Challenges to the Global Economy, Remarks by John Lipsky, First Deputy Managing Director, International Monetary Fund at the National Association of Business Economics

October 7, 2008

International Monetary Fund

At the National Association of Business Economics

October 7, 2008

| Download the presentation (325 kb PDF) |

It is a pleasure to address such a distinguished audience gathered here for NABE's annual meetings, and I would like to thank Susan Doolittle for the invitation.

We have been witnessing a period of exceptional uncertainty and profound change in financial markets. I'm sure that NABE members don't have to be reminded of the series of astonishing events that have punctuated recent weeks.

Against this backdrop, I would like to share with you some views on the current financial turmoil and the current key challenges to the global economy.

Of course, it is widely recognized that the financial turmoil has dramatically increased the degree of uncertainty regarding the global economic outlook. This includes uncertainty about the potential degree of negative feedback between the current process of financial sector deleveraging and credit growth, and between slowing credit gains and real economic growth.

While recognizing the heightened uncertainty, our latest global forecast anticipates a further weakening of the global economy in the coming months. At the same time, we also expect that a gradual growth recovery will begin during next year's second half, assuming that an appropriate and decisive policy response to the current challenges also will be forthcoming.

So I would like today to share with you our views on the outlook and the lessons we have drawn from the current financial turmoil. In addition, I would like to reflect on the policy options currently facing us.

