–December 16, 2010. Country weights used to construct aggregate growth rates for groups of economies were revised. When economies are not listed alphabetically, they are ordered on the basis of economic size. The aggregated quarterly data are seasonally adjusted. | |||||||||||

|

1 The quarterly estimates and projections account for 90 percent of the world purchasing-power-parity weights. | |||||||||||

|

2 The quarterly estimates and projections account for approximately 78 percent of the emerging and developing economies. | |||||||||||

|

3 Indonesia, Malaysia, Philippines, Thailand, and Vietnam. | |||||||||||

|

4 Simple average of prices of U.K. Brent, Dubai, and West Texas Intermediate crude oil. The average price of oil in U.S. dollars a barrel was $78.93 in 2010; the assumed price based on futures markets is $89.50 in 2011 and $89.75 in 2012. | |||||||||||

|

5 Six-month rate for the United States and Japan. Three-month rate for the Euro Area. | |||||||||||

The recovery is set to continue…

The baseline projections below assume that current policy actions manage to keep the financial turmoil and its real effects contained in the periphery of the euro area, resulting in only a modest drag on the global recovery. This view reflects the limited financial spillovers observed so far across financial markets and regions, as well as the fact that policy responses following the Greek crisis helped limit its impact on the global recovery in the second half of 2010. The baseline also assumes that policymakers in emerging markets respond in a timely manner to keep overheating pressures in check.

Activity in the advanced economies is projected to expand by 2½ percent during 2011–12, which is still sluggish considering the depth of the 2009 recession and insufficient to make a significant dent in high unemployment rates. Nevertheless, the 2011 growth projection is an upward revision of ¼ percentage point relative to the October 2010 WEO, mostly due to a new fiscal package passed in late 2010 in the United States that is expected to boost economic growth this year by ½ percent. A package with a similar growth impact passed in Japan is expected to sustain a moderate recovery in 2011. And although growth in the periphery of the euro area is marked down for this year, this is offset by an upward revision to growth in Germany, due to stronger domestic demand.

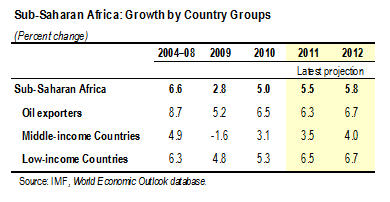

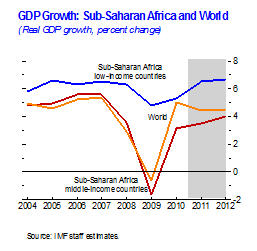

In both 2011 and 2012, growth in emerging and developing economies is expected to remain buoyant at 6½ percent, a modest slowdown from the 7 percent growth registered last year and broadly unchanged from the October 2010 WEO. Developing Asia continues to grow most rapidly, but other emerging regions are also expected to continue their strong rebound. Notably, growth in sub-Saharan Africa—projected at 5½ percent in 2011 and 5¾ percent in 2012—is expected to exceed growth in all other regions except developing Asia. This reflects sustained strength in domestic demand in many of the region’s economies as well as rising global demand for commodities (Box 1).

…and financial conditions in most regions are expected to remain stable

Financial conditions are expected generally to remain stable or improve this year. Bank lending conditions in the major advanced economies are expected to ease further, and bond issuance by nonfinancial firms is also expected to strengthen. Amid generally sluggish recovery and continued high saving in key emerging Asian economies, real yields are likely to remain low through 2011. In the United States, the outlook for Treasury yields is uncertain: a gradually strengthening recovery and fiscal concerns may push up yields, while quantitative easing may hold them back.

Financial stresses, however, are expected to remain elevated in the periphery of the euro area, where market participants are still concerned about sovereign and banking risk, the political feasibility of current and envisioned austerity measures, and the lack of a comprehensive solution. European sovereign peripheral spreads and bank funding costs are thus likely to remain elevated during the first half of this year, and financial turbulence could re-intensify.

Under a baseline scenario in which contagion from turmoil in the euro area periphery is contained, emerging market capital inflows are expected to remain strong and financial conditions robust. Bond issuance by emerging market sovereigns and firms is expected to remain robust in 2011. Low interest rates in mature markets and fairly strong investor appetite will continue to pose upside risks to emerging market flows and asset prices, despite some recent slowdown of inflows.

Commodity prices will remain high, and inflation is rising in some emerging economies

Prices for both oil and non-oil commodities rose considerably in 2010, in response to strong global demand but also to supply shocks for selected commodities. Upward pressure on prices is expected to persist in 2011, due to continued robust demand and a sluggish supply response to tightening market conditions. As a result, the IMF’s baseline petroleum price projection for 2011 is now $90 per barrel, up from $79 per barrel in the October 2010 WEO. As for non-oil commodities, weather-related crop damage was greater than expected in late 2010, and price effects are expected to unwind only after the 2011 crop season. As a result, non-oil commodity prices are expected to increase by 11 percent in 2011. Near-term risks are now to the upside for most commodity classes.

