Two Trilemmas for Monetary Policy

July 24, 2017

Good morning. It is a pleasure to be here at the Bank Negara Malaysia, and to begin this morning session on “What Lies Beyond Price Stability?” I wish to start out by thanking Governor Muhammad bin Ibrahim and the organizers of this conference for their kind invitation.

The conference topic could not be more relevant. Next month, August 9 will mark the tenth anniversary of BNP Paribas’ suspension of three of its funds holding U.S. subprime-related assets. The event led to extensive liquidity operations by the ECB and the Federal Reserve, but unappreciated at the time, this event heralded a period of financial turbulence that would culminate in the Global Financial Crisis and a worldwide recession. Even after an initial global bounce-back, turbulence continued in the form of the euro zone crisis.

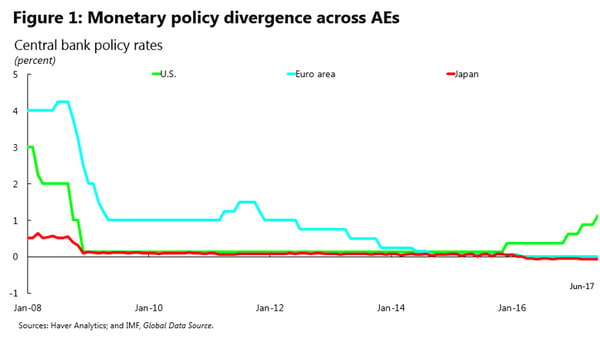

For the major advanced economies, much of the decade has been spent in lacklustre growth with periods of worrisome deflationary pressures. Central bank responses included ultra-low and even negative nominal interest rates, as well as unconventional balance sheet and lending policies. The Fed emerged from years at the zero interest-rate bound only in December 2015 and has slowly carried out three subsequent rate hikes in its drive to “normalize” monetary policy. In the euro zone the balance of sentiment on the ECB board seems to be shifting toward tightening, although core inflation remains below the 2% target. And the Bank of Japan remains solidly committed to an unconventional package, including pegging the 10-year bond rate at zero, in the face of persistently very low inflation. Figure 1 illustrates trends in policy interest rates.

Emerging markets, by and large, were relatively resilient to the impact of the great crisis, making good use of exchange-rate flexibility and high levels of international reserves accumulated in the earlier 2000s. Indeed, in several Asian countries, these policy frameworks had grown up after the Asian Crisis, which can be said to have started with the devaluation of the Thai baht 20 years ago this month. (So we have a double anniversary!) In the Global Financial Crisis, financial instability radiated out from the advanced North Atlantic economies, and emerging economies’ earlier reforms and policy buffers stood them in good stead. Soon afterward, however, emerging economies felt the spillovers of unconventional monetary easing in advanced economies – in the form of strong capital inflows – and then faced outflow pressures, not only as Fed tightening came closer, but as shifts in China’s policy mix, including exchange rate policies, spilled over to global commodity and financial markets.

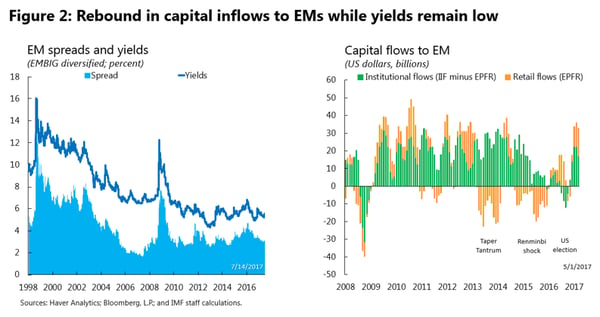

In the face of these cross-currents, it was difficult for synchronized global growth to take hold. But now, we can cautiously identify signs that this may be changing. In our April World Economic Outlook , we noted that the world economy seemed to be gaining momentum after a disappointing first half of 2016 with broadly-based improvements in soft indicators – including consumer confidence and manufacturing PMIs – as well as hard indicators relating to investment, trade, and manufacturing. For the first time in a while, the Fund was able to raise its global growth projections – which in April we placed at 3.5% for 2017 and 3.6% in 2018. Capital inflows have returned to emerging markets, and borrowing spreads are compressed (Figure 2).

