Belgium: Staff Concluding Statement of the 2017 Article IV Mission

December 12, 2016

Following successful reforms during the government’s first year in office, the fiscal strategy veered off track in 2016, with a large overshoot of the deficit target. Given the high level of public debt and the increasingly uncertain external environment, it will be essential for the public sector to be both a source of stability and a contributor to stronger growth. Major efforts are therefore needed to make the public sector more efficient and to pursue reforms that would raise the country’s growth potential. Staff recommends to:

-

Implement a credible 2017 budget based on realistic revenue and spending assumptions, and supported by high quality measures.

-

Rein in the growth of public spending through efficiency-oriented reforms at all levels of government.

-

Agree on a coherent infrastructure investment strategy to remove transport bottlenecks and underpin the sustainability of the energy supply.

-

Pursue further tax reform to safeguard revenues while supporting investment and employment.

-

Raise employment rates, especially among the young and non-EU immigrants.

-

Strengthen competition in services to boost productivity and reduce prices paid by firms and consumers.

The government implemented important economic reforms during its first year in office. The 2015 pension reform and the ongoing efforts to contain rising health care costs have been major steps toward addressing the cost of ageing. Wage moderation—including through the temporary suspension of indexation ( saut d’index)—and the targeted labor tax wedge cuts under the first stage of the tax shift have significantly reduced the labor cost gap with neighboring countries. And efforts to limit spending growth contributed to a reduction of the fiscal deficit. These were big steps forward.

This year has proved to be more challenging. The terror attacks in Paris and Brussels had a significant, albeit temporary, effect on the economy. The deficit of the general government is expected to have risen to 3 percent of GDP, far above target. This partly reflected exceptional factors, but also a further decline in the revenue ratio, as the financing of the initial phase of the tax shift has not fully materialized yet, and higher spending, including from the early resumption of indexation and the continued rise in the number of people claiming disability benefits. On the positive side, labor market reforms are progressing and could help support competitiveness and private sector job creation.

The weaker fiscal position is a concern, especially given the high level of debt and the uncertain external environment. After the large fiscal slippage this year, it will be critical to implement a 2017 budget that is based on a credible deficit target, backed by realistic revenue and spending assumptions, and supported by high quality measures. With real GDP growth projected to rebound to 1½ percent and ongoing efforts to contain spending, we expect a notable reduction in the deficit.

A broad and well-coordinated reform strategy is needed to raise the country’s growth potential and bring down public debt. A central task is to balance the budget across all levels of government. This is a major challenge, requiring about 2½ percent of GDP in measures. It should be based on an ambitious and credible medium-term strategy—agreed between all levels of government—that delivers a gradual reduction in spending while safeguarding fiscal revenues. Given the potential impact on domestic demand, it will be important to base consolidation on high quality fiscal measures accompanied by reforms to raise Belgium’s growth potential, including by raising the low rates of employment among certain groups, pursing a coherent infrastructure investment strategy, and strengthening competition in services.

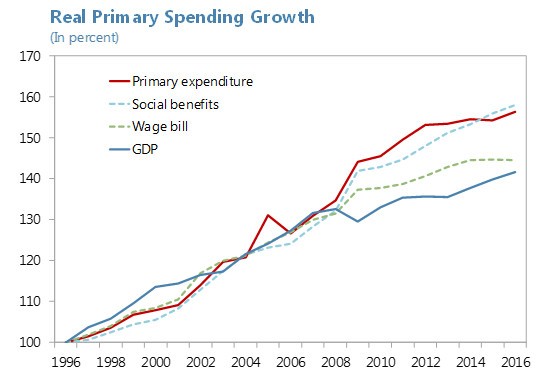

The bulk of fiscal consolidation must come from the expenditure side. After years of rapid growth, public expenditure amounts to nearly 54 percent of GDP, among the highest in the EU, but not necessarily translating into better services or social outcomes. There is significant scope to make spending more efficient, in particular by (i) reducing the high level of subsidies, (ii) making the division of labor between levels of government more efficient, (iii) accelerating ongoing reductions in public employment, (iv) better coordination and monitoring of the budget process across levels of government, (v) enhancing means-testing and better control of social benefits, with a view to better targeting the most vulnerable.

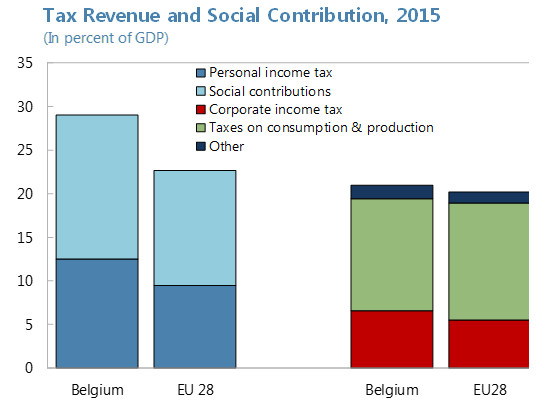

Further tax reform should safeguard revenues while making the system more supportive of jobs and growth. The targeted personal income tax and social security contribution cuts planned for 2018−20 will further reduce the high tax burden on labor. However, it is essential to ensure revenue neutrality through additional offsetting measures, including by strengthening environmental taxation and eliminating deductions and exemptions, including on VAT and for company cars. We would see merit in lowering the corporate income tax and reforming the notional interest deduction if it is part of a much broader and revenue neutral reform of business and investment income taxation. The aim should be to create a more level playing field across business and investment activities, through a review of profit tax deductions, rules against tax avoidance, capital gains taxation, interest and dividend withholding taxes, tax treatment of rental income and real estate, and tax preferences on savings accounts.

