2017 Article IV Consultation with the United States of America - Concluding Statement of the IMF Mission

June 27, 2017

The Macroeconomic Outlook

1. The U.S. economy is in its third longest expansion since 1850. Real GDP is now 12 percent higher than its pre-recession peak, job growth has been persistently strong and, although there are measurement uncertainties, the U.S. economy appears to be back at full employment.

2. However, the outlook is clouded by important medium-term imbalances. The U.S. economic model is not working as well as it could in generating broadly shared income growth. It is burdened by a rising public debt. The U.S. dollar is moderately overvalued (by around 10-20 percent). The external position is moderately weaker than implied by medium term fundamentals and desirable policies. The current account deficit is expected to be around 3 percent of GDP over the medium-term and the net international investment position has deteriorated markedly in the past several years. Most critically, relative to historical performance, post-crisis growth has been too low and too unequal.

3. To address these shortcomings, the administration intends a wide-ranging overhaul of policies, although a fully articulated policy plan has yet to emerge. The administration’s budget proposes to reduce the fiscal deficit and debt, to reprioritize public spending, and to revamp the tax system. However, during the Article IV consultation it became evident that many details about these plans are still undecided. Given these policy uncertainties, the IMF’s macroeconomic forecast uses a baseline assumption of unchanged policies. Specifically, it neither builds in the effect of tax reform nor the expenditure reductions proposed in the administration’s budget. Under this forecast, growth is expected to rise modestly above 2 percent this year and next, driven by continued solid consumption growth and a cyclical rebound in private investment. Growth is forecast to subsequently converge to the underlying potential growth rate of 1.8 percent.

4. Significant policy uncertainties imply larger-than-usual, two-sided risks to the forecast. On the one hand, a medium-term path of fiscal consolidation, such as that proposed in the budget, would result in a growth rate that is below this baseline. On the other hand, spending reductions could be less ambitious and tax reforms could lower federal revenues, providing stimulus to the economy, raising near-term growth (and possibly potential growth), but with negative implications for debt sustainability and the current account imbalance. Over the medium-term, a broader retreat from cross-border integration would represent a downside risk to trade, sentiment, and growth.

Policy Goals

5. Like many other advanced economies, the U.S. is being confronted with secular shifts on multiple fronts. These include technological change that is reshaping the labor market, low productivity growth, rising skills premia, and an aging population. Despite having high per capita income and being one of the most flexible, competitive, and innovative economies in the world, the U.S. model appears to be having difficulties adapting to these secular changes. As was pointed out in the administration’s budget, these shifts are having real consequences for people’s livelihoods: household incomes are stagnating for a large share of the population (in inflation-adjusted terms, more than half of U.S. households has a lower income today than they did in 2000); job opportunities are deteriorating with many workers too discouraged to remain in the labor force (since 2007, the labor force participation rate has fallen from 66 to below 63 percent of the non-institutionalized civilian population); prospects for upward mobility are waning; and the poverty rate (at 13.5 percent) is one of the highest among advanced economies.

6. A comprehensive policy package is needed. The administration’s priorities include taking steps to spark faster economic and productivity growth, stimulate job creation, incentivize business investment, balance the budget, bring down the public debt, and create fiscal space to finance priorities such as infrastructure. These objectives are welcome but the consultation revealed differences on a range of policies and left open questions as to whether the administration’s proposed policy strategies are best suited to achieve their intended purpose. Nonetheless, there was agreement that the policy package will need to incorporate reforms on multiple, macro-critical fronts. These include building a more efficient tax system, improving education and developing skills, reprioritizing federal spending, improving the effectiveness of the regulatory system, and reforming the immigration and welfare systems. The right policy package represents an upside risk to growth and would serve to ensure a broad-based improvement in living standards. The remainder of this concluding statement aims to outline a possible set of macroeconomic and supply-side policies that would achieve such an outcome.

7. However, it should be said at the start that, even with an ideal constellation of pro-growth policies, the potential growth dividend is likely to be less than that projected in the budget and will take longer to materialize. The U.S. is effectively at full employment. For policy changes to be successful in achieving sustained, higher growth they would need to raise the U.S. potential growth path. The international experience and U.S. history would suggest that a sustained acceleration in annual growth of more than 1 percentage points, as projected by the administration, is unlikely. Indeed, since the 1980s there are only a few identified cases among the advanced economies where this has happened. These episodes mostly took place in the mid to late 1990s against a backdrop of strong global demand and many of them were associated with recoveries from recessions. The U.S. itself experienced one comparable growth acceleration as it recovered from the deep recession of the early 1980s. However, this event occurred during a period of favorable demographics, rising labor force participation, a significant expansion of the federal fiscal deficit, and an acceleration in trading partner growth. These tailwinds are unlikely to recur today.