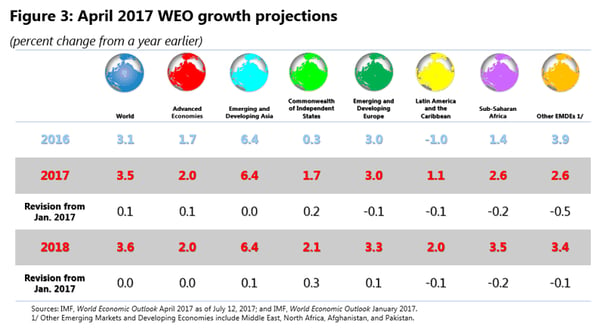

Later this morning, here at the Bank Negara Malaysia, we will be announcing our revised, July update to last April’s projections. Without revealing too much, I will just say that the broad trends we identified in April seem to be holding firm. Figure 3 shows that previous set of projections by country grouping.

Naturally our April projections showed differences across regions. Much of

Latin America, the Middle East, and Sub-Saharan Africa continue to

struggle, beset by persistently low commodity prices, policy uncertainty,

and in some cases climate-related shocks and security concerns. On the

other hand, this region—emerging and developing Asia--is the world’s

undisputed growth leader, with growth well above 6% for China, above 7% for

India, and at about 5% for the ASEAN-5 countries. I must note, however,

that longer-term trends of low productivity growth, inequality, and

demographic transition pose a challenge to future potential growth in much

of the world – and these challenges are beyond the reach of monetary

policy. This is also true of certain downside risks to the outlook – for

example, the risk of a protectionist outbreak.

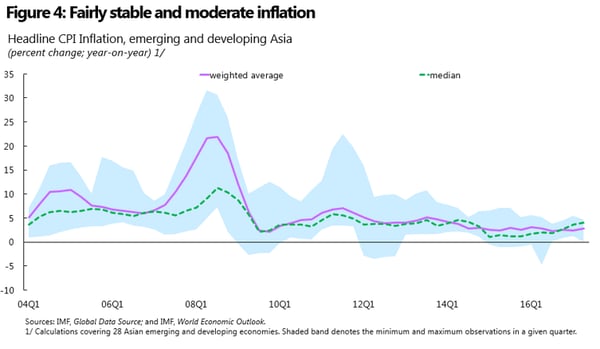

Monetary policy can enhance macroeconomic stability, though, and one of the key ways it does so is by anchoring inflation expectations at moderate levels. To be perfectly candid, while the question of “What Lies Beyond Price Stability?” is vitally important – and I will turn to that in a minute – the question of “What Lies Behind Price Stability?” is one that is not as well understood as some economists might pretend. Pure fiat money depends for its value on being broadly acceptable in exchange for goods and services – which requires, in turn, that people have confidence in its value. In other words, money derives its value from a network externality, such that my opinion of money’s value depends on everyone else’s. That’s why central banks that wish to target inflation successfully must establish track records of credibility by consistently producing inflation near target, and why credibility, once lost, can be so hard to restore. In that respect, the transition over the last two decades in this region, and in emerging markets more generally, from exchange-rate determined monetary policies toward monetary policies more oriented to price stability, has produced fairly stable and moderate inflation – on average in developing and emerging Asia, our April WEO forecast was for somewhat over 3% inflation, though this average conceals variation between higher inflation countries such as India and lower inflation in countries such as Thailand. See Figure 4 on inflation experience since the mid-2000s.

The American baseball great Yogi Berra is reputed to have said: “It’s tough to make predictions, especially about the future.” So as always, considerable uncertainty surrounds our projections. Consumer and business confidence in advanced economies could rise. On the other hand, further consolidation of the current momentum faces headwinds, including the already-mentioned downward trend in productivity growth across the world, possible volatility as the Federal Reserve normalizes in response to an evolving US policy mix, repercussions of possible ECB monetary policy shifts, or a more abrupt than expected economic rebalancing process in China.

