Central banks should better communicate monetary policy’s distributional effects

Central banks across the globe are responding to the economic effects of the COVID-19 pandemic through extensive monetary easing, including interest rate cuts and asset purchases. Such accommodative policies have served to limit the fallout from the pandemic. Whether, at the same time, these policies exacerbate inequality, however, is up for debate. Monetary policy is seen, in part, as responsible for boosting equity markets from pandemic lows, which is, in the first instance, good news mainly for the rich. Yet monetary easing also has the potential to reduce inequality; for instance, because low interest rates can encourage small businesses to take out loans and hire workers.

So, on balance, is easy monetary policy increasing or reducing inequality?

Meet the Sampsons

Monetary policy discussions are often fairly abstract, so let’s think about this on a more personal level. What does it mean for you when your central bank eases monetary policy? Does it help or hurt your finances, and how do you fare compared with others? At a basic level, this depends on your income, wealth, savings, and debt.

To illustrate, let’s introduce the Sampsons, a hypothetical family composed of Lisa, a young woman in her early twenties; her parents Margarita and Homero; and her uncle Arturo, an accountant in his fifties. How does monetary easing affect them?

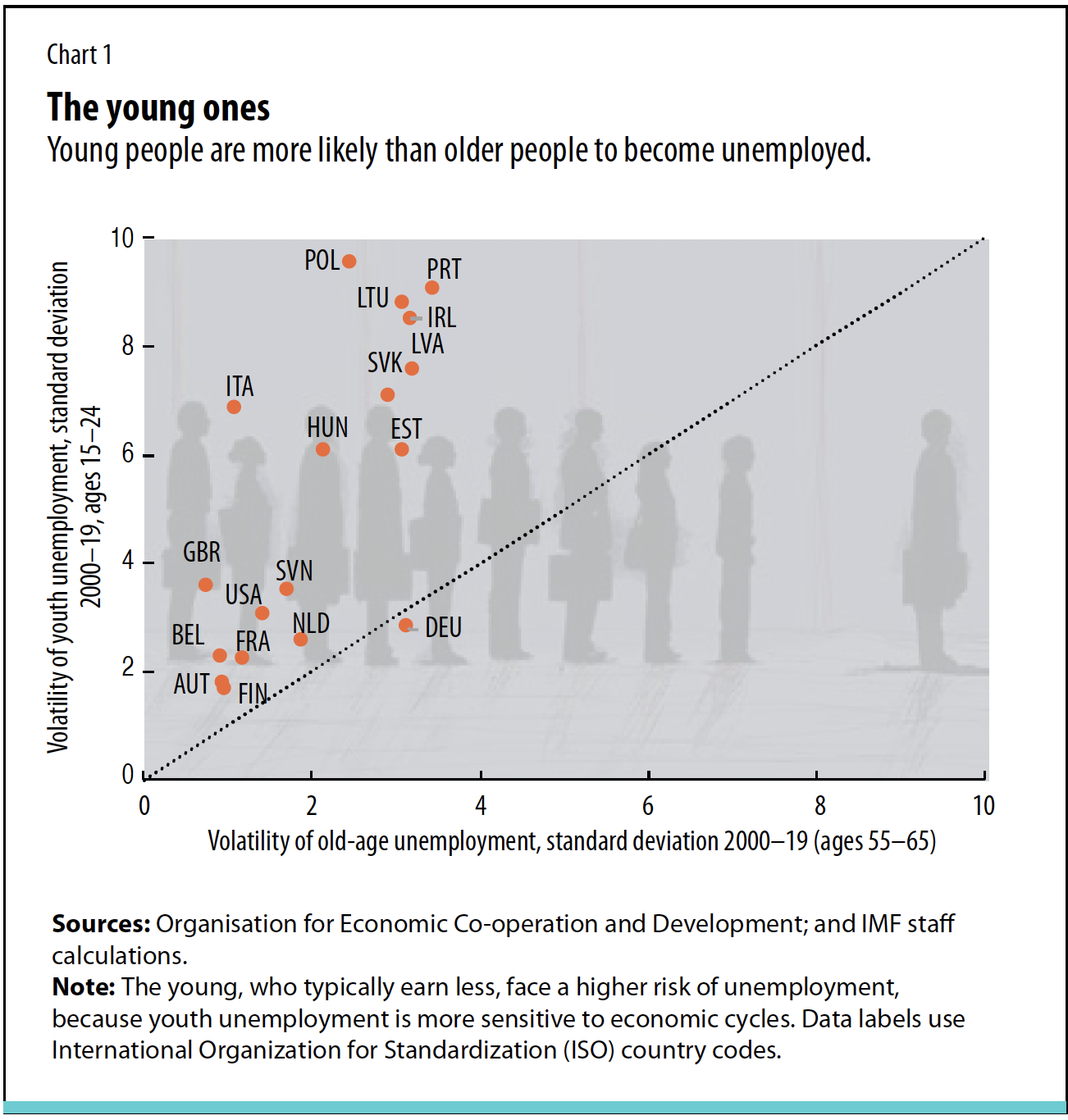

First consider Lisa, who relies on her income as a waitress to pursue a nursing degree part-time. She is currently a low-skilled worker and earns less than older, higher-skilled, and more experienced workers, such as her uncle Arturo. Lisa is also more likely than older workers to lose her job during a recession and become unemployed (see Chart 1).

The good news for Lisa is that monetary easing makes recessions less harsh on unemployment. Through this labor earnings channel, monetary easing stimulates economic activity and reduces unemployment, disproportionately benefiting younger, less experienced, and lower-paid workers, who are often the first to lose their jobs in a recession. In the absence of monetary easing, she would have been more likely to lose her job, and the labor earnings gap between her and her uncle would have been even larger. Even if Lisa had found a new job, it might have been precarious—for example, with a short-term contract and few benefits.

Now consider Arturo, who earns a wage, has capital income from investments in bonds and stocks, and owns a house. Lower interest rates would boost his capital income; hence Arturo would benefit via the income composition channel, as well as from the higher value of his investments in bonds, stocks, and real estate via the balance sheet channel. Lisa, however, would not gain directly from higher capital income nor from higher asset prices, as she does not have any assets.

