Cars and motorbikes navigate through a busy street in Bangkok, Thailand. The country’s economy registered strong growth last year, at an estimated 3.9 percent (photo: FrankFell/robertharding/Newscom)

Thailand's Economic Outlook in Six Charts

June 8, 2018

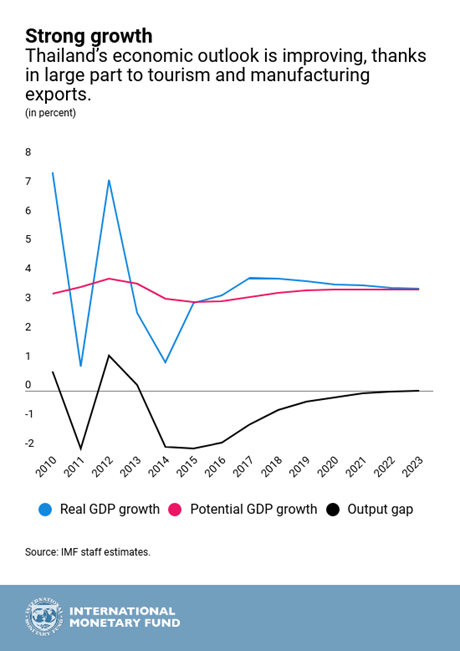

Thailand’s economic outlook is improving. Growth is estimated at 3.9 percent in 2017—the fastest pace on an annual basis since 2013—but it has yet to become broad-based. To secure growth that benefits everyone, the country will need to implement key reforms to raise domestic demand and prepare for the impact of an aging population, said the IMF in its latest annual assessment.

The following six charts show why the IMF suggests the need for reforms in these areas.

Related Links

-

Thailand’s growth momentum is expected to continue in 2018 and 2019. Strong growth in tourism and exports of manufacturing goods are expected to continue to sustain this momentum. Investment and consumption are projected to recover gradually.

-

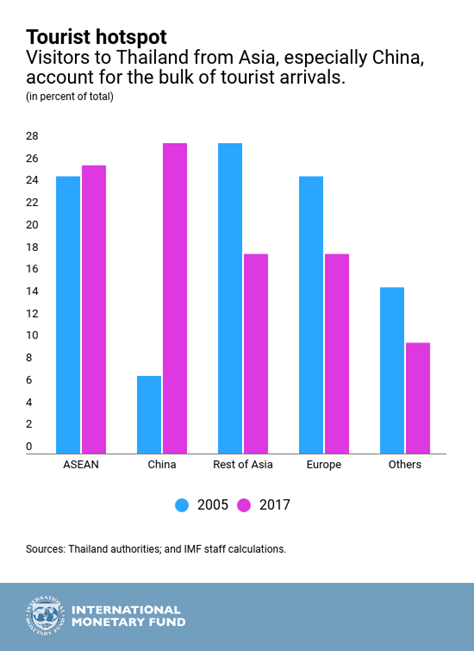

Tourism is a key driver of growth and of the large current account surplus, which stood at 10.6 percent of GDP in 2017. More than 34 million tourists visit Thailand yearly. A boom in tourism is good news for the economy, but the gains—concentrated in a few select tourist hotspots—have yet to benefit other sectors of the economy.

-

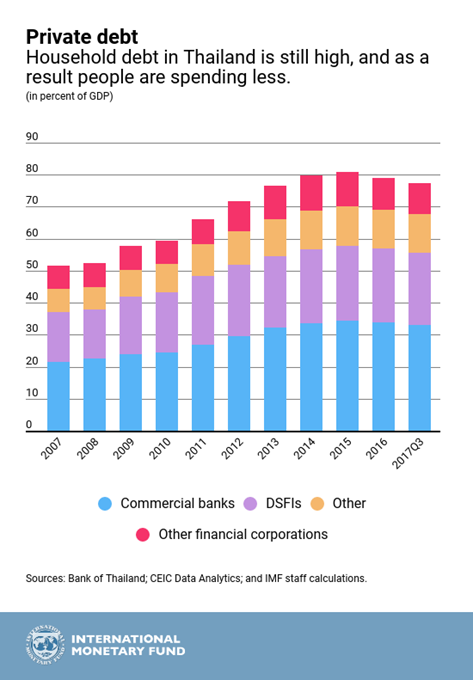

Yet, household debt in the country is still high, which is one of the reasons why people are holding up spending. High debt resulted partly from past policies that incentivized credit growth, such as the first car loan program. These policies have now been discontinued. The Bank of Thailand has also imposed limits on personal loans and credit card debt. As these debts begin to be paid off, the drag on household spending should be reduced.