And then there is the elephant in the room – the possibility of a turn away from multilateralism and toward more inward-looking, including protectionist, policies. In that connection, we can only hope that the recent reformulation of the Group of Twenty’s past position on trade leads to constructive strengthening of the world trading system.

One area where multilateralism has been vital is in international efforts to safeguard financial stability. Much progress has been made since the Global Financial Crisis, but much remains to be done. The global crisis also made clear that our theoretical frameworks for understanding how monetary policy affects the economy were woefully incomplete in their modelling of the critical role of financial markets. Thus, the timing of this conference could not be better: in my opinion, a big part of the answer to the question “What Lies Beyond Price Stability?” is financial stability, and particularly for emerging market economies, a better understanding of the transmission of macroprudential and monetary policies across borders is a key requirement for both better national policies and more effective international collaboration.

Trilemmas and globalization

Countries do operate in an increasingly interconnected world; not a vacuum. This is especially the case for smaller economies in a globalized world. As highlighted by the basic monetary trilemma, if there are free capital flows, it is possible to have independent monetary policies through exchange rate flexibility. While even a pure floating rate regime alone cannot shut out global financial developments, the exchange rate regime is central to the channels of transmission from the main financial centers to the rest of the world through gross credit flows and leverage, as well as to the range of policy responses available.

Even in a closed economy, monetary policy alone cannot deliver financial stability. The problem for monetary policy is likely to be even worse in the open economy, because the availability of tools may be constrained by a second, financial policy trilemma that is distinct from the monetary trilemma. This second trilemma, formulated by Dirk Schoenmaker , may be less familiar than the monetary policy trilemma. It posits that only two of the following three can coexist at the same time:

1. Sole national responsibility for financial policy.

2. International financial integration.

3. Financial stability.

The euro area crisis, which erupted when banking oversight and resolution were still fully vested at the member-state level, is a poster child for the financial trilemma. Additional structural weaknesses played a role in the euro crisis, so it is vitally important—and central to my argument—to point out that flexible exchange rates do not offer a full escape from the financial trilemma. Because the financial trilemma implies that national prudential policies cannot be fully effective when capital markets are open to cross-border transactions, even when exchange rates are flexible, it provides the main rationale for a globally collaborative international reform agenda.

Neither does the financial trilemma invalidate the monetary trilemma and turn it into a dilemma where the exchange rate regime does not matter; rather, it tells us that in the face of the imperfect insulating properties of floating rates, financial openness may make policy trade-offs harsher. But they would be harsher still without the safety valve of exchange rate flexibility.

So floating exchange rates, while extremely helpful for many countries, are not a panacea for all problems—that is, they provide extra monetary policy space but do not offer complete insulation from foreign shocks. They do offer some protection, however—interestingly, even from financial-sector shocks from abroad. In a new paper with Jonathan Ostry and Mahvash Qureshi, we find that emerging economies with fixed exchange rates are more exposed to global financial conditions that can raise financial vulnerabilities, such as rapid domestic credit and house-price growth, and increases in bank leverage.