On the turmoil

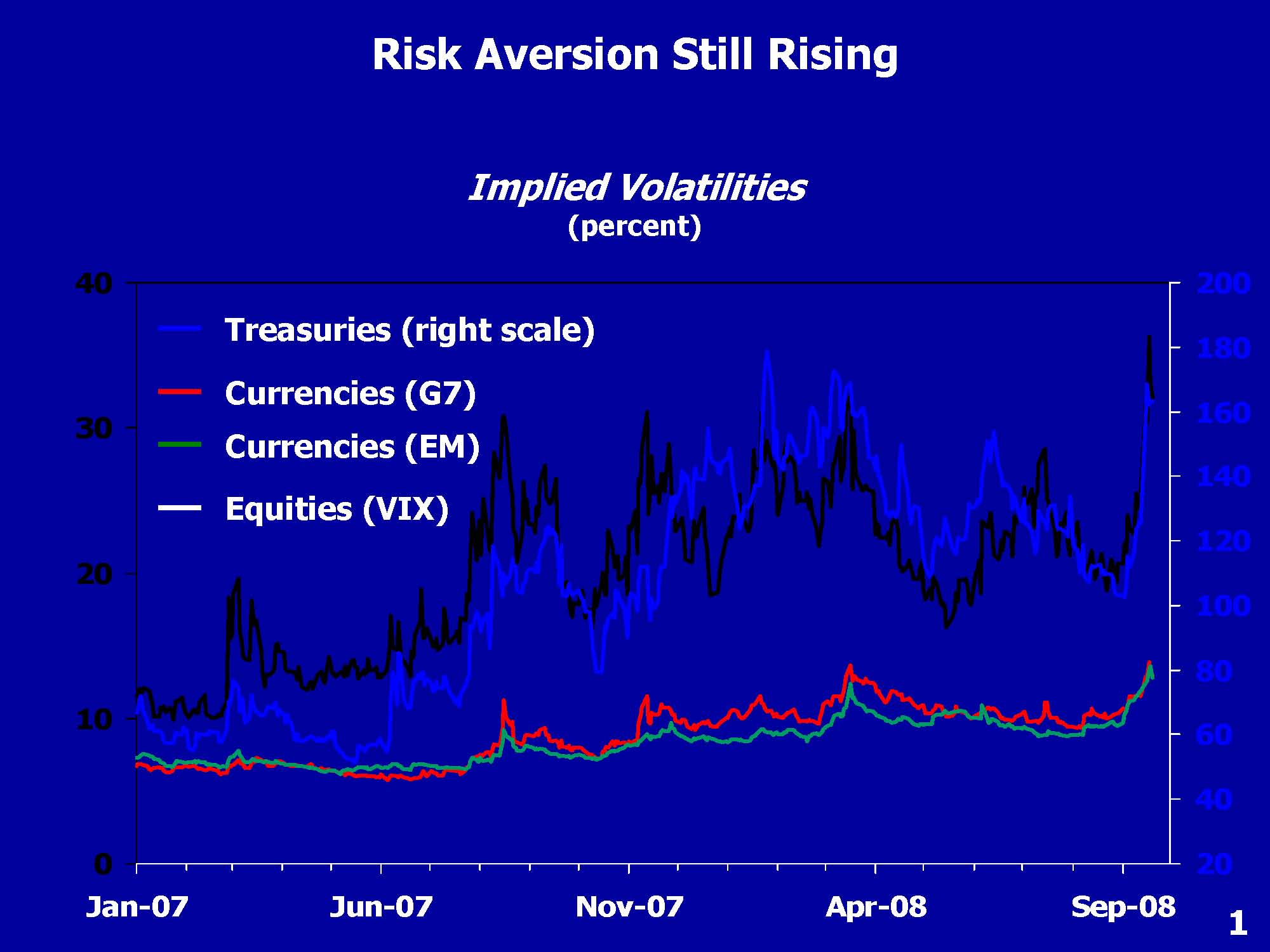

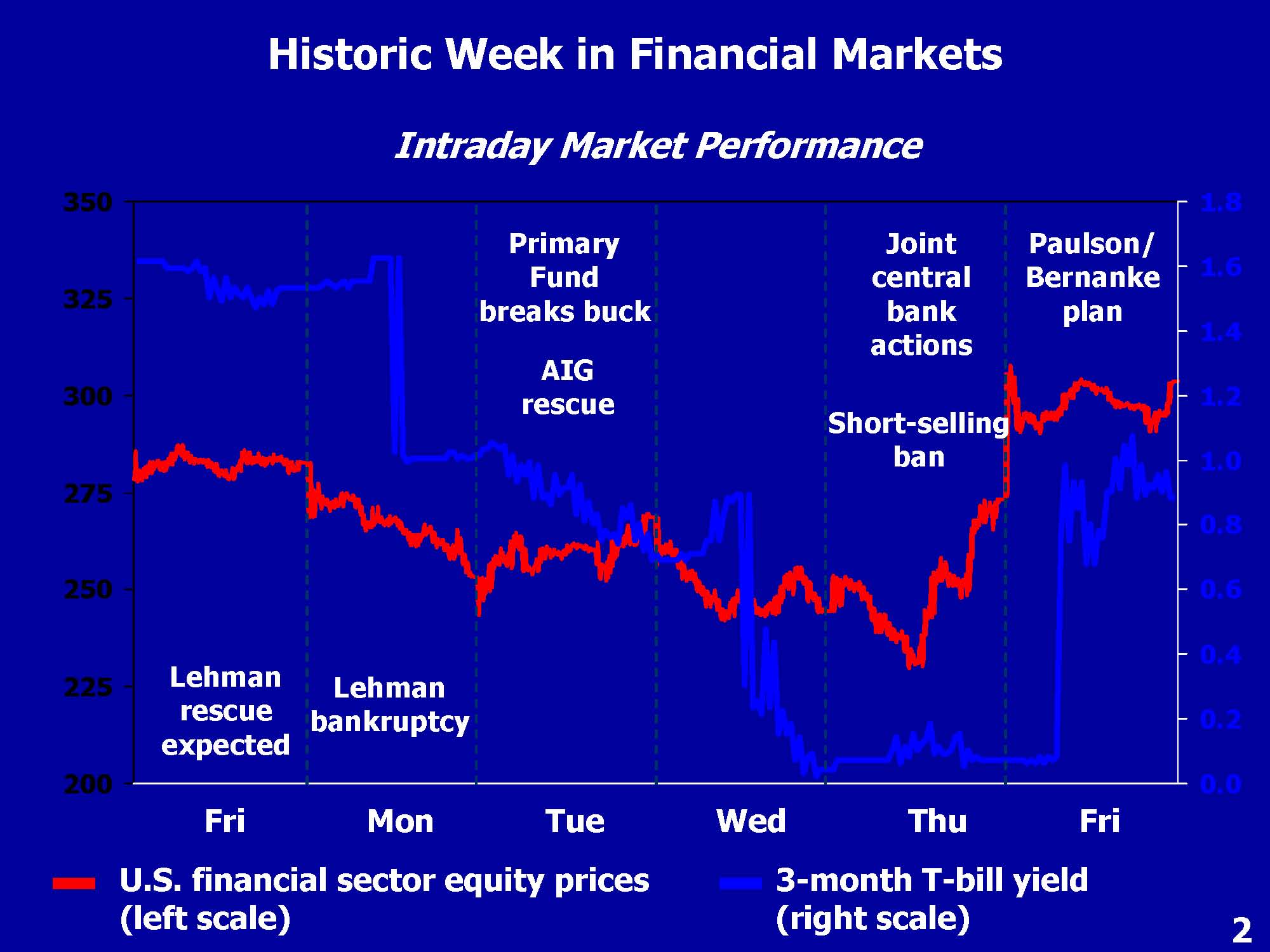

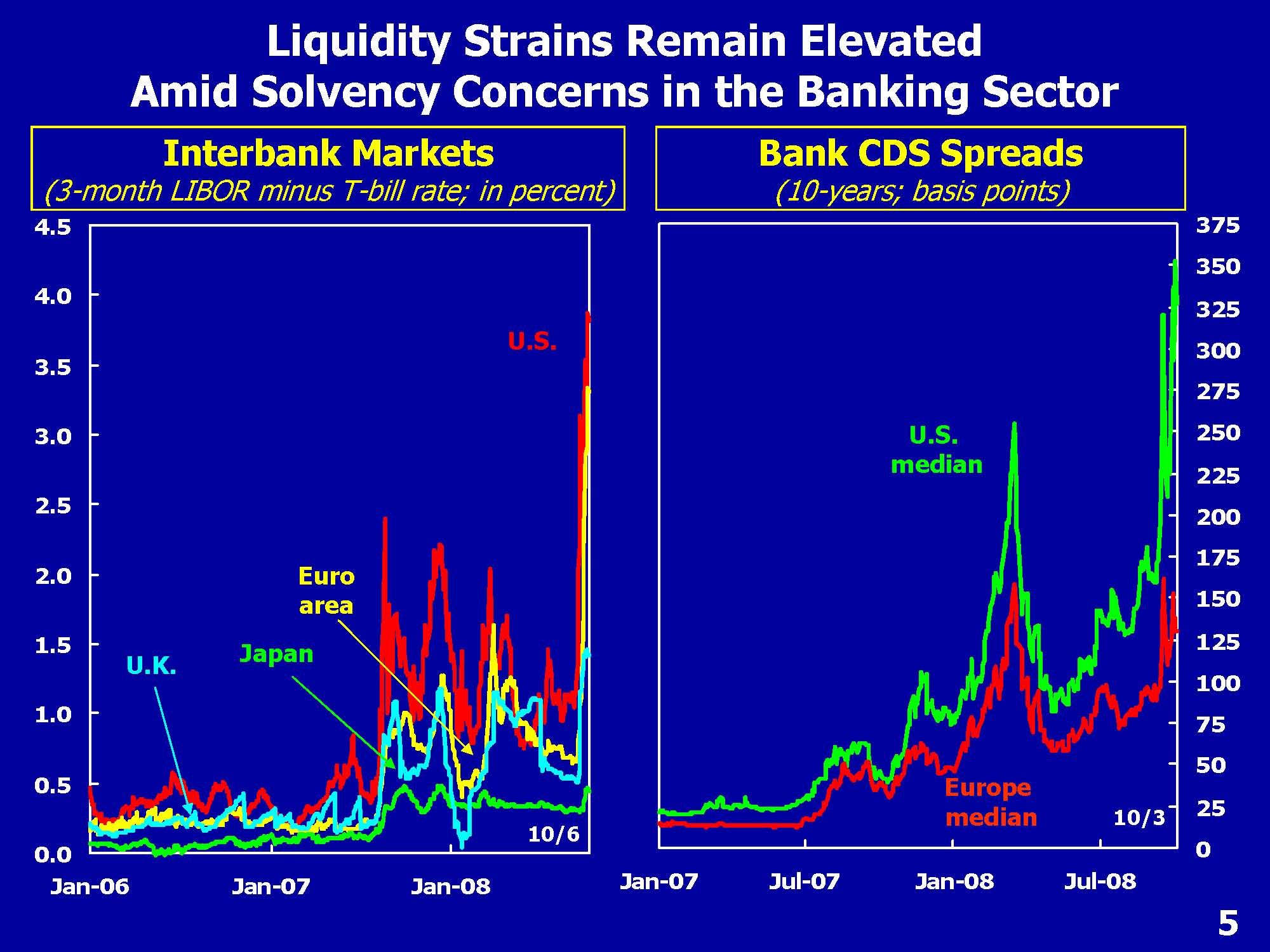

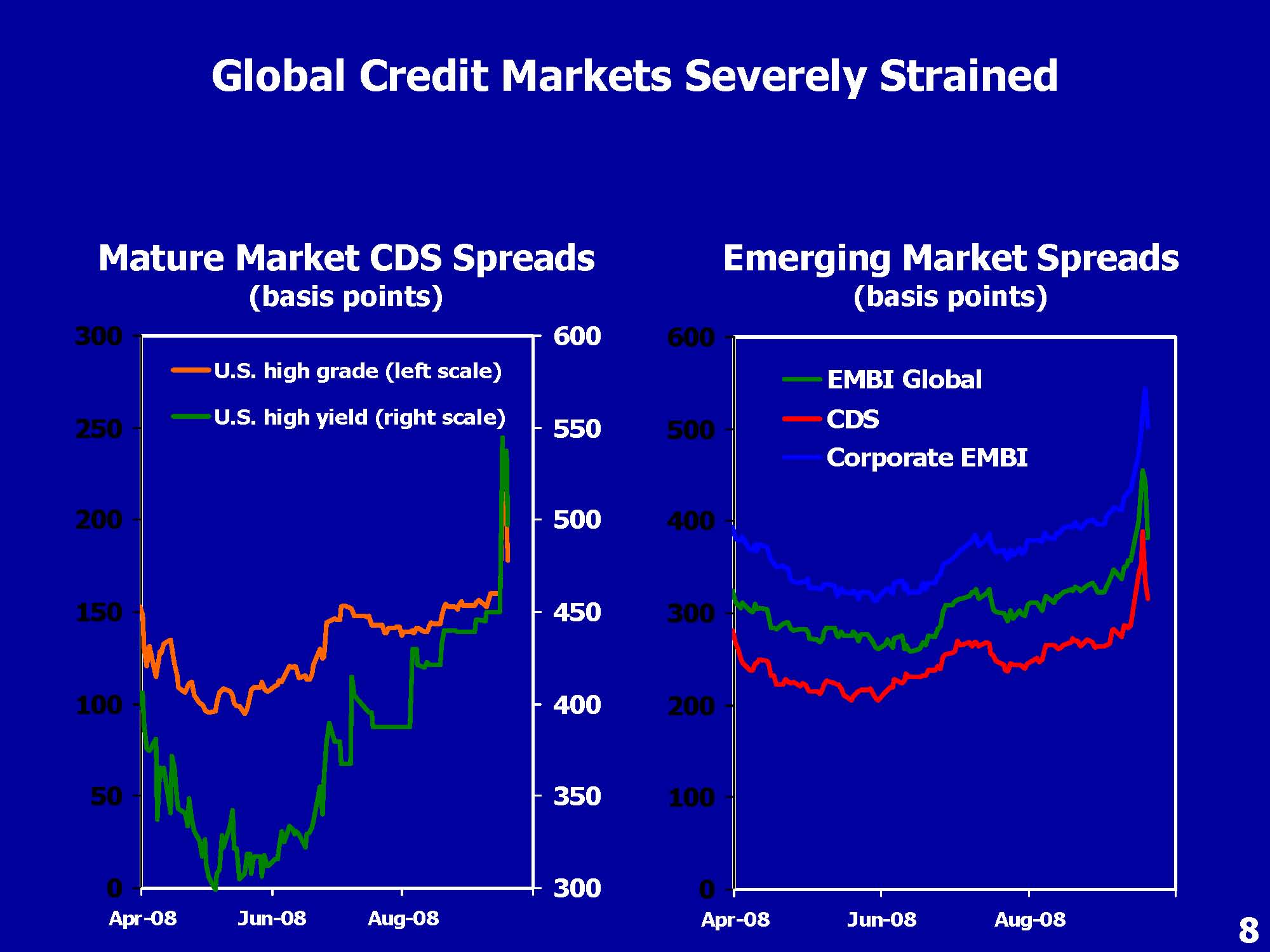

The United States remains at the epicenter of the financial market turmoil that originated in the summer of 2007, and that has continued to reverberate and spread across the globe. The seriousness and the pervasiveness of the turmoil cannot be overstated.  Just recently, investor risk aversion jumped suddenly, with volatility rising and a massive flight to high quality assets as the US Treasury bill rate traded near zero percent.

Just recently, investor risk aversion jumped suddenly, with volatility rising and a massive flight to high quality assets as the US Treasury bill rate traded near zero percent.

