Romania: Staff Concluding Statement of the 2017 Article IV Mission

March 17, 2017

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF's Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

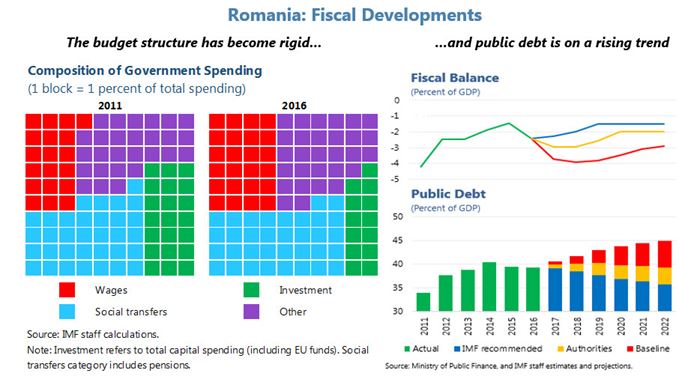

Romania strengthened its economy considerably after the global financial crisis and its macroeconomic indicators compare favorably to its peers. However, successive tax cuts, wage increases in excess of productivity, and limited high quality public investment are beginning to threaten these gains and constrain potential growth. A reorientation of policies from stimulating consumption to supporting investment is needed for sustainable growth. Protecting policy buffers, strengthening structural reforms—particularly to prioritize EU funds absorption—and sustaining the fight against corruption will help secure faster income convergence with the European Union.

Context and outlook

1. Romania has enjoyed strong economic growth in recent years. Real growth reached 4.8 percent in 2016, amongst the highest in the European Union (EU), with private consumption boosted by an expansionary and pro-cyclical fiscal policy and wage increases. Low imported inflation and indirect tax cuts have kept inflation subdued despite the unemployment rate being at historic lows. Growth is projected at 4.2 percent in 2017 supported by continued stimulus to private consumption from a new round of fiscal relaxation and wage increases.

2. A reorientation of policies—from stimulating consumption to supporting investment—however is required to make growth sustainable. Without a strong push to boost investment, accelerate structural reforms, and strengthen institutions, growth is projected to slow over the medium term, reducing the pace of convergence towards the EU’s income level. Progress on structural reforms has been limited: the quality of public investment remains low, absorption of EU funds has been weak, restructuring and privatization of state-owned enterprises has stagnated, and private investment remains below pre-crisis levels.

3. Risks to the medium-term outlook are tilted to the downside . A perception that fiscal prudence has been abandoned, or signs that institutions are weakening, would adversely affect market confidence. Coupled with continued political tensions, this could dampen economic activity, raise the cost of government borrowing and put pressure on the exchange rate. Continued tightening of the labor market and wage growth in excess of productivity threaten Romania’s competitiveness. The main external risks are a protracted slowdown in the euro area and rising interest rates in the U.S. On the upside, prudent economic policies and visible steps to accelerate the pace of structural reforms and improve governance would send a powerful signal about Romania as a good place for doing business.

Fiscal policy

4. Fiscal policy should focus on protecting revenues and moderating expenses . Successive tax cuts have structurally shrunk the revenue envelope while the share of wages and pensions has grown at the cost of investment. The current expansionary stance is not warranted by the cyclical position of the economy and puts at risk Romania’s favorable macroeconomic indicators relative to peers. Recent experience—when Romania’s public debt tripled in only a few years—highlights the importance of fiscal prudence. The mission recommends the revenue envelope be protected, wage and pension growth be moderated, and the authorities aim for a medium-term deficit of 1.5 percent of GDP to rebuild buffers. This can be achieved by reducing the 2017 deficit to around 2.3 percent of GDP—a broadly neutral stance—and to 2 percent in 2018.