The Macroeconomic Policy Mix

8. With the economy at full employment it is important that the U.S. puts in place the right policy mix for this stage in the cycle. That would involve gradually removing both fiscal and monetary support and refocusing efforts on expanding potential growth, raising competitiveness, and strengthening the supply side. Doing so will lower the current account deficit and improve the net international investment position, reduce the overvaluation of the U.S. dollar, and have positive spillovers to others. There are two parts to this policy shift:

Part 1: A balanced medium-term fiscal consolidation

9. Under unchanged policies, demographic trends and rising interest rates will lead to a steady increase in fiscal deficits and public debt over the medium-term. To prevent this, the U.S. should put in place a plan for medium-term fiscal consolidation that targets a federal primary surplus of around 1 percent of GDP (or a general government primary surplus of around ¾ percent of GDP). This adjustment can be gradual but ought to start in 2018 so as to lower the federal debt-GDP ratio over the medium-term.

10. The administration’s budget proposes an expenditure-based medium-term fiscal consolidation. Under the authorities’ budget, the federal primary balance is forecast to go from a 1.9 percent of GDP deficit to a 2.1 percent of GDP surplus over the next 10 years. This adjustment is predicated on a modest increase in revenues, a reduction in both non-defense spending and defense outlays as a share of GDP, and an extremely optimistic growth assumption. The non-defense spending reductions are concentrated in two broad areas: a downsizing of line agencies (outside of defense and security) and reductions in spending on safety net programs. Fewer details are currently available on the tax reform that the budget is based upon but our understanding is that it will be designed to improve efficiency and lower marginal rates while leaving the federal revenue-GDP ratio broadly unchanged.

11. A different composition of adjustment could stabilize the public debt-GDP ratio with smaller costs to growth and living standards. As currently framed, the budget implies significant cuts to discretionary spending that, in the staff’s view, would seem to place a disproportionate share of the adjustment burden on low- and middle-income households. This would appear counter to the budget’s goals of promoting safety and prosperity for all Americans. An alternative approach would rely on:

- A tax reform that simplifies the tax system, improves efficiency and, importantly, increases the federal revenue-GDP ratio (see below).

- More balanced expenditure restraint that strengthens the effectiveness and efficiency of the safety net and reprioritizes appropriations, increasing spending on those programs that encourage labor force participation, improve infrastructure, and raise productivity and human capital.

- Measures to reform the social security system including raising the income ceiling for social security contributions, indexing benefits to chained CPI or PCE inflation, raising the retirement age, and instituting greater progressivity in the benefit structure.

- Policy action to contain healthcare cost inflation including through technological solutions that increase efficiency, greater cost sharing with beneficiaries, and shifting incentives toward remunerating providers for health outcomes (rather than per procedure).

Part 2: A gradual and well-communicated monetary normalization

12. With the Federal Reserve having largely achieved its dual mandate of price stability and maximum employment, policy rates should continue to rise. The pace of rate increases can be gradual, especially when compared with previous tightening cycles, and should certainly be data dependent. Given the downside risks to inflation and the asymmetries posed by the effective lower bound, the Federal Reserve should be ready to accept some modest, temporary overshooting of its inflation goal that allows inflation to approach the 2 percent medium-term target from above. Doing so would provide valuable insurance against the risks of disinflation and having to bring the federal funds rate back down to zero.

13. Alongside the ongoing normalization in policy rates, it is appropriate that the Federal Reserve looks to unwind the post-crisis increase in its holdings of treasury and mortgage backed securities. Given the risk of triggering an unexpected steepening of the yield curve or a rise in MBS spreads, plans for the Fed’s balance sheet should be well-telegraphed at an early stage. The recent addendum to the policy normalization principles and plans provides market participants with a clear path for changes in reinvestment policy that will help avoid undue volatility in fixed income markets. The addendum also outlines the criteria that the Fed will consider in deciding whether to deviate from its announced principles. As balance sheet normalization proceeds, the FOMC could provide a broad indication of what the eventual monetary policy operating framework may look like over a longer horizon. Continued clear communication will maintain the Federal Reserve’s estimable track record of smoothly normalizing U.S. monetary policy.