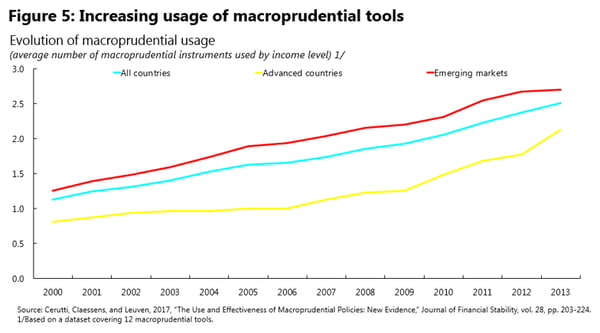

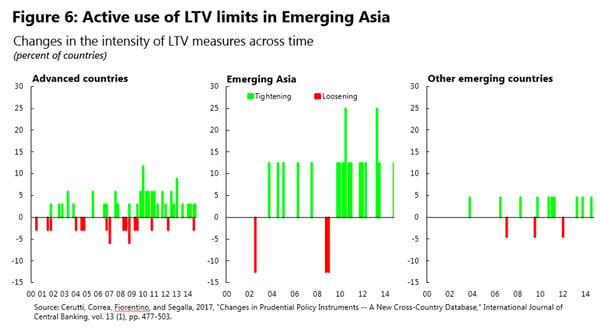

In the wake of the GFC, countries pursued new macroprudential and monetary-policy approaches with strong potential spillovers across borders (see Figures 5 and 6). The financial trilemma implies that the effectiveness of macroprudential tools is constrained in a financially globalized world, for example due to regulatory arbitrage, making some sort of international cooperation necessary to enhance the effectiveness and contain the spillovers of financial policies. The monetary trilemma suggests that exchange-rate flexibility is the best response to foreign monetary shocks, but monetary responses have sometimes been difficult for countries at the effective lower nominal interest rate bound, while other countries, especially emerging and developing economies, have experienced difficulties in adapting their monetary and prudential policies to financial shocks from abroad and the capital flows that come with them.

Implications for the international monetary system

The classic literature on the international monetary system (IMS) that I

learned in graduate school in the 1970s focused on issues of exchange rate

adjustment, balance of payments adjustment, and international liquidity.

From this perspective, the major question about the gold standard was how

it addressed issues of internal devaluation and revaluation, stability

mechanisms to ensure balance of payments equilibrium, and adequacy of the

supply of international reserve assets. Failures in all these dimensions

prompted the Bretton Woods arrangements that founded the IMF; the breakdown

of that system led to widespread adoption of floating exchange rates,

which, as economists such as Friedman, Meade, and Johnson had argued, would

provide better solutions to the classic macroeconomic problems of

international monetary relations.

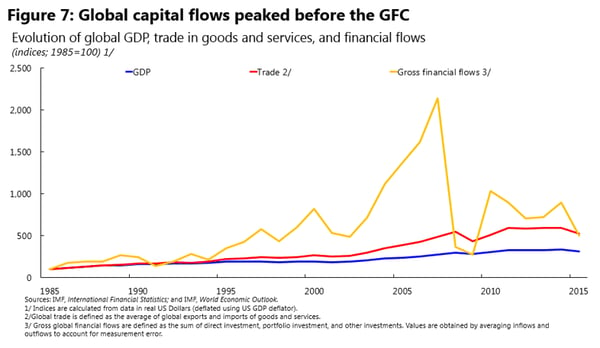

But the Bretton Woods arrangements, as originally conceived, presupposed a world in which international capital mobility would remain restricted (as it was in 1946 when the IMF opened its doors) or at least tightly controlled, and in which domestic financial markets were also subject to intense government regulation and even repression. In such a world, questions of finance and financial stability – and their relationship with the system of international monetary exchange – were pushed to the background. This perspective became increasingly outdated, however, as growing world trade brought with it growing capital mobility (helping to undermine fixed but adjustable exchange rates), and in which governments, for various reasons, at various speeds, and with varying sequencing, dismantled both internal and external financial restrictions. By the eve of the GFC, global capital flows had reached very high levels (see Figure 7), with the rapid growth and elevated volume of these flows arguably signalling stability risks.

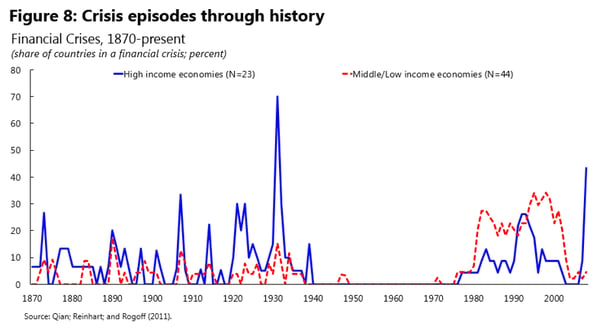

Indeed, a broader reading of history would have recognized that financial instability has been a key feature of the international monetary system since time immemorial. Gold standard writers such as Thornton and Bagehot wrote on the interplay between foreign exchange intervention and the central bank’s lender of last resort role, a theme very much evident in recent crises. The early Great Depression was marked by multiple banking crises, creating powerful currency speculation. In this perspective, the early post-World War II period, with its relatively tight restrictions on financial activity, gave us only a temporary breather (see Figure 8).

