The city center and central business district, Astana, Kazakhstan (photo: Gavin Hellioer/Newscom)

Five Key Questions: The Caucasus and Central Asia Economic Outlook

May 14, 2018

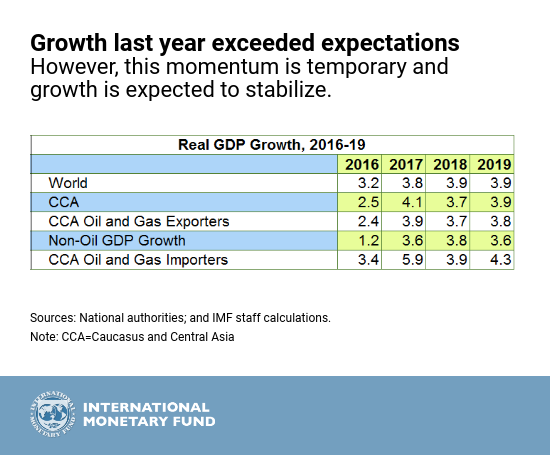

According to the IMF’s latest forecast for the Caucasus and Central Asia (CCA) region, growth was stronger than expected in 2017, but will moderate going forward. What are the main takeaways from the CCA Regional Economic Outlook, and what do they mean for the region moving forward? We answer five key questions.

Related Links

What were the primary factors driving growth in the CCA in 2017?

Strong public investment in Azerbaijan and higher oil production in Kazakhstan, coupled with a significant increase in oil prices in the latter half of 2017, led to better-than-expected growth. This helped drive growth for CCA’s oil exporters up to almost 4 percent.

Growth in oil importers exceeded expectations at 5.9 percent. All countries benefitted from rising remittances, while strong external demand provided an additional boost to countries such as Georgia and Tajikistan. A reduction in interest rates and a strong rebound in the agricultural sector also helped GDP growth reach 7.5 percent in Armenia.

Overall, regional growth is expected to be 3.7 percent in 2018 and 3.9 percent in 2019, assuming current policies, indicating a slowdown in the current growth momentum.

Why is the CCA region’s growth headed for moderation?

The driving factors behind the stronger-than-expected performance in 2017 are likely to prove temporary. In Kazakhstan, for instance, the IMF expects gains from oil production to slow and the country’s non-oil activity to experience only a gradual pickup due to weak credit growth, among other reasons. Meanwhile, growth in remittances is expected to taper off, limiting further gains for oil importers.

What is the main challenge facing the CCA region?

If the medium-term growth projections are realized, the region’s economy will have grown at less than half the average rate seen between 2000 and 2010. This will also imply that the region has grown at a slower pace than other emerging markets, increasingly falling behind its peers.

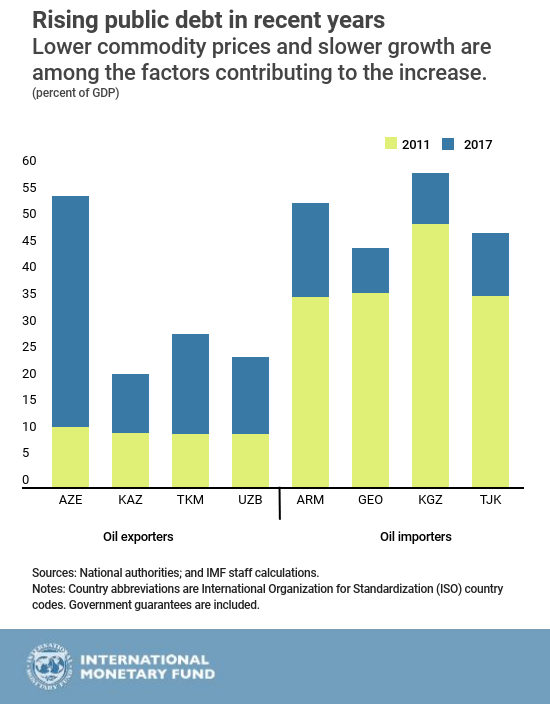

At the same time, with debt levels three times higher than they were seven years ago, countries have limited capacity to increase public spending to boost growth, while weak banks in some countries limit the availability of credit to boost private investment in the economy.

This illustrates that the current growth model that is largely based on oil and gas, mining, remittances, construction, and public spending is, more and more, inconsistent with an economic vision that champions strong and sustainable inclusive growth.

Moving forward, what policy priorities should the CCA region focus on?

The top priority for the CCA region is the need to accelerate the transition to an economic growth model underpinned by a strong private sector. This will require several steps, from cleaning up the banking system in certain countries to improving the business climate in others.

The region should also continue its efforts to strengthen its fiscal resilience in a manner that best positions countries for growth over the medium term. This should include strengthening revenues to help finance critical public investments and social spending without increasing debt.

Finally, CCA countries must work to champion openness and integration—both globally and within the region. Trade within the region has gone down significantly in recent decades, and non-oil exports to the rest of the world are well below levels of emerging markets. Greater integration would allow the region to capitalize on the opportunities presented by the strengthening global economy.

What can countries in the CCA region do to boost their resilience to risks?

Countries in the region should not be complacent. The global economic outlook is positive, but that should not be taken as a sign that further reforms are necessary. The CCA should use this opportunity to accelerate structural reforms aimed at boosting their resilience to fiscal risks that may materialize in the months and years ahead.

The report mentions some encouraging examples of countries strengthening their defenses. Georgia, for example, published an extended fiscal risks statement that covers public-private partnerships, power purchases agreements, and contingent liabilities related to state-owned enterprises. Likewise, Armenia’s efforts to enact a new public-private partnership law aligned with international best practices and to strengthen the role of its Finance Ministry’s Fiscal Risks Assessment Division are positive steps.

As the global economy continues to grow, the report hopes that countries across the CCA region will capitalize on this moment, with a reform agenda that moves away from an economic model based on remittances, commodities, and the public sector, and toward one defined by a well-diversified private sector.