5. Without additional effort, it will be challenging to meet the budget deficit target of 3 percent of GDP in 2017 . The mission projects a deficit of 3.7 percent of GDP. The budget included wage and pension increases and revenue cuts with an estimated cost of 1.4 percent of GDP. Previously legislated tax cuts entering into effect this year carry an additional cost of 0.9 percent of GDP. Possible near-term measures to reduce the deficit include expenditure reprioritization and postponing a planned pension increase. However, without timely action, reducing the deficit to 3 percent, which would be associated with lower growth, may require withholding the automatic 10 percent spending buffer and delaying capital spending, both of which are less desirable ways to achieve the target.

|

General Government Operations and EU Funds

(Percent of GDP unless otherwise stated) |

|||

|

2016

Prel. |

2017

Proj. |

2018

Proj. |

|

| Revenue | 29.1 | 29.0 | 29.2 |

| Tax revenue | 26.0 | 26.0 | 25.8 |

| Revenue from EU funds | 0.5 | 0.6 | 1.1 |

| Other revenue | 2.5 | 2.4 | 2.3 |

| Expenditure | 31.5 | 32.7 | 33.1 |

| Total capital spending | 3.8 | 3.5 | 3.7 |

| EU projects | 1.2 | 1.0 | 1.9 |

| Domestic capital spending | 2.5 | 2.5 | 1.7 |

| Other expenditure | 27.7 | 29.3 | 29.5 |

| Cash Balance | -2.4 | -3.7 | -3.9 |

| Memorandum items | |||

| Cyclically adjusted balance 1/ | -2.5 | -4.1 | -4.2 |

| Nominal GDP (in billions of lei) | 759 | 807 | 866 |

| Real GDP (percent change) | 4.8 | 4.2 | 3.4 |

| Output gap 2/ | 0.3 | 1.0 | 0.9 |

| Public debt | 39.2 | 40.6 | 41.7 |

|

Sources: Romanian authorities and staff calculations.

Figures may not add up due to rounding off. 1/ Expressed as percent of potential GDP. 2/ Percentage deviation of actual from potencial GDP. |

|||

6. Moreover, there are risks of further deterioration of the fiscal balance going forward. Under current policies, the deficit is projected to deteriorate to 3.9 percent of GDP in 2018, reflecting the full-year effect of the pension increase scheduled to enter into effect in July. Other measures included in the government’s program (such as the implementation of the unified wage bill, reduction of social security contribution rates, and further tax cuts) could raise the deficit by 5.5 percent of GDP over the next few years (see table).

| Fiscal Cost of Potential Additional Measures, 2017-2020 1/ (Percent of GDP) |

||||||

| Measure | Date of implementation | 2017-2020 | ||||

| Revenue | 3.4 | |||||

| Cut in social security contributions | January 2018 | 1.0 | ||||

| Differential reduced PIT | January 2018 | 1.4 | ||||

| Reduction in VAT to 18 percent | January 2018 | 0.4 | ||||

| Loss of dividends from SOEs | January 2018 | 0.3 | ||||

| Zero-rated VAT for real estate | May 2017 | 0.3 | ||||

| Expenditure | 2.1 | |||||

| Unified wage law 2/ | July 2017 | 2.1 | ||||

| Total effect on the budget | 5.5 | |||||

| 1/ Staff estimates based on preliminary information as of March 2017. Figures may not add up due to rounding off. 2/ Figures reported in this table represent the net effect on the budget. |

||||||

7. Medium term consolidation should be supported by reforms to enhance the effectiveness of the public sector.

- Reforming public remuneration . The government plans a unified wage law to eliminate distortions in the public remuneration system. The law should create a transparent and equitable pay system that does not distort the labor market and helps make public administration more efficient. Implementation should be gradual and in line with available fiscal space.

- Improving revenue collection . Romania has the largest Value-Added Tax compliance gap in the EU. Reform of the tax administration (ANAF) needs to be accelerated. Key priorities are to implement a modern compliance risk management approach, strengthening the large taxpayers’ unit, and reforming the IT system.

- Enhancing expenditure efficiency and commitment controls . The authorities should implement recommendations from recently conducted expenditure reviews and expand such reviews to other key sectors. In light of the significant expenditure commitment in the 2017 budget for local investment programs, it would be important to strengthen transparency and the commitment controls system. It will also be important to assess the sustainability of the pension system.