Financial sector risks have increased and problems in the sector clearly have begun to spill over to the real sector. However, coherent and decisive policy responses would help to slow down the self-fulfilling downward spiral of confidence, restore the efficient workings of markets, and thereby reduce the risk of a deep and protracted global downturn.

Financial sector risks have increased and problems in the sector clearly have begun to spill over to the real sector. However, coherent and decisive policy responses would help to slow down the self-fulfilling downward spiral of confidence, restore the efficient workings of markets, and thereby reduce the risk of a deep and protracted global downturn.

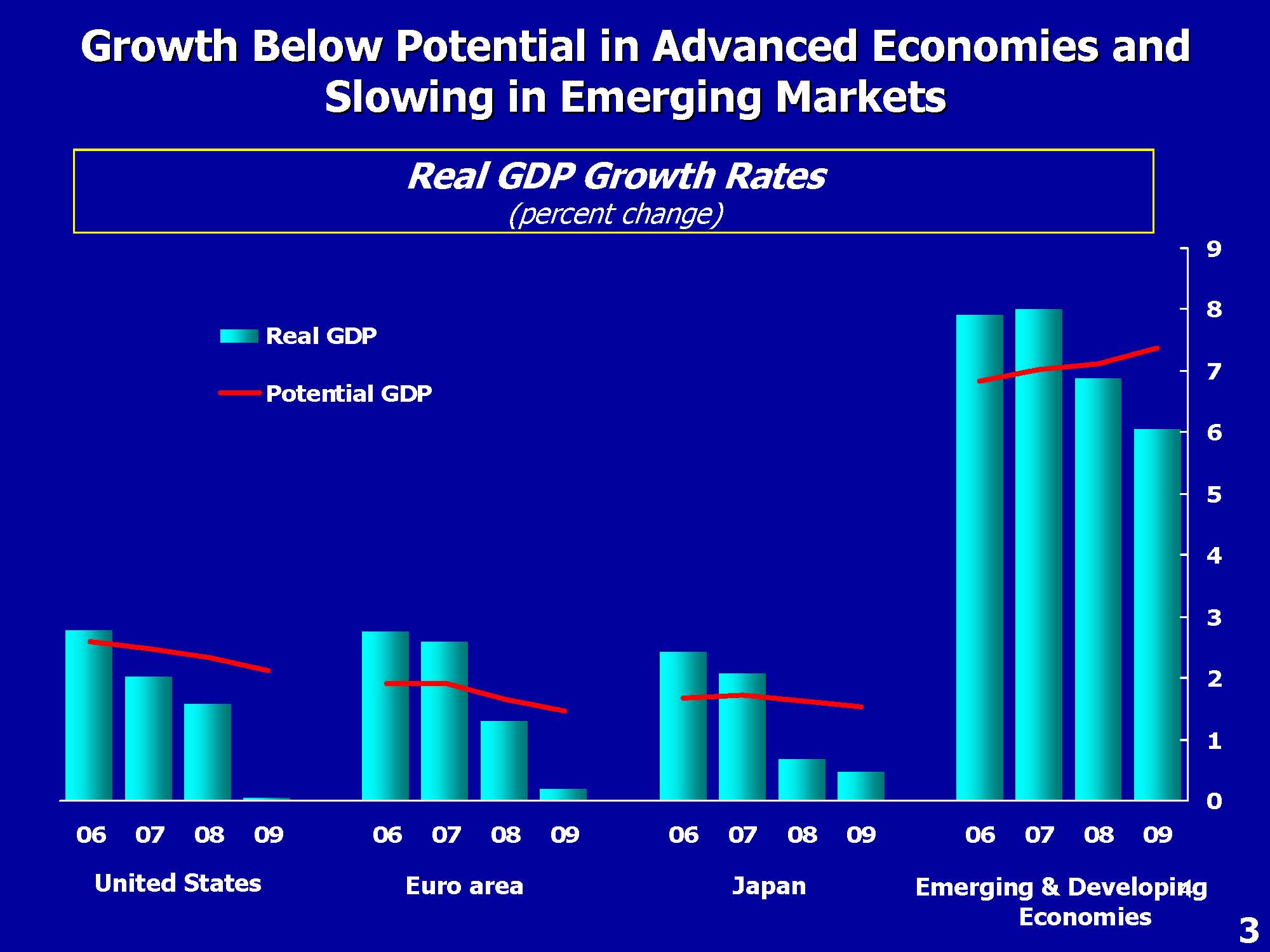

