Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Asia: Growth Remains Strong, Expected to Ease Only Modestly

May 3, 2016

- Regional economy to expand by 5.3 percent in 2016 despite softening

- China

- slowdown, risks dominate outlook

- Policies and reforms needed to boost resilience

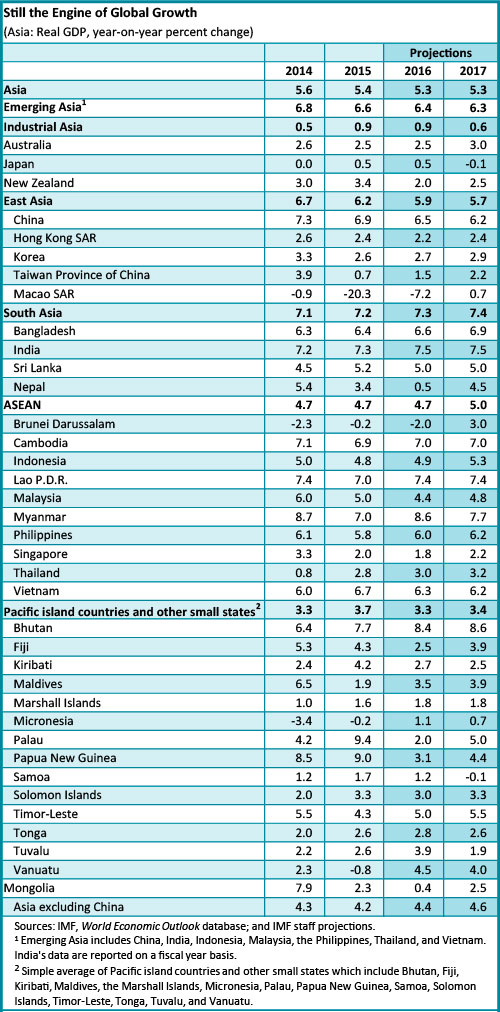

Growth in Asia and the Pacific is expected to remain strong at 5.3 percent this year and next, accounting for almost two-thirds of global growth.

Workers at a steel factory in Dalian city, China: low unemployment, a dip in commodities prices, and an increase in disposable income are some of the factors contributing to continued growth across Asia (photo: Imaginechina/Corbis)

Regional Economic Outlook

Despite a slight moderation, Asia remains the engine of global growth, according to the IMF’s latest Regional Economic Outlook for Asia and the Pacific. While external demand remains sluggish, domestic demand continues to show resilience across most of the region, driven by low unemployment, growth in disposable income, lower commodities prices, and macroeconomic stimulus.

“Of course, Asia is impacted by the still weak global recovery, and by the ongoing and necessary rebalancing in China,” said Changyong Rhee, Director of the Asia and Pacific Department at the IMF. “But domestic demand has remained remarkably resilient throughout most of the region, supported by rising real incomes, especially in commodity importers, and supportive macroeconomic policies in many countries,” he added.

A mixed outlook

The outlook for individual countries within the region varies (see table). China and Japan, the two largest economies in Asia, continue to face challenges. China’s growth is forecast to moderate from 6.9 percent in 2015 to 6.5 percent this year and 6.2 percent in 2017. China’s economy continues its rebalancing of shifting away from manufacturing and investment to services and consumption.

While this transition to slower but more sustainable growth is desirable for both China and the global economy, it is causing changes in the manufacturing sector over the medium term, as heavy industries, such as steel and shipbuilding, face major consolidation to reduce excess capacity. Meanwhile, consumer expenditure has become a more important growth engine.

Japan’s growth is expected to continue at 0.5 percent in 2016, before dropping to -0.1 percent in 2017 as the effect of the widely anticipated consumption tax increase takes hold (although this forecast does not take into account likely growth-supporting policies to offset the increase). An aging population and high public debt remain major drags on Japan’s long-term growth.

Other economies in the region are set to perform well. India has benefited from lower oil prices and remains the fastest-growing large economy in the world, with GDP expected to increase by 7.5 percent this year and next. In Southeast Asia, Vietnam is leading the fast-growing economies in the region, helped by rapidly growing exports of electronics and garment manufactures. For the Philippines and Malaysia, growth is expected to remain robust, underpinned by resilient domestic demand.

Downside risks loom large

However, the region faces a number of external challenges, including slow growth in advanced economies, a broad slowdown across emerging markets, weak global trade, persistently low commodity prices, and increasingly volatile global financial markets. These risks compound domestic vulnerabilities, such as high debt incurred in recent years. In the short term, China’s transition to a new growth model will disrupt its regional partners, especially those heavily exposed to the region’s biggest economy.

Geopolitical tensions and domestic policy uncertainty add risks of potential trade disruptions or lower domestic demand. Natural disasters, too, can reverse economic gains, particularly in lower-income countries and small states (including many Pacific islands). Small states also face the challenge of reduced financial services by global banks (or “de-risking”), which could hold back financial inclusion and growth.

The report also recognizes, however, that the outcome could turn out more positive than forecast. Low commodity prices could be a bigger boost to the region’s economies than expected; and regional and multilateral trade agreements, such as the Trans-Pacific Partnership, could benefit Asia-Pacific even before they are ratified.

Boosting resilience and growth

While Asian economies have strong buffers and are relatively well positioned to face the challenges ahead, countries will need to adopt economic policies that shore up growth and reduce their exposure to global and regional risks. For instance, since monetary settings are broadly appropriate and inflation remains low, there is room to cut policy rates if needed to boost demand.

On the fiscal front, gradual consolidation is generally desirable to rebuild policy space, but countries can adjust the composition of spending to allow for growth-friendly and much-needed infrastructure and social spending in many economies.

Flexible exchange rates should continue to be the first line of defense against external shocks. At the same time, foreign-exchange intervention and capital-flow measures could be deployed in special circumstances, such as disorderly market conditions. The report also notes that region has extensively used macroprudential policies to deal with financial volatility and risks and should continue to do so as a complement to monetary and fiscal policies.

The report also emphasizes that structural reforms are needed to help bolster potential growth and facilitate rebalancing. The region’s past reforms have been highly effective, fostering economic diversification and facilitating Asia’s entry into global markets.

Winners and losers from China’s transition

Three background studies in the Regional Economic Outlook report also discuss how commodity exporters and countries in the Asia-Pacific region are affected by income inequality and China’s rebalancing. China’s slowdown has an impact on global commodity prices, contributing in particular to a large drop in prices of some metals. At the same time, demand for some foodstuff has increased as a result of rebalancing in China, as changes in consumers’ tastes have tended to favor higher-quality and higher-protein items, and Chinese tourism continues to grow.

The analysis shows that the impact of China’s rebalancing will depend on each country’s specific exposure to China’s economy. Economies that rely on China’s consumers can be winners, while those more dependent on investment and manufacturing could lose in the near term. Over time, however, the region is likely to benefit as the rebalancing makes China’s growth model more sustainable.

Tackling increasing inequality

The third study in the report notes that more recently inequality has risen in many countries in Asia, with growth less beneficial to the poor compared with the past. The report concludes that structural reforms, along with fiscal policy, can help reduce inequality and foster more inclusive growth. Countries will need to address inequality of opportunities, in particular the need to broaden access to education, health, and financial services, as well as tackle labor-market duality and informality.

Reforms should avoid costly, across-the-board subsidy schemes while focusing instead on the expansion of social spending through well-targeted interventions and more-progressive tax codes. Recent reforms, such as the elimination of fuel-price controls in most major economies of the region, bode well for the future.