Finally, let’s examine the case of Margarita and Homero, who are retired after saving all their lives and rely on their retirement income and interest from bank deposits. They are net savers. Lisa is a net borrower, with both student and car loans. With an interest rate cut, Lisa would owe the bank less in interest payments, either because her loan rates would be lower (if the loan is adjustable) or because she could refinance at a lower rate. But Margarita and Homero would lose out because their interest income would fall as a result of lower interest rates (and possibly in real terms, as inflation could increase with monetary easing). Their retirement income could fall in real terms.

All else equal, monetary easing tends to hurt savers with little debt and large bank deposits while benefiting net borrowers (Auclert 2019; Tzamourani 2021). In other words, it redistributes from savers to borrowers: this is known as the savings redistribution channel.

The winner is…

The net effect for Lisa, her parents, and uncle would depend on the combined impact of monetary policy action via different channels, as they would gain through some channels but lose through others.

Lisa, for example, would benefit from monetary easing, via her labor earnings and her lower debt servicing cost, although she would not benefit directly from higher asset prices.

Arturo would benefit following monetary easing from both higher labor earnings and higher capital income—but if he is a net saver, he would be hurt by lower interest income. Margarita and Homero’s losses on interest income from their savings could be offset by a higher home value—and possibly from no longer having to support their previously struggling daughter if monetary actions help secure her job.

Different channels

As illustrated by the Sampsons, the magnitude of the distributional effects of monetary easing depends on the relative importance of different channels, which may also vary based on different country characteristics.

In countries with higher levels of financial inclusion, for instance, poor households have easier access to credit and are more likely to be able to take out mortgages to buy houses—thereby benefiting from lower interest rates. In other countries, people who tend to buy homes for cash would not benefit from lower rates. In countries with bank-based financial systems, people who hold their savings in bank deposits and are not in debt could lose out from monetary easing through the savings redistribution channel. In countries with more extensive social protection, a lower risk of unemployment for lower-income workers as a result of monetary easing may be more muted than in countries with less social protection.

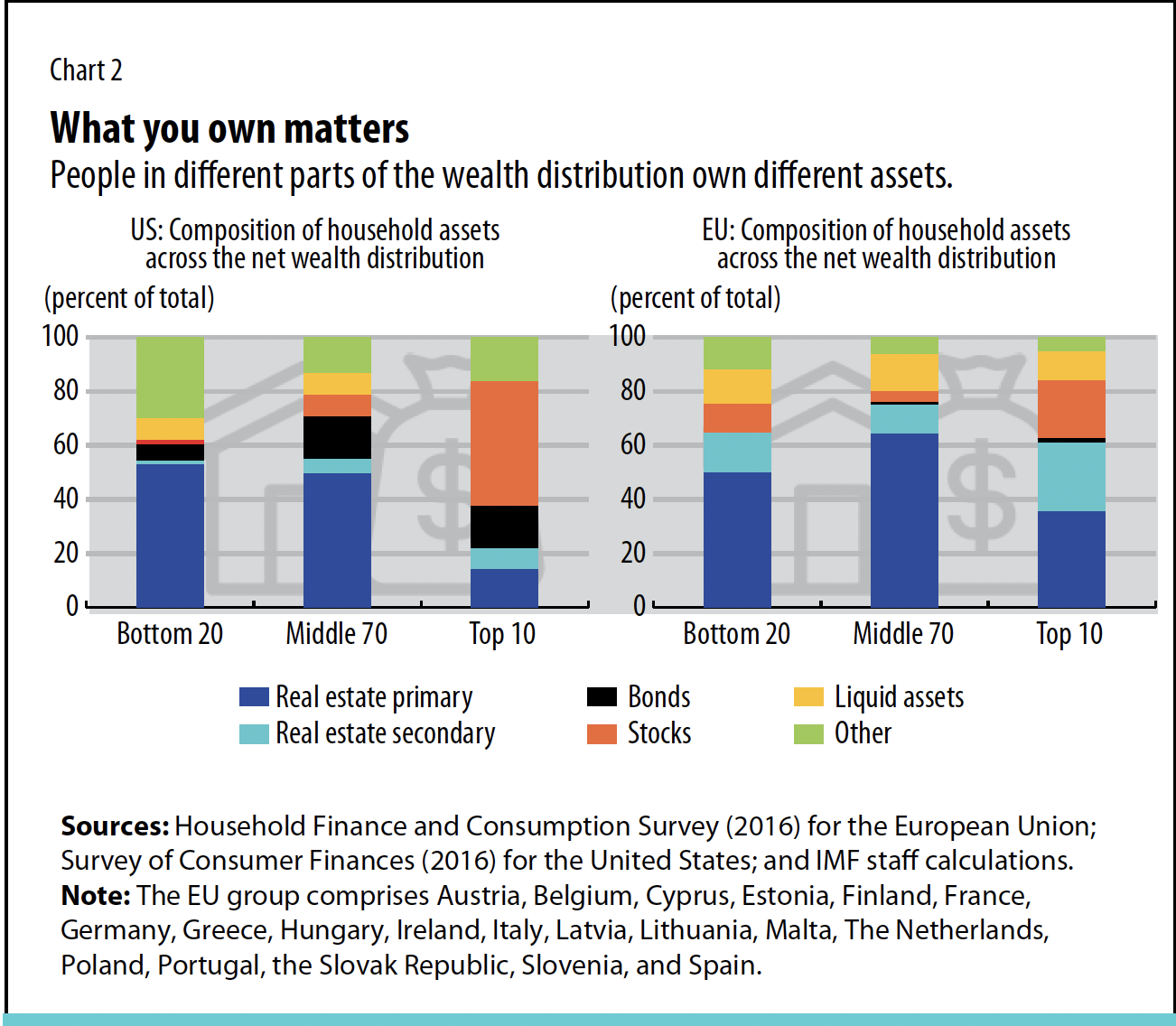

In the European Union and the United States, the impact of the balance sheet channel on inequality can vary depending on the types of assets people own. Capital income tends to matter most for the wealthiest households because they hold more financial assets. This is especially true in the United States, where almost two-thirds of the assets of the wealthiest 10 percent are in bonds (16 percent) and stocks (46 percent—see Chart 2). Except for this group, real estate is the largest asset for most households in both the European Union and the United States. This means that the impact of monetary easing may have more equitable effects via house prices than through capital income, and people with mortgages also benefit from lower debt payments.