-

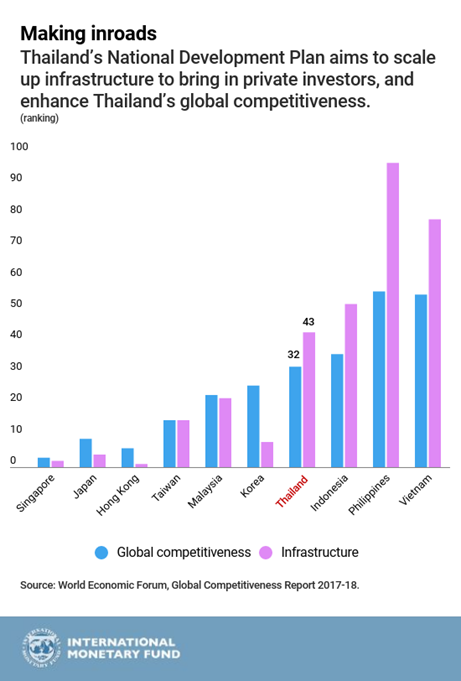

Scaling up public investment in Thailand can help spur domestic demand and make growth more inclusive. This is critical after the steep slowdown in private investment observed over the last five years. An infrastructure-based fiscal stimulus can bring in private investors and raise long-run growth prospects by adding to the capital stock.

-

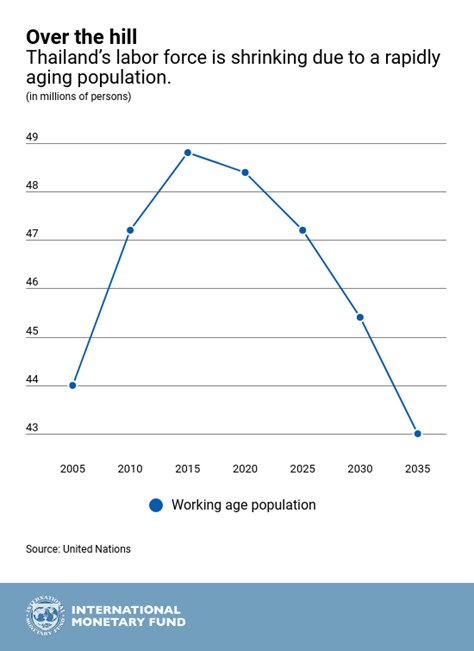

Promoting participation in the workforce can help Thailand ease the impact of a shrinking labor force due to a rapidly aging population. Although women’s participation rate in Thailand is relatively high by international standards, it still lags that of men. Government support for child care services can increase women’s participation in the workforce and boost labor productivity. Pension reform, including increasing the pensionable age and providing adequate coverage, would also help to increase overall labor force participation in the country.

-

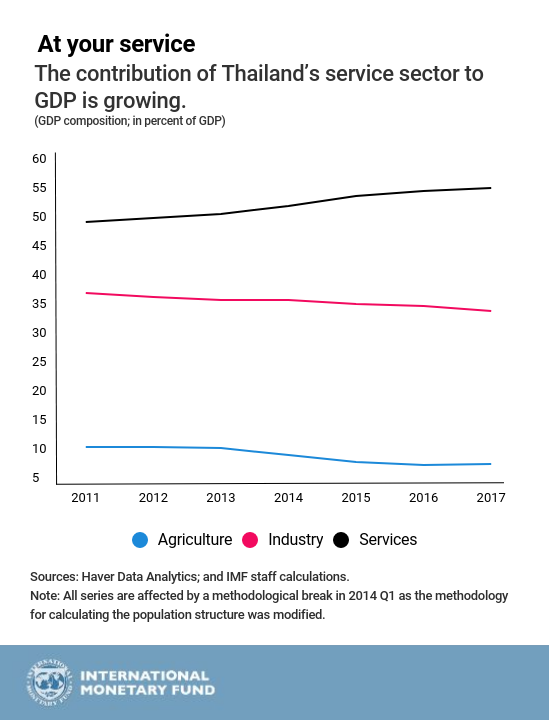

Thailand’s service sector is expanding, while the government is embracing the digital revolution to boost productivity. The government recently launched a national e-payment system that would help boost tax collection efficiency. In addition to upgrading the country’s strong manufacturing base in automobiles and electronics, policy focus is also extending to new sources of growth. These include industries such as robotics, aerospace, and biotechnology. As automation continues to transform the future of work, promoting education and training initiatives in the country can help upgrade skill-sets for today’s and tomorrow’s global job market.