We therefore recognize now that the implications of IMS arrangements for international financial stability are as important as the classic macroeconomic questions. But they need to be analysed with new economic models and addressed by distinctive regulatory tools, in particular, macroprudential tools. The financial trilemma reminds us that effective policy implementation involves not only attention to global conditions and coordination with domestic monetary and fiscal policies, but also good international cooperation among national regulators. In other words, the framework for international collaboration in financial policy is an integral part of a healthy global system of exchange. The IMF’s job has evolved considerably since 1946, and it now plays a central role within that multilateral framework.

What is the evidence on effectiveness and cross-border impact of macroprudential tools?

We still do not know how effective macroprudential policies will be, even within countries, through the economic cycle. We have limited experience because many macroprudential instruments were introduced after the Global Financial Crisis. But, we are progressing in this area, including in putting together large macroprudential datasets, and research using these is becoming ever more active. What do we know about the spillovers abroad from macroprudential policies – a question central to the financial trilemma?

In general, the fast expanding empirical literature on the effectiveness of macroprudential policies can be divided into two groups. A first group seeks to uncover—by taking advantage of detailed, confidential datasets—whether specific macroprudential instruments are effective in reducing procyclicality and the build-up of systemic risk within economies. Using bank-level information from the United Kingdom, for example, Aiyar, Calomiris, and Wieladek show that bank-specific capital requirements dampened lending by domestically regulated UK banks, but resident foreign branches increased lending in response to tighter capital requirements on a relevant reference group of domestically-regulated banks.

A second group of studies pursues a cross-country approach. It also finds that macroprudential instruments indeed have an economic effect on financial variables, but subject to some cross-border offsets. For example, Cerutti, Claessens, and Laeven , covering up to 119 countries, find that the effects of macroprudential tools are less powerful in financially more developed and open economies, and deployment comes with greater cross-border borrowing, suggesting possible avoidance. In principle, this avoidance could be limited through adapting financial-sector regulations, seeking foreign reciprocity, or adopting capital flow management tools. The Fund is currently analysing the interaction of CFMs and MPMs in the light of its Institutional View on CFMs.

Implementation of macroprudential policies

The fact that macroprudential authorities sometimes can tap several instruments represents an opportunity, given the trade-offs that I described earlier. Multiple alternative tools could allow a more precise selection of the macroprudential instrument that is closest to the root of a distortion at a given time and place. Better targeting of negative externalities and market failures could minimize collateral damage from taming procyclicality and the build-up of systemic risk.

Unfortunately, the effectiveness of these tools is not uniform or always certain, and cross-border aspects (including avoidance) are important. Here again, the presence of several instruments in a context of uncertainty also can be an advantage. As Bill Brainard famously highlighted in 1967—now a half century behind us!—optimal policy in the presence of instrument uncertainty differs significantly from optimal policy in a world of certainty. In general, all instruments can be helpful, even if there is only one target. To paraphrase former Federal Reserve governor Jeremy Stein , a portfolio of instruments is more likely to “get in all the cracks.” One can view the quest to add a capital floor to Basel III in this light. This perspective is different and more realistic than the Tinbergen view of one instrument per target.

Of course, we more typically don’t even have the luxury of enough instruments, let alone a surplus, in which case the Tinbergen principle again fails to apply and nasty trade-offs can come to the fore. International cooperation is always important, but especially so in such cases.

International cooperation

In line with the evolution of macroeconomic arrangements to govern the IMS since the advent of advanced-country floating in 1973, the infrastructure of international financial collaboration has evolved as well. This is not surprising, because some of the initial impetus for cross-border regulatory cooperation came from the financial risks caused by potential currency mismatches in a new world of floating exchange rates.