Strengthening the Foundations for Growth and Resilience

Taxes

14. The U.S. needs a fundamental tax reform. There is broad agreement on the objectives: simplify the system, lower marginal rates, scale back the extensive network of tax preferences, incentivize labor force participation, mitigate income polarization, and support low and middle-income households. To provide resources for fiscal outlays that can strengthen potential growth and to contribute to the needed reduction in the public debt, tax reform ought to be designed to be revenue enhancing over the medium-term. Such a reform could include:

- Business tax . The U.S. corporate income tax could move to a rent tax (either a cashflow tax or an allowance for corporate capital tax) with a somewhat lower marginal rate. This would incentivize business investment and lessen the existing bias toward debt finance. Such a reform could be combined with an elimination of the various corporate tax preferences that currently complicate the system, making the tax code more equitable and efficient. Naturally, such a change would have important domestic effects (on activity and investment) and sizable international spillovers.

- Taxing offshore profits . The administration’s proposal to enact a one-time tax on the stock of unrepatriated profits of multinationals deserves support as part of a comprehensive tax reform package. Such profits could be taxed at a rate that is modestly lower than the current corporate rate. Providing only moderate tax relief would be efficient (since it is a tax on past profits) particularly given that the existing system of tax deferral has already conveyed significant benefits to those taxpayers that have chosen not to repatriate profits. Such a policy would generate a temporary uplift in fiscal revenues and payment of the resulting tax liability could be spread over several years to address liquidity concerns of affected corporations. Transitioning to a territorial system, as has been proposed by the administration, merits consideration but ought to be combined with a minimum tax for profits earned in low tax jurisdictions to limit the scope of profit-shifting.

- Individual income tax . Providing tax relief for low and middle-income groups, as has been proposed by the administration, would help alleviate income polarization and encourage labor force participation. The bulk of itemized deductions can be eliminated alongside an increase in the standard deduction. Any remaining deductions (e.g. for mortgage interest and charitable contributions) could be capped. The authorities could also expand eligibility and increase the generosity of the earned income tax credit (EITC) to support lower income households and incentivize work. To lessen the risk an expanded EITC leads to a decline in pre-tax wages at the bottom of the income distribution, the EITC expansion ought to be combined with an increase in the federal minimum wage.

- Pass-through entities. Any tax rate reductions for pass-throughs need to take revenue implications into account. Setting the effective rate on pass-throughs below the effective rate on distributed corporate profits or the top marginal personal income tax rate creates important incentives for some firms to become pass-throughs and for high income employees to become independent contractors in order to lessen their tax burden.

- Consumption taxes . To ensure the overall tax reform is revenue-gaining the U.S. has the scope to rely more on other revenue sources including a federal level consumption tax, a broad-based carbon tax, and a higher federal gas tax. To give a sense of what is feasible, a broad-based, 5 percent consumption tax would generate around 1½ percent of GDP per year in revenues, a carbon tax of around US$45 per ton of CO2 would generate 0.5 percent of GDP per year, and each 50 cents increase in the gas tax would raise revenues of around 0.3 percent of GDP per year.

Infrastructure

15. As pointed out in the administration’s budget, underinvestment in infrastructure has become a growing constraint on private sector productivity and long-term growth and job creation. Investment in public infrastructure has declined significantly in the post-recession period. This has led to a deterioration in the public capital stock (particularly since maintenance spending has been eroded). A permanent increase in federal, state and local infrastructure spending of at least 0.5 percent of GDP per year is needed (based on the American Society of Civil Engineers estimates of the U.S. infrastructure gap). Priorities include improving the quality and reliability of surface transportation and upgrading infrastructure technologies (e.g., in high speed rail, ports, and telecommunications). It will be important to ensure the right mix is achieved between the public funding of maintenance and repair versus new projects. The US$200 billion appropriation in the budget aimed at catalyzing US$1 trillion in private and public infrastructure investment would, if realized, support long-term growth.