The uptick in consumer price inflation in emerging economies in 2010 was attributable partly to rising food prices. But the recent bout of high food price inflation has been quite persistent, straining the budgets of low-income households and beginning to feed into overall price inflation in a number of economies. More important, rapid growth in emerging and developing economies has narrowed or in some cases closed output gaps in these economies. Accordingly, overheating pressures are starting to materialize in some cases. Consumer prices in these economies are projected to rise 6 percent this year, an upward revision of ¾ percentage point relative to the October 2010 WEO. Signs of overheating are also becoming apparent in some countries via rapid credit growth or rising asset prices.

The picture is quite different in advanced economies, where still-ample economic slack and well-anchored inflation expectations will generally keep inflation pressures subdued. Inflation is expected to remain at 1½ percent this year, unchanged from 2010 and a slight upward revision from the October 2010 WEO.

Downside risks remain elevated

Downside risks arise from the possibility of tensions in the euro area periphery spreading to the core of Europe; the lack of progress in formulating medium-term fiscal consolidation plans in major advanced economies; the continued weakness of the U.S. real estate market; high commodity prices; and overheating and the potential for boom-bust cycles in emerging markets. On the upside, there are risks from stronger-than-expected business investment rebounds in major advanced economies.

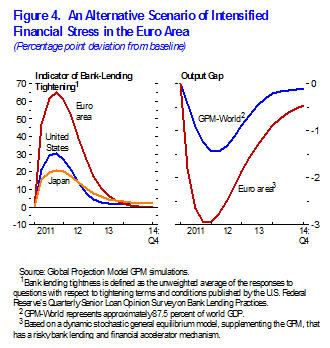

The risk of financial turmoil spreading from the periphery to the core of Europe is a by-product of continuing weakness among financial institutions in many of the region’s advanced economies, and a lack of transparency about their exposures. As a result, financial institutions and sovereigns are closely linked, with spillovers between the two sectors occurring in both directions. Although the periphery accounts for only a small portion of the euro area’s overall output and trade, substantial financial linkages with countries in the core, as well as financial spillovers through higher risk aversion and lower equity prices, could generate a slowdown in growth and demand that would hinder the global recovery. In particular, continued market pressures could result in serious funding pressures for major banks and sovereigns, increasing the likelihood that problems spill over to core countries. Figure 4 (CSV|PDF) presents an alternative scenario that illustrates how larger spillovers can subtract from growth. The scenario—which is broadly similar to the one presented in the July 2010 WEO Update—assumes that a large shock followed by insufficiently rapid and strong policy action results in significant losses on securities and credit in the euro area periphery. This causes capital ratios to fall substantially in several countries, both in the periphery and the core. Under such a scenario, European banks tighten lending conditions by a similar magnitude as during the collapse of Lehman Brothers in 2008. As a result, euro area growth is reduced by about 2½ percentage points relative to the baseline. Assuming that financial spillovers to the rest of the world are limited—with the increase in bank-lending tightness in the United States about half that in Europe—global growth in 2011 is lower by about 1 percentage point than in the baseline. But if financial contagion to the rest of the world is more severe—resulting in a spike in generalized risk aversion, a drying up of liquidity, and sharp falls in equity markets—the impact on global growth would be substantially larger, amplified by balance sheet weaknesses in other major advanced economies.

Another downside risk stems from insufficient progress in developing medium-term fiscal consolidation plans in large advanced economies. The recently implemented stimulus measures in the United States and Japan make it more challenging to ensure medium-term fiscal sustainability. Therefore, it has become even more important to formulate more credible plans to bring debt down over the medium term.

On the upside, business investment could rebound faster than currently expected in key advanced economies, underpinned by strong corporate sector profitability.

In emerging economies, key risks relate to overheating, a rapid rise of inflation pressures, and the possibility of a hard landing. In the near term, upside risks to growth have risen, driven by accommodative policies, strong terms-of-trade gains for commodity exporters, and resurgent capital inflows. If, however, policymakers fall behind the curve in responding to nascent overheating pressures and asset price bubbles, macroeconomic policies in key emerging economies could be setting the stage for boom-bust dynamics in real estate and credit markets and, eventually, a hard landing in these economies. With emerging markets now accounting for almost 40 percent of global consumption and more than two-thirds of global growth, a slowdown in these economies would deal a serious blow to the global recovery—and to the rebalancing that needs to take place.

Decisive policy actions are needed to lessen risks and sustain growth

Despite the signs of near-term decoupling—between the periphery and core of Europe, between financial stresses and the real economy, and between advanced and emerging economies—the global economy remains tightly interconnected. A host of measures are needed in different countries to reduce vulnerabilities and rebalance growth in order to strengthen and sustain global growth in the years to come. In the advanced economies, the most pressing needs are to alleviate financial stress in the euro area and to push forward with needed repairs and reforms of the financial system as well as with medium-term fiscal consolidation. Such growth-enhancing policies would help address persistently high unemployment, a key challenge for these economies. They would also produce beneficial spillovers to emerging economies, where the main policy challenge is to respond appropriately to capital inflows, keep overheating pressures in check, and facilitate external rebalancing.