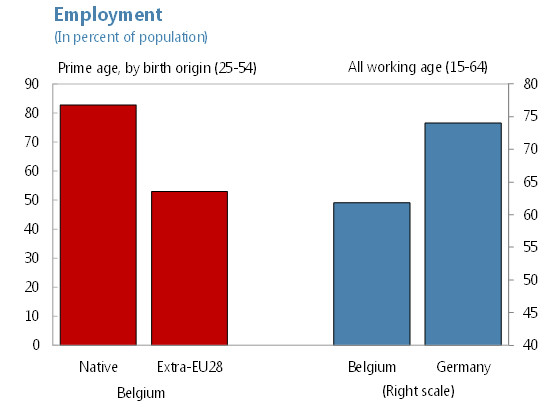

Raising the low employment rates among certain groups would provide a major boost to Belgium’s growth potential. While employment growth has been solid, the labor market remains severely fragmented across regions and skill levels. Many younger and older persons are not working, and non-EU immigrants are even less integrated in the labor market than in other European countries. Only about half of non-EU immigrants aged 25–55 are employed, compared to over 80 percent for Belgian-born residents. Four broad priorities stand out: (i) preserving the gains from wage moderation by linking wage growth to broader labor market and economic conditions (supported by a reform of the 1996 law on employment and competitiveness); (ii) further reducing the labor tax wedge; (iii) improving education and on-the-job training, in particular given the need for competency in multiple languages and unmet demand for certain technical skills; and (iv) addressing barriers to geographical mobility, including traffic congestion, gaps in the public transport network, and the high house transactions tax.

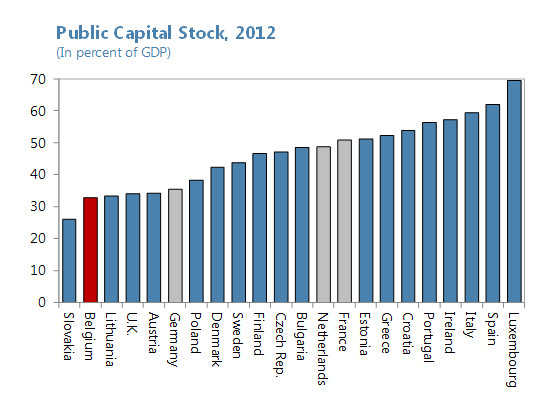

Improving the public infrastructure and strengthening competition in services would support productivity growth and competitiveness. A growing backlog in public investment is weighing on economic activity, with bottlenecks particularly severe in transport infrastructure and growing concerns about the future of the energy sector. To ensure the efficiency of investment, it will be critical to develop a comprehensive and prioritized infrastructure strategy that is agreed between all levels of government, and reflected in medium-term budget plans. In addition, greater competition in services—including in telecommunications, retail, and the legal, architectural, and accounting professions—could help reduce prices paid by consumers and firms while enhancing productivity.

The financial sector will have to continue adapting to the low interest rate environment. The banking sector has restructured and returned to profitability since the crisis. However, the possibility of a prolonged period of very low interest rates could put pressure on profit margins, especially given the banks’ high reliance on deposits and mortgage lending. To maintain the sector’s soundness and resilience, business models need to continue adapting, including through further cost reduction and diversification of revenue sources. It will also be important to monitor and address potential risks in the mortgage and life insurance markets.

We thank the authorities for their constructive policy dialogue and kind hospitality.

Belgium—Economic Highlights

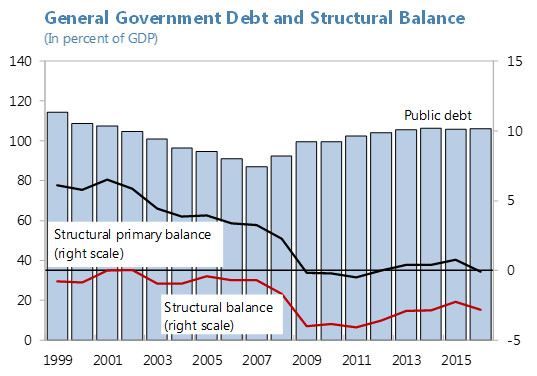

Belgium’s long record of primary surpluses and debt reduction was undone by the crisis, with strong expenditure growth thereafter, and a reversal in fiscal adjustment in 2016.

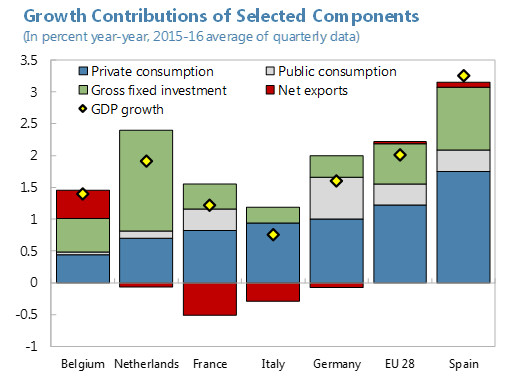

Growth has increasingly been driven by investment and net exports, while private consumption growth was more subdued than in peer countries. The stock of public capital is low after years of underinvestment.

Taxes on labor income are significantly higher than in other EU countries. Employment rates are low for several groups, especially among immigrants from outside the EU.

Sources: Haver Analytics, Eurostat, NBB, and IMF Staff calculations.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Wiktor Krzyzanowski

Phone: +1 202 623-7100Email: MEDIA@IMF.org