Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Rise in Emerging Market Corporate Debt Driven by Global Factors

September 29, 2015

- Firm borrowing has quadrupled in past decade

- Low interest rates, investor search for higher returns play role

- Emerging markets must prepare for higher interest rates

Debt levels of firms in emerging market economies have risen, particularly in construction, and oil and gas, due to low interest rates in advanced economies, as well as other global factors, according to new research from the International Monetary Fund.

A construction project in Turkey: debt levels of firms, particularly in construction, have risen (photo: Claudia Wiens/Corbis)

GLOBAL FINANCIAL STABILITY REPORT

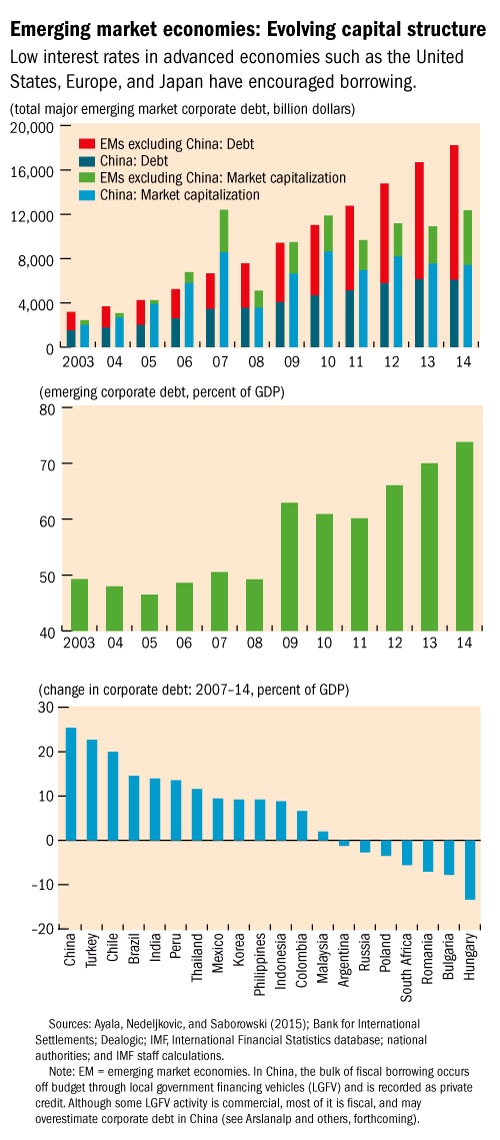

Low interest rates in advanced economies such as the United States, Europe, and Japan have encouraged this borrowing. The increase in firms’ debt-to-asset ratio, commonly known as leverage, has often included a higher share of foreign-currency liabilities.

Incurring leverage can be beneficial, since it can facilitate investment and thereby faster growth—but it also entails risks.

In the latest research for the Global Financial Stability Report, the IMF said global factors such as low interest rates, investors in advanced economies’ search for higher returns, and commodity prices appear to have become relatively more important determinants in the rise in corporate debt in emerging market economies.

Emerging market corporate debt on the rise

The corporate debt of nonfinancial firms across major emerging markets rose sharply from about $4 trillion in 2004 to well over $18 trillion in 2014 (Figure).

The IMF said the emerging market corporate debt-to-GDP ratio had grown by 26 percentage points in the same period, but with notable differences across countries. While estimates of corporate leverage rose markedly in China and in Turkey, corporate indebtedness also rose appreciably in many Latin American countries, including for example, Chile, Brazil, Peru, Mexico, and Colombia.

The composition of emerging market debt has also changed. In particular, although bank loans still account for the largest share of corporate debt, the share of bonds has nearly doubled over the last decade, reaching 17 percent in 2014.

Dependence on favorable global financial conditions makes firms vulnerable

The IMF analysis finds that the relative roles of firm- and country-specific factors as drivers of borrowing and bond issuance in emerging markets have declined in recent years. Global factors appear to have become relatively more important determinants in the post-crisis period. Despite weaker balance sheets, emerging market firms have managed to issue bonds at lower yields and longer maturities.

“These developments make emerging market economies more vulnerable to a rise in interest rates, dollar appreciation, and an increase in global risk aversion,” said Gaston Gelos, Chief of the Global Financial Stability Analysis Division at the IMF.

Firms that have borrowed the most stand to endure the sharpest rise in their debt-service costs once interest rates begin to rise in some advanced economies. Furthermore, local currency depreciations associated with rising policy rates in the advanced economies would make it increasingly difficult for emerging market firms to service their foreign currency-denominated debts if they are not hedged adequately. At the same time, lower commodity prices reduce the natural hedge of firms involved in this business.

Prudential policies and enhanced surveillance

The evidence suggests the emerging markets should prepare for the eventual rise in interest rates in advanced economies. “In particular, policymakers should monitor vulnerable and systemically important firms, as well as banks and other sectors closely linked to them,” said Gelos. “Such enhanced monitoring requires that the collection of data on corporate sector finances, including foreign-currency exposures, be improved,” he added.

To help contain the further buildup of risk, countries can use macroprudential policies, designed to keep the financial system as a whole safe, to limit excessive bank lending and associated increases in corporate sector leverage. Possible tools include higher capital requirements for foreign exchange exposures, and caps on the share of such exposures on banks’ balance sheets. Policymakers can also use microprudential measures, aimed at protecting individual institutions. For instance, regulators can conduct bank stress tests related to foreign currency risks, including derivatives positions. In the event of disruptive capital outflows, however, policymakers would have to use a combination of monetary, fiscal, and financial sector policies depending on country circumstances, to safeguard economic and financial stability.

Lastly, emerging markets should be prepared for corporate distress and sporadic failures in the wake of rising interest rates in advanced economies, and where needed, should reform insolvency regimes.

The IMF will release further research from the Global Financial Stability Report on October 7.