In the euro area, comprehensive, rapid, and decisive policy actions are required to address downside risks. Important steps at both the national and the euro-area-wide level have been taken since May, including measures to strengthen fiscal balances and introduce structural reforms, the stepping up of extraordinary liquidity support and the introduction of the Securities Markets Program by the European Central Bank (ECB), and the establishment of the temporary European Financial Stability Facility (EFSF), to be succeeded by the permanent European Stability Mechanism (ESM) after 2013. But additional strengthening of national policy actions to further secure fiscal sustainability and rekindle growth continues to be key in many countries. Markets remain skittish about potential losses in the region’s banks and have not been assuaged by stress tests conducted to date. New stress tests that are more realistic, thorough, and stringent will increase clarity. They will need to be followed quickly by recapitalization. Markets also need to be reassured that sufficient resources are available from the center to deal with downside risks and that the overall policy approach is consistent. Hence the EFSF as well as the envisioned permanent ESM must have the ability to raise sufficient resources and deploy them in a flexible manner, as needed. In the meantime, the ECB will need to continue to provide liquidity and remain active in securities purchases to help preserve financial stability.

More generally in the advanced economies, there is a need for continued progress to repair and reform financial systems. This is a critical element of the normalization of credit conditions and would help reduce the burden on monetary and fiscal policy to support the recovery. The specific financial sector policies needed are discussed in more detail in the January 2011 Global Financial Stability Report Update.

The vulnerability of sovereigns emphasizes the urgency of moving toward more sustainable fiscal paths—not just by countries in the euro area periphery, but also by major advanced economies. In the near term, emerging signs of a handoff from public to private demand in many large advanced economies suggests that countries can push forward in formulating and implementing credible medium-term consolidation plans. Although some targeted measures in the United States are justifiable at this juncture given the still weak labor and housing markets, the recently implemented stimulus is expected to deliver only a relatively small growth dividend (given its size) at a considerable fiscal cost. The U.S. fiscal deficit is now projected at 10¾ percent in 2011 (more than double that in the euro area), and gross government debt is projected to exceed 110 percent of GDP in 2016. The absence of a credible, medium-term fiscal strategy would eventually drive up U.S. interest rates, which could prove disruptive for global financial markets and for the world economy. It is thus even more critical that policies be put in place to bring debt down over the medium term. Such measures could include entitlement reforms, caps on discretionary spending, reforms of the tax system to boost fiscal revenue, and the establishment or strengthening of fiscal institutions. Fiscal issues are discussed in more detail in the January 2011 Fiscal Monitor Update.

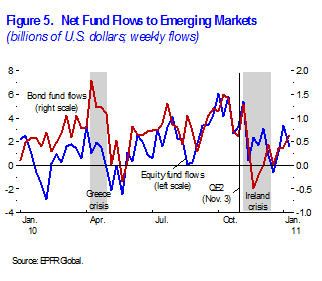

At the same time, monetary accommodation needs to continue in the advanced economies. As long as inflation expectations remain anchored and unemployment stays high, this is the right policy from a domestic perspective. Furthermore, it seems to have had an effect: following the news in August that a second round of quantitative easing was imminent, long-term rates fell to new lows in the United States. Although U.S. Treasury yields have since increased, particularly in the last quarter of 2010, this seems primarily attributable to the improving outlook for the U.S. economy, a fact corroborated by the strong performance of equity markets. From an external perspective, however, there is concern that quantitative easing in the United States could result in a flood of capital outflows toward emerging markets. The recent slowdown in capital inflows to emerging markets suggests that such effects may be limited so far (Figure 5: CSV|PDF).

In contrast, monetary tightening should begin or continue in emerging economies where overheating pressures are starting to emerge. Recent policy rate hikes by various countries are welcome in this regard, although in some of them more nominal exchange rate appreciation would have been preferable. Such tightening can, however, exacerbate the strong capital inflows that many of these economies are now experiencing. Therefore, prudential measures to keep increases in credit or asset markets from becoming excessive should also be considered.

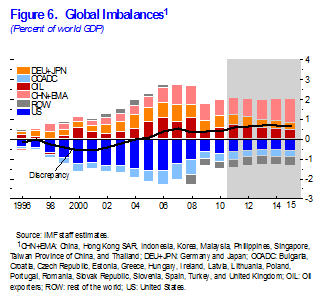

The renewed surge in capital inflows to some emerging markets, whether driven by stronger fundamentals in the emerging economies themselves or by looser monetary policy in advanced economies, requires an appropriate policy response. A number of these economies quickly overcame the crisis and have continued to run current account surpluses (Figure 6: CSV|PDF), yet their real effective exchange rates remain close to precrisis levels—that is, the response to renewed capital inflows has been to accumulate even more foreign exchange reserves. For these countries, allowing the currency to appreciate would help combat overheating pressures and facilitate a healthy rebalancing from external to domestic demand. In other countries where the currency is above levels consistent with medium-term fundamentals, fiscal adjustment can help lower interest rates and restrain domestic demand. Macroeconomic policy responses may, however, need to be complemented by strengthened macro-prudential measures (for example, stricter loan-to-value ratios, funding composition restrictions) and, in some cases, capital controls.