Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Akerlof Says Free Markets May Manipulate Our Thinking

November 25, 2015

- In an interview, Nobel Laureate Akerlof explains how free markets may make fools of us

- Economies have a “phishing” equilibrium, where any chance for extra profit will be taken up

- Role of stories as a powerful tool of motivation is needed in economic analysis

At a recent IMF forum, George Akerlof, 2001 Nobel Laureate in Economics, discussed his new book, which is based on the idea that free market forces can produce systemic harm by exploiting human weaknesses.

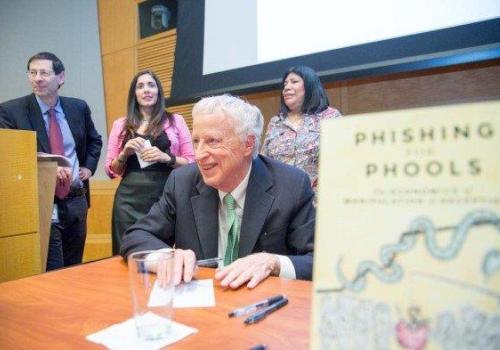

George Akerlof, Nobel Laureate in Economics, presents his new book at a recent IMF forum. Akerlof told a captive audience that “phishing” affects our everyday walk of life (photo: IMF)

IMF BOOK FORUM

Ever since Adam Smith, the central teaching of economics has been that free markets provide us with material well-being, as if by an invisible hand. In a recent book, Phishing for Phools—The Economics of Manipulation and Deception, Nobel Prize–winning economists George Akerlof, University Professor at the McCourt School of Public Policy at Georgetown University, and former resident scholar at the Fund, and Robert J. Shiller, Professor at Yale, deliver a fundamental challenge to this insight. They argue that markets are inherently filled with tricks and traps and will “phish” us as “phools.”

Akerlof and Shiller use the word “phish” defined more broadly as businesses getting people to do things that are in the interests of the phishermen (such as banks, drug companies, real estate agents, and cigarette companies) but not in the interest of the target (such as investors, sick people, homeowners, and smokers). The authors bring this idea to life through fascinating stories and examples that show how phishing affects every walk of life.

Hui Tong, Senior Economist at the IMF’s Research Department caught up with George Akerlof to discuss his book.

Tong: Phishing for Phools argues that manipulation and trickery play a significant role in free markets. Could you elaborate on that?

George Akerlof: The book is based on conversations with Danny Kahneman [Economics Nobel laureate in 2002] some 25 years ago. In a conversation then, Danny told me that the basis for psychology was that humans are machines that are prone to error. The job of the psychologist is to ferret out that error. In contrast, he said, the basic, fundamental notion of economics is equilibrium. That equilibrium means that if there is a profit left on the table, someone will take up that opportunity for profit.

Danny’s insight says that free markets will not just provide what we really want. That is only the case if those human machines make the right choices. But free markets will also provide us with dysfunctional choices as long as there is a profit to be made.

These principles mean that if we have weaknesses in the equilibrium, the weakness will be exploited if there is a profit to be made. Among all those business people looking around and deciding where to spend their investment dollars, some will look to see if there are unusual profits to be made from our weaknesses. If they see such an opportunity, that will be what they choose.

As a result, economies will have a phishing equilibrium. That is an equilibrium in which every chance for profit more than the ordinary will be taken up. And that will include businesses’ willingness to provide us with the wrong choices.

Tong: According to Phishing for Phools, financial crises are the same each time. Why is that?

Akerlof: “Phishing for phools” in financial markets is the leading cause of financial crises resulting in the deepest recessions. In the 1920s it was Swedish matches (think Ivar Kreuger of Kreuger and Toll); in the 1990s it was the dot.coms; in the 2000s it was subprime mortgages (think Angelo Mozilo of Countrywide).

Every time, the stories are different; the entrepreneurs are different; their offerings are different. But, also, every time it is the same. There are the phishermen; there are the phools. And when the built-up stock of undiscovered phishes (named “the bezzle” by John Kenneth Galbraith) gets discovered, asset prices crash.

As an example of this phenomenon, the book traces the role of poor credit ratings as the epicenter of the financial crisis of 2008. It looks at the history (and economics) of how the ratings agencies built up their reputations over the course of almost a century—until economic incentives changed. In the old days of relational banking, those who sought the ratings wanted them to be accurate; they would not take their business elsewhere if the ratings happened to be low. But when the financial industry became more competitive, low ratings would result in loss of business for the raters (and also for those who sought them). Yet the security-buying public still depended on the ratings for purchasing assets. These dynamics created a phishing equilibrium in which mortgage-backed securities were systematically overrated. When this was discovered, we had the crash.

Tong: What would the book suggest for the IMF’s future work?

Akerlof: I think that there are two major takeaways. First, our traditional economics leaves out a major reason for skepticism. Free competitive markets do not always work as well as standard economics teaches us. There is an important downside—an equilibrium—in which we are phished for phools. If we had had this inbuilt skepticism about free markets, more than just a few economists would have predicted the financial crisis. We would have foreseen when, how, and why it would occur.

But there is a second takeaway—this is the role of stories. People do not necessarily think as pictured in economic models. A great deal of our thought process (although perhaps not all of it) is in terms of stories. This is a major factor in our being phished: the phisher seeks to graft onto the phool the story that he or she wants the phool to adopt.

Economics as a whole leaves out the role stories play in its analysis. The book seeks to explain why a national “story” about the benign nature of free markets has had a severe effect on the quality of U.S. government, and on national policy more generally.

This analysis of the United States carries over to the work of the Fund more generally. In almost all of its work, the Fund is trying not just to describe the optimal policy, but also to paint a correct picture of the economic trade-offs involved. In this, the Fund is teaching its own interpretation of the story. This appreciation of the role of stories, and how they serve as a powerful tool of motivation, is needed in most economic analysis as a way to legitimize economic policies. Acknowledging the importance of such stories is probably the most crucial and pervasive message for the work of the Fund.

Akerlof signing his book for IMF staff.