Financial regulation

16. Important gains have been made in strengthening the financial oversight structure since the global financial crisis. There is scope to fine-tune some aspects of the system as has been proposed by the U.S. Treasury. For example, there is a case for a simpler regime for small and community banks, that is backed by risk-based supervision, or a revisiting of the thresholds for institutions to be subject to stress tests or to be considered systemic. However, the current approach to regulation, supervision and resolution should be preserved. This would include supporting the Financial Stability Oversight Council in its efforts to identify risks and respond to emerging threats to financial stability; extending the analytical work of the Office of Financial Research; and continuing to strengthen the Fed’s Comprehensive Capital Analysis and Review stress testing exercise. The U.S. ought to maintain its special resolution regime for systemic financial entities as a backstop to resolution under the bankruptcy code so as to facilitate orderly resolution and prevent any contagion that could put system-wide stability at risk. In this regard, a court-based bankruptcy regime may prove insufficiently nimble, lack the authority to provide needed temporary public financial support, lead to a dilution of regulators’ powers, and give rise to stability and contagion risks. The current risk-based capital framework should not be replaced with a simple leverage ratio. Such an effort may give incentives for banks to increase capital but also creates incentives for capital to be placed into more risky activities. It would be particularly problematic to allow banks to self-select into a lower regulatory and supervisory regime, regardless of the underlying systemic risk of their operations. Finally, the current designation framework could be improved to be more expeditious, transparent, and accountable. The maintenance of a robust financial regulatory regime in the U.S. has had positive spillovers to others both by reducing financial stability risks in the U.S. and the knock-on effects from encouraging progress to strengthen the global regulatory framework.

Trade

17. The U.S. commitment to free, fair and mutually beneficial trade and to improving the rules-based international trading system is welcome. The U.S. has also reiterated that it intends to keep its markets open and to fight protectionism, while standing firm against all unfair trade practices. Open international trade has long supported U.S. growth and job creation with positive spillovers for others. However, a slower pace of global trade reform since the early 2000’s has left in place trade barriers, subsidies, and other trade-distorting measures. Further trade integration and the promotion of a level playing field in international trade, particularly in growth areas such as services, would offer important gains to the U.S. in terms of productivity, economic growth, and job creation. U.S. participation in multilateral efforts to resolve global excess capacity is welcome. However, the U.S. ought to be judicious in its use of import restrictions on national security grounds and avoid measures that inadvertently weaken, rather than strengthen, the overall economy. Finally, there is scope to modernize trade agreements (including NAFTA)—for example on transparency provisions, e-commerce, services, as well as labor, environmental and safety standards—in ways that are mutually beneficial for all signatories. The U.S. would benefit by remaining open as it pursues new or amended trade agreements.

Deregulation

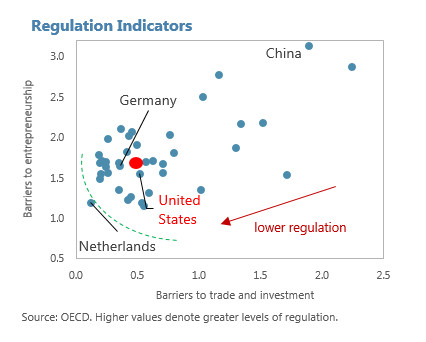

18. A central plank of the new administration’s economic plan is to revisit federal regulations in a range of areas. In international comparisons, the U.S. already scores favorably on regulatory barriers to entrepreneurship, trade and investment. Nonetheless, a simplification and streamlining of federal regulations as well as an effort to harmonize rules across states would likely boost efficiency and could stimulate job creation and growth. There may also be scope to achieve desired outcomes through means other than regulation (e.g. to replace regulatory limits on carbon with a broad-based carbon tax). However, in reforming the current regulatory system, care is needed to avoid negative consequences for the environment, workplace safety, and protections for lower income workers.

Maintaining a Productive and Flexible Workforce

19. To complement the policies described above, there is a range of measures that could be taken to increase the flexibility and adaptability of households and businesses, to mitigate secular trends in income polarization and poverty, raise labor force participation, and create the environment to increase investments in human capital. Many of these macro-critical areas would both raise potential growth but would also help ensure that gains in income and opportunities are able to improve the living standards of the majority of the population. Such reform areas include:

Education

20. Access to better and more cost-effective education can raise productivity and increase the flexibility of U.S. workers to adjust to structural shifts in labor demand or displacement by technology or trade. There is also broad evidence that investments in education can lessen the intergenerational persistence of poverty. Funding can be better prioritized toward early childhood education (including instituting universal pre-K) and to support science, technology, engineering, and mathematics programs. There is also a strong case to redesign the financing model for public schools to reduce funding differences across districts and provide more resources to schools with high concentrations of students from low income households. The administration’s support for federal, state and local efforts to offer attractive, non-college career paths (e.g., through apprenticeship and vocational programs) is welcome. However, the high levels of private and public expenditure on higher education, alongside relatively unimpressive attainment statistics, suggest the need for a greater focus on preparing students for college and fostering retention once they are enrolled. Alternative state and federal financing options for tertiary education may help increase access for students from lower and middle income households.

