Key Questions on Sudan

In recognition of the commendable progress Sudan has made in establishing a track record of economic reform, on June 29, 2021 the IMF and World Bank approved Sudan’s eligibility for debt relief under the Enhanced Heavily Indebted Poor Countries (HIPC) Initiative. Debt relief will help Sudan improve its economic prospects, reduce poverty, and raise living standards for the Sudanese people. A Debt Relief Analysis (DRA) based on estimated end-2020 data targets a reduction in Sudan’s public- and publicly-guaranteed external debt to the “150 percent of exports” threshold under HIPC. Under such a scenario, assuming full application of debt relief and participation by all creditors, this would imply an estimated reduction in Sudan’s debt from $56 billion to $6 billion at Completion Point in present value terms.

- What does the Decision Point mean and why is it important for Sudan?

- What happens next? What more does Sudan need to do to get the full amount of debt relief?

- Why does Sudan need debt relief?

- What is the composition of Sudan’s debt and what does debt relief mean in the context of the HIPC initiative?

- Sudan has a new financing arrangement with the IMF. What is the purpose of that?

- How is Sudan’s economy currently doing and how has the global COVID-19 pandemic affected the country?

- What role does the international community play in supporting Sudan’s plea to attain debt relief?

- Does debt relief provide fresh resources to Sudan?

What does the Decision Point mean and why is it important for Sudan?

At Decision Point, a country becomes eligible for debt relief under the Enhanced HIPC Initiative. A country reaches Decision Point when it: (1) establishes a minimum six-month track record of satisfactory performance under an IMF Upper-Credit-Tranche quality program; in Sudan’s case, the UCT-quality Staff-Monitored Program (SMP); (2) clears its arrears to the World Bank, AfDB, and IMF, and agrees to a strategy to clear arrears to other multilateral creditors; (3) agrees to a set of appropriate completion point triggers with IMF and IDA staff; and (4) adopts at least an interim Poverty Reduction Strategy.

Debt relief under the HIPC Initiative will significantly reduce Sudan’s external debt burden. Assuming full application and creditor participation, Sudan’s debt is expected to decline from about $56 billion under current assumptions to $28 billion at Decision Point in present value terms. At Completion Point, debt is estimated to decline further to around $6 billion.

What happens next? What more does Sudan need to do to get the full amount of debt relief?

To obtain full debt relief, Sudan will need to reach the HIPC Completion Point. This can be accomplished once Sudan implements the floating Completion Point triggers (including satisfactory implementation of their full Poverty Reduction Strategy for at least one year) and maintains a track record of satisfactory macroeconomic performance under the country’s Extended Credit Facility (ECF).

Why does Sudan need debt relief?

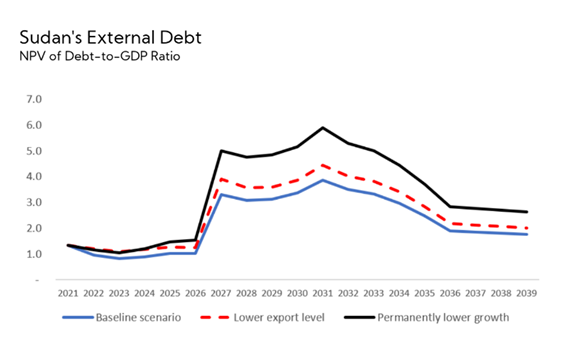

Sudan’s debt is large and mostly comprised of long-standing arrears (see composition below) that have accumulated over time. Standing at over 150 percent of GDP and over ten (10) times of exports, Sudan’s debt is unsustainable. The HIPC framework aims to lower an eligible country’s debt burden to 150 percent of exports in order to align it with their capacity to repay.

What is the composition of Sudan’s debt and what does debt relief mean in the context of the HIPC initiative?

Sudan owes debt to multilateral creditors (11 percent), Paris Club and non-Paris Club bilateral creditors (78 percent, split 42 and 36 percent, respectively) and commercial creditors (11 percent). Under the HIPC initiative, all creditors are expected to share in the burden of debt relief by providing comparability of treatment. Comparability of treatment means that Sudan should not accept less favorable terms from any one creditor than others; in other words, all creditors should apply the “common reduction factor” equally to their outstanding debt stock in providing relief.

Sudan has a new financing arrangement with the IMF. What is the purpose of that?

The new Extended Credit Facility (ECF) will anchor the authorities’ policies and reforms between the HIPC Decision Point and Completion Point. The reform priorities in the ECF arrangement have been closely coordinated with other donors and complement the proposed HIPC floating Completion Point (CP) triggers that will determine precisely when Sudan could reach the Completion Point.

Reforms will focus on: fiscal stability through increased domestic revenue mobilization and reduced energy subsidies, and measures to strengthen the social safety net; supporting exchange rate flexibility and the adoption of a reserve money targeting regime; strengthening the financial sector by implementing a dual banking system and reforming the bank resolution regime; and strengthening governance and transparency, especially in the SOE sector.

How is Sudan’s economy currently doing and how has the global COVID-19 pandemic affected the country?

Despite recording a third consecutive year of contraction in 2020 (-3.6 percent), the Sudanese economy held up better than the Middle East and North Africa region as a whole despite COVID-19 mitigation measures and record flooding. Inflation rose to 379 percent y/y in May 2021 due to large monetization of the fiscal deficit and was exacerbated by shortages of food and fuel. Growth is expected to pick up in 2021 with inflation falling as the fiscal deficit is reduced and higher grant financing lowers the need for monetization.

The COVID-19 pandemic has compounded the challenges faced by the transitional government. The official number of confirmed COVID cases stands at 34,889 with 2,600 deaths as of May 24. Due to an accelerating infection rate, on May 18 the government suspended studies in all universities and schools for one month and banned certain mass gatherings.

What role does the international community play in supporting Sudan’s plea to attain debt relief?

The international community supports Sudan in achieving debt relief on multiple levels. The IMF and World Bank are supporting Sudan’s efforts to reintegrate with the international financial community through the HIPC process, including through the joint debt reconciliation exercise. The IMF supports the authorities’ policy agenda to achieve a satisfactory track record through the Staff-Monitored Program, while the World Bank and African Development Bank (AfDB) lent their support to the development of a Poverty Reduction Strategy. Sudan cleared its arrears to the World Bank on March 26 and the African Development Bank on May 12, and to the IMF on June 29. Several bilateral partners are also providing support.

Does debt relief provide fresh resources to Sudan?

No, debt relief aims to bring the level and repayment schedule of the debt that Sudan currently has to a level that is sustainable, with debt service payments that are consistent with Sudan’s limited payment capacity. At Decision Point, Sudan’s stock of debt will decline but its debt service payments will likely increase as Sudan resumes debt service payments. That said, reintegration with the international financing community and becoming current on debt service obligations falling due will unlock concessional financing and grants from multilateral as well as bilateral donors. Moreover, sustained strong macroeconomic policies and improvements in the business climate will help attract foreign investment.