Structural reforms

8. Achieving higher sustainable growth will be difficult without stronger efforts to increase efficient investment and reform state-owned enterprises (SOEs). The quality of infrastructure in Romania is amongst the lowest in the EU. There is a critical need to strengthen public investment institutions to fully utilize European funds and improve the quality of domestically financed investment. Recent efforts to complete the designation of managing authorities, comply with ex-ante conditionality, and advance eligibility checks on EU-financed projects are welcome and should continue. It will also be essential to strengthen the preparation of large infrastructure projects.

9. Improving the performance of SOEs is also essential to raise economic efficiency and enhance the quality of public investment . The authorities should reenergize the stalled program for privatization and restructuring of SOEs to help improve overall SOE financial performance and reduce arrears. A few successful privatizations and initial public offerings (IPOs)—such as Hidroelectrica which is awaiting appointment of a Supervisory Board—would also help raise Romania’s international profile as an investment destination. In addition, the appointment of professional board members and managers should continue in accordance with the principles of the recently adopted corporate governance law. Banks should be excluded from this law because banks are already subject to a specialized corporate governance law. The government envisages creating a sovereign fund to support investment. The mission recommends that this fund be based on best international practices related to the appointment of management, transparency, auditing, selection of investment projects, and use of state guarantees to minimize potential fiscal risks.

10. The tight labor market conditions call for measures to alleviate existing pressures. The government should focus on reducing mismatches in the labor market by improving vocational education and training and strengthening the capacity of the National Employment Agency. Continued hikes in the minimum wage risk undermining competitiveness and hampering job creation, particularly for low-skilled employees. It is necessary to establish a transparent wage setting mechanism based on clear and objective criteria, especially labor productivity.

11. The drive against corruption should continue. Romania has made considerable gains in this area. Lower corruption and strong institutions are associated with multiple economic benefits: it helps raise tax collections, improve the allocation of scarce public resources, and attract both domestic and foreign investment. Maintaining the momentum will require effective implementation of the national anti-corruption strategy, preventing conflict of interest in public procurement, and strengthening the management of seized assets.

Monetary policy and financial sector

12. The National Bank of Romania should remain vigilant against rising inflationary pressures and consider tightening monetary conditions. Underlying domestic inflation and credit growth remain subdued but rising inflation in trading partners, high wage growth amidst tight labor market conditions, and the additional fiscal impulse are expected to put upward pressure on prices. Under unchanged policies, the mission expects inflation will exceed the upper end of the NBR’s target band by mid-2018. Given lags in the monetary transmission mechanism, and consistent with strengthening the monetary policy framework, the authorities should reduce the gap between short-term market rates and the policy rate by narrowing the interest rate corridor and absorbing excess liquidity. This would prepare the ground for an eventual policy rate hike later. In the absence of corrective fiscal measures, monetary policy will need to shoulder a bigger burden in managing domestic demand—a suboptimal policy mix.

13. The mission welcomes the significant reduction in banks’ non-performing loans (NPLs) and encourages close monitoring of banks’ growing exposure to households and the government. The NBR stands out in the region for proactively encouraging NPL sales and write-offs. Also, previous threats to financial stability from potentially damaging laws have lessened after recent decisions of the constitutional court. The NBR should closely monitor developments in the credit market and help foster prudent credit expansion on the part of banks. While overall credit growth has been sluggish, mortgage lending has grown primarily due to the government’s Prima Casa guarantee program. Also, banks have increased their holdings of government debt, exposing them to market risk. This growing exposure of banks to households and the government should be carefully monitored and the central bank should address any emerging risks.

The mission visited Bucharest during March 8-17 and met with President Klaus Iohannis, Prime Minister Sorin Grindeanu, Vice-Prime Minister Sevil Shhaideh, Minister of Finance Viorel Ștefan, Governor Mugur Isărescu, Minister of Economy Mihai Tudose, members of Parliament, other public officials, representatives of the private sector, and other stakeholders. The mission is grateful to the authorities and other counterparts for their warm hospitality, excellent cooperation, and constructive discussions.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Andreas Adriano

Phone: +1 202 623-7100Email: MEDIA@IMF.org