Family-friendly benefits

21. The cost and availability of childcare is a constraint to labor force participation. It is also of concern that one-in-four single parent households are living in poverty. The administration recognizes that family-friendly benefits can be an important policy lever to slow the downward trend in labor force participation and support low- and middle-income families. In this regard, the budget’s intention to create a program that offers six weeks of paid leave to new parents and provide help for families struggling with child and dependent care expenses are positive steps.

Supporting low- and middle-income households

22. Mitigating the ongoing hollowing out of middle-income earners and reducing the currently high levels of poverty would raise labor supply, boost human capital and productivity, and improve living standards. In addition to the reforms discussed above—education, family-friendly benefits, and expanding the EITC—other policies that could help include:

- Disability insurance . As proposed in the budget, there is scope to strengthen the design of the disability insurance program to provide incentives for beneficiaries to work part time or eventually return to full time work (rather than drop out of the labor force). Such a reform ought to be undertaken carefully, however, to prevent legitimate recipients being excluded from this important safety net.

- Social assistance . There is significant scope to upgrade federal and state-level social programs to better help the most vulnerable. “Cliffs” in social benefits—such as Medicaid, the Supplemental Nutrition Assistance Program, the Child Health Insurance Program, Temporary Assistance for Needy Families, and housing assistance—could be reassessed with a view to smoothing the phase-out for the near-poor. This would not only reduce disparities but also encourage labor force participation for those earning above, but close to, the federal poverty line. There is scope to simplify and unify the various programs underlying the safety net, increase the generosity of direct transfer programs, learn from the diversity of experiences at the state-level to identify the most effective approaches, and better-target federal payments to program outcomes. These improvements to social programs could be undertaken with a relatively small budgetary cost.

Immigration

23. A skills-based immigration system would enhance labor participation and productivity. The administration has recognized the importance of such reform. Demographic changes will lead to a steady decline in labor force participation in the coming years, slowing labor force growth from an annual average of about 1 percent over the last 25 years to about ½ percent in the coming decade. The dependency ratio—the share of the old and young population as percent of the working age population—is expected to rise from about 60 percent today to 75 percent by 2037. This is even with around 0.6 million new immigrants entering the labor force each year. A comprehensive, skills-based reform of the immigration system has the potential to expand the labor force, improve the dependency ratio, and raise the average level of human capital. This could have significant positive effects on long-term potential growth and help ease the medium-term fiscal challenges.

Healthcare

24. Health care policies should protect those gains in coverage that have been achieved since the financial crisis (particularly for those at the lower end of the income distribution) and contain healthcare cost inflation. Doing so will have positive implications for well-being, productivity, and labor force participation. This, in turn, will strengthen growth and job creation, reduce economic insecurity associated with the lack of health coverage, and have positive effects for the medium-term fiscal position. Changes have been proposed to remove the individual and employer mandates, eliminate various taxes and subsidies, reverse the Medicaid expansion, and give states more flexibility and control over the health care market. Such changes ought to be undertaken carefully to avoid compromising the pooling of risks (an essential foundation for a well-functioning health insurance system) or excluding those with limited incomes from the healthcare system. Mechanisms to encourage cost control in the provision of services need to be examined, including through an evaluation of existing pilot programs and an application of new technologies that can increase efficiencies and pricing transparency. There also ought to be some assessment of the scope for anti-trust actions where the market concentration of providers or insurers has risen and where premiums for non-group policies have been rising rapidly.

The Executive Board of the International Monetary Fund will conclude the 2017 Article IV Consultation with the United States by reviewing and discussing the IMF staff findings that have been outlined in this statement. This Board discussion is currently scheduled for July 24, 2017.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Wiktor Krzyzanowski

Phone: +1 202 623-7100Email: MEDIA@IMF.org