The Basel Committee on Banking Supervision has been grappling with the financial trilemma since 1974, gradually but continually extending the scope and efficacy of international regulatory cooperation. The Basel III blueprint is part of the latest reform wave. It calls for jurisdictional reciprocity in the application of countercyclical capital buffers, so that foreign banks with loans to a country that has invoked the supplementary capital buffer are also subject to the buffer with respect to those loans. By raising the effectiveness of domestic authorities’ macroprudential tools, this provision reduces the burden on monetary and macroprudential policy. The Financial Stability Board importantly extends international financial cooperation to the non-bank financial sector.

Another little-discussed benefit of international agreements, as has been the case in trade policy, is that they may create something of a “precommitment technology” for regulators, limiting the scope for dynamic inconsistency problems that can undermine credibility and thereby, financial stability. We have come a long-way in our thinking about the advantages of central-bank independence in monetary policy, but macroprudential policy is, if anything, even more heavily subject to political pressures. As in monetary policy, financial markets will be more stable if they perceive a dependable and therefore credible link between market developments and the policymaker’s macroprudential response. Adherence to global frameworks may also promote transparency in macroprudential policymaking.

Monetary policy for financial stability?

A perennial debate has raged over the specific role of monetary policy in the pursuit of financial stability. Some have recommended that, even in countries where inflation remains below target levels and wage pressures subdued, interest rates be pre-emptively raised to choke off financial excesses. At the other extreme, others have suggested that for small open economies, monetary policies and even the exchange-rate regime play little role in the safeguarding financial stability – instead, the small open economy is the hostage of a global financial cycle originating in advanced economies and primarily the United States. My take on the balance of evidence is different and would point to six precepts:

- Price stability is a prerequisite for financial stability – there is no trade-off.

- In view of the above-mentioned fragility of anchored price expectations, a clear linkage between monetary policy decisions and inflation developments is essential – diluting this link with a range of hard-to-communicate financial considerations would be confusing and dangerous.

- In any case, the quantitative impact of interest rates on

financial-market excesses is quite uncertain. Jeremy Stein’s famous remark

that monetary policy “gets in all the cracks” was meant to indicate its

broad reach, in a world where the effects and collateral impacts of

specific macroprudential tools are uncertain. Others

contend monetary policy cannot and should not be relied on for financial

stability objectives.

- Flexible exchange rates not only aid in the pursuit of domestic price stability, they do provide some degree of insulation from foreign financial (as well as monetary) shocks.

- Financial stability is not guaranteed by price stability or flexible exchange rates, of course, but should be addressed directly through regulatory tools, including macroprudential measures. These would include limiting currency mismatches, which in the past have undermined exchange-rate flexibility as a stabilizer, both creating negative balance-sheet effects of depreciation and while also allowing a more potent transmission of currency appreciation to balance sheets and hence domestic credit.

- In open economies, financial stability policy can be more effective with the benefit of multilateral regulatory coordination and cooperation. Such cooperation can also play a role in constructively limiting the scope for destabilizing discretion in macroprudential policy.

At the October 2016, annual meetings of the IMF and World Bank, the former U.S. Treasury Secretary, Tim Geithner, who played a leading role in the response to the Global Financial Crisis, gave the annual Per Jacobsson lecture . He posed the question “Are We Safer?” Sadly, his answer was a rather resounding “no” – based on his view of limited monetary and fiscal policy space in advanced economies, as well as his evaluation of recent regulatory reforms. I would urge even those who feel that Geithner was overly pessimistic to recognize that vigilance, sound country-level policies, and multilateral efforts remain necessary, as does more and better research on the ways policies and policy spillovers can hurt or help. The discussions at today’s conference are therefore most welcome. Monetary policy firmly oriented toward medium-term price stability, in my view, remains a necessary condition for overall economic stability. But, in the wake of the crises of recent decades, we cannot pretend that it is a sufficient condition.

IMF Communications Department

MEDIA RELATIONS

Phone: +1 202 623-7100Email: MEDIA@IMF.org