Oil rig in Lagos, Nigeria. The country needs to increase its non-oil revenues (photo: Igor SPb/iStock by Getty Images)

Nigeria: Out of Recession and Looking Beyond Oil

March 15, 2018

Nigeria’s economy is exiting a painful recession, but policy implementation needs to move quickly and comprehensively to facilitate economic recovery and help the country reap its longer-term potential, says the IMF in its latest economic health check of sub-Saharan Africa’s largest economy.

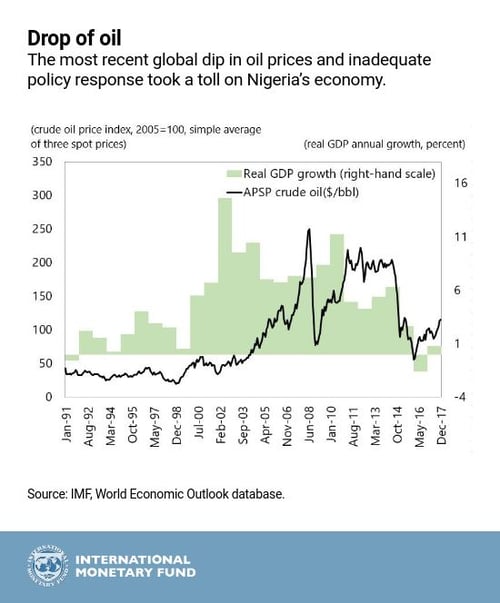

Growth in Nigeria recovered to 0.8 percent in 2017 after a historic collapse in oil prices—exacerbated by falling oil production and inadequate policies—took a major toll on the economy (chart). The recent rise in oil prices is supporting the recovery, but more needs to be done to reduce unemployment and address poverty.

Related Links

According to the report, rising oil prices, new foreign exchange measures, attractive yields on government securities, and a tighter monetary policy have made foreign exchange more readily available and helped contain inflation. Consequently, investors are returning to Nigeria.

Economic growth in the fourth quarter of 2017 was positive for the third consecutive quarter, driven mainly by recovering oil production. The economy—excluding the oil and agricultural sectors—saw a first modest year-on-year expansion, after seven quarters of contraction.

Policies initiated under the government’s Economic Recovery and Growth Plan have started to tackle some of the challenges facing the economy. They include the beginning of convergence in foreign exchange windows by reducing the number of existing exchange rates in the economy, a narrowing of the parallel market premium, some improvement in tax administration, anti-corruption efforts, and significant strides in improving the business environment.

Limited room for maneuver

Despite these positive developments, the economic situation remains challenging, says the IMF. Inflation, especially of food prices, remains high. Vulnerabilities in the banking sector are rising. Low tax revenues are keeping the fiscal deficit high, leading to more government borrowing that is crowding out private sector activity. Distortions in foreign exchange markets are slowing efforts to attract longer-term investment and diversify the economy.

Nigeria is also faced with important social, economic, and political challenges. Factors weighing on the economy include a large infrastructure gap, high gender and income inequality, corruption, and the ongoing humanitarian crisis in the northeast.

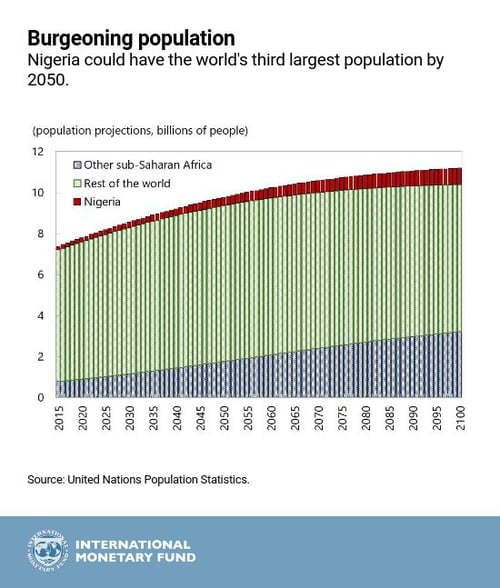

Nigeria needs to forcefully address these challenges so that it can provide enough jobs for its young people in the years ahead. The economy is growing at close to 3 percent annually, with youth (0 to 19 years of age) accounting for more than 54 percent of the population. Demographic trends imply that Nigeria could be the third most populous country in the world by 2050 (chart). This could present a significant challenge to per capita growth, requiring faster action to improve per capita incomes, reduce high unemployment, and bring down poverty.

Full steam ahead

“Following through on planned reforms now and at full steam is what will lift Nigeria’s growth rates to their potential,” says Amine Mati, IMF mission chief and senior resident representative in Nigeria. Reaching growth rates that will make a difference requires urgent implementation of a well-designed and comprehensive reform package that would include

-

a growth-friendly fiscal policy aimed at reducing oil revenue dependence and creating space for priority expenditure (infrastructure and social safety nets) for the private sector;

-

keeping monetary policy tight in the short term to contain inflation;

-

creating a unified and more flexible exchange rate;

-

strengthening banking sector resilience to boost investor confidence and facilitate public and private sector decision making;

-

implementing structural reforms to improve the business environment, in particular, accelerating the power sector recovery plan to energize the economy;

-

accelerating the work on governance and transparency initiatives to stimulate private sector activity; and

-

updating and implementing the financial inclusion and gender strategies to help create more equal opportunities and higher workforce productivity.