Studies (pre–COVID-19) that put together several of the above channels find mixed and often economically negligible net distributional effects overall from transitory monetary policy easing, with some variation across countries and between conventional (interest rates) and unconventional (asset purchases) monetary policy. In the United States, for example, income inequality rises and consumption inequality falls following monetary easing—but the effects are small and temporary (Kaplan, Moll, and Violante 2018).

The big question

Given widening income and wealth gaps, and limited room in the budget in many countries, should monetary policy do more to address inequality?

The problem is that monetary policy is a blunt tool that is poorly suited to the challenges facing specific demographic or socioeconomic groups. Moreover, adding one more objective for central banks may undermine the efficacy of monetary policy, since pursuing lower inequality might be at odds with the mandate to maintain price and output stability. Other actors, most notably the government, are better able to tackle issues related to rising inequality given that these long-term trends are driven largely by structural factors and require finer tools to target specific groups.

Central banks, by remaining focused on their primary function, will be free to do what they do best: take appropriate action to counter economic downturns and protect jobs while maintaining price stability. At the same time, central banks should better understand and factor in differences among households within their existing policy frameworks, including through modeling and analysis of the distribution of income and wealth, which affects monetary policy transmission.

At the same time, supportive fiscal policy and structural reforms combined with monetary policy easing can improve both macroeconomic and distributional outcomes. Targeted fiscal support, along with well-sequenced structural reforms—such as active labor market policies, including job search assistance and retraining—is especially well suited to addressing rising inequality and helping those left behind by economic transformation.

The key role for central banks in the inequality debate—including during COVID-19—is clear communication through various outlets, including speeches by central bank officials, official reports, and community outreach events, about the distributional effects of monetary policy actions, both positive and negative. They need to explain how their actions may increase aggregate welfare by boosting the employment prospects of the poorest and reducing consumption inequality. Clear communication is essential for the preservation of public trust and the clarification of capabilities under their mandate.

Major central banks are starting to explicitly discuss the distributional effects of their actions (Carney 2016; Lane 2019). The Federal Reserve has also recently revised its mandate, including to emphasize maximum employment as a broad-based, inclusive goal and to strengthen the benefits of monetary policy stimulus for the poor.

Beyond COVID-19

The pandemic is having considerable distributional effects, and debates about inequality continue, including in the context of central banks. The relative importance of the various channels through which monetary policy affects inequality may change if the pandemic persistently alters the distribution of income and wealth.

While macroeconomic stability remains their primary goal, central banks do have a role to play by communicating about, monitoring, and analyzing the distributional effects of monetary policy. Central banks should also highlight counterfactuals—the overall increase in welfare thanks to monetary policy actions, despite possible distributional effects. Finally, central banks should explain that the secular increase in inequality and long-term decline in interest rates are driven largely by structural factors, which can be tackled only with other government policies.

This article is based on a recent IMF Working Paper (“Distributional Effects of Monetary Policy”) by the article authors and Valentina Bonifacio, Luis Brandao-Marques, Balazs Csonto, Philipp Engler, Davide Furceri, Rui Mano, Machiko Narita, Murad Omoev, and Gurnain Pasricha.

References:

Auclert, A. 2019. “Monetary Policy and the Redistribution Channel.” American Economic Review 109 (6): 2333–367.

Carney, M. 2016. “The Spectre of Monetarism.” Roscoe Lecture, John Moores University, Liverpool, UK, December 5.

Kaplan, G., B. Moll, and G. L. Violante. 2018. “Monetary Policy According to HANK.” American Economic Review 108 (3): 697–743.

Lane, P. 2019. “Households and the Transmission of Monetary Policy.” Speech at the Central Bank of Ireland/ECB Conference on Household Finance and Consumption, Dublin, December 16.

Tzamourani, P. 2021. “The Interest Rate Exposure of Euro Area Households.” European Economic Review 132 (February): 103643.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily represent the views of the IMF and its Executive Board, or IMF policy.