Newly built apartment blocks in Stockholm, Sweden: Many Swedish households take out large mortgage loans to pay for soaring house prices (photo: Bloomberg/Gettyimages)

Sweden: Great Economic Performance but Mind the Debt

November 17, 2016

- Swedish economy is in good shape

- Rising portion of households with high debt is creating risks to economic stability

- Large and regionally‑interconnected banking system needs stronger supervision

The Swedish economy is in good health and growing robustly. Nevertheless, households are increasingly taking on large mortgage debts that might cause trouble, and the sheer size of the financial sector together with its central role in the region in itself calls for intensified supervision, says the IMF in its new economic and financial assessments.

Related Links

Headline Swedish indicators describe a healthy economy: growth was very strong at 4.1 percent in first half of 2016 (after 4.1 percent in 2015), driven mainly by domestic demand. High private investment growth is particularly strong in housing construction, while government spending related to migrants supported consumption and job creation. Unemployment has come down to just under 7 percent (from 8 percent in 2011-14).

However, the relative comfort of the broader economic situation masks several challenges. Sweden has yet to adequately tackle the imbalances in the housing market, which push up prices and debt, upgrade prudential oversight to match the scale of the financial sector, and ensure that the robust labor market also helps to integrate the large inflow of refugees Sweden received in 2015, the reports point out.

House prices and household debt

Although the pace of increases has slowed somewhat recently, home prices in Sweden have risen to high levels, especially in the main cities. Swedes looking for housing are taking out increasingly large mortgages. It is seen in the rising shares of new mortgage borrowers whose debts are staggeringly high relative to income (see Chart 1).

“As more people take on a lot of debt, the economy becomes vulnerable over time,” said Craig Beaumont, in charge of the annual evaluation report on Sweden’s economy. But the risk comes less from a wave of defaults on mortgages, and more from a cut in their spending as Swedish households prioritize servicing their debts. There are knock-on effects on employment and demand, which, in turn, endangers small firms.

“The resilience of households to future shocks needs to be protected so that they do not have to severely cut back on consumption,” Beaumont added.

One way to slow the rise in debt relative to Swedes’ income is to build more housing to moderate the long uptrend in housing prices, so borrowers don’t need to take on ever greater debts. The housing market would also benefit from the ending of the deductibility of mortgage interest and phasing out rent controls while protecting the vulnerable, says the report. In the shorter term, though, the financial supervisor should adopt tools to lean against the rise in the share of highly indebted households.

Large financial sector must remain resilient

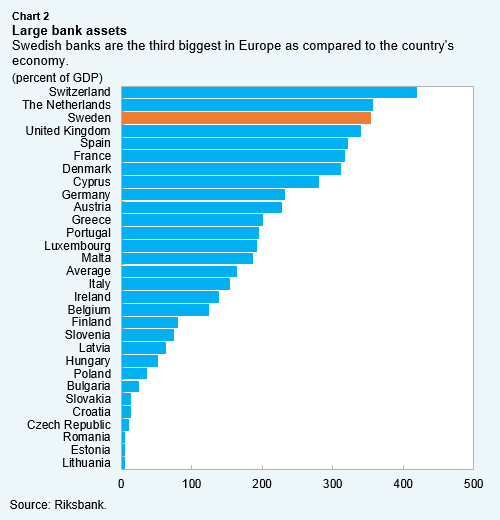

Sweden’s financial system is one of Europe’s largest relative to the country’s economy (see Chart 2). It is also complex and highly interconnected domestically and internationally, reflecting Sweden’s role as a regional financial hub.

“The systemic nature of the Swedish financial sector raises expectations for the quality of the financial sector policy framework and financial safety nets,” said Martin Cihak, in charge of the Financial System Stability Assessment for Sweden. In countries with systemically important financial sectors, like Sweden, the IMF undertakes such in-depth assessments every five years.

The analysis suggests that Swedish financial institutions are largely resilient to solvency shocks, but reliance on funding through capital markets makes them sensitive to global market sentiment. A house price decline combined with a lower confidence in Swedish housing market collateral could trigger disturbances across the region, the report notes.

To cope with the responsibility that comes with size, Sweden should upgrade its financial oversight system in terms of resources, toolkit, and mandate.

“One of our key recommendations is to fix deficiencies in the legal framework for macroprudential policy to allow timely action,” said Cihak.

“In that regard, it is encouraging that the Swedish authorities recently announced a political agreement on expanding the ability of the country’s financial supervisory authority to counteract financial imbalances in the credit market,” he added.

Integration of immigrants

A record number of asylum seekers, almost 163,000, arrived in Sweden last year—the highest in Europe relative to population—leading to increased government spending and consumption. Asylum applications have since dropped to roughly 15,000 in the first half of 2016. However, the stretched administration struggles to process residence permit applications and to find suitable housing in municipalities, slowing the migrants’ integration into the labor market and into Swedish society. The report recommends a focus on affordable housing, streamlined wage subsidies, and temporary targeted exceptions to high entry-level wages. Although migrant related spending doubles from 2015 to 2017, the country’s strong fiscal position and the temporary nature of this spending has not compromised the country’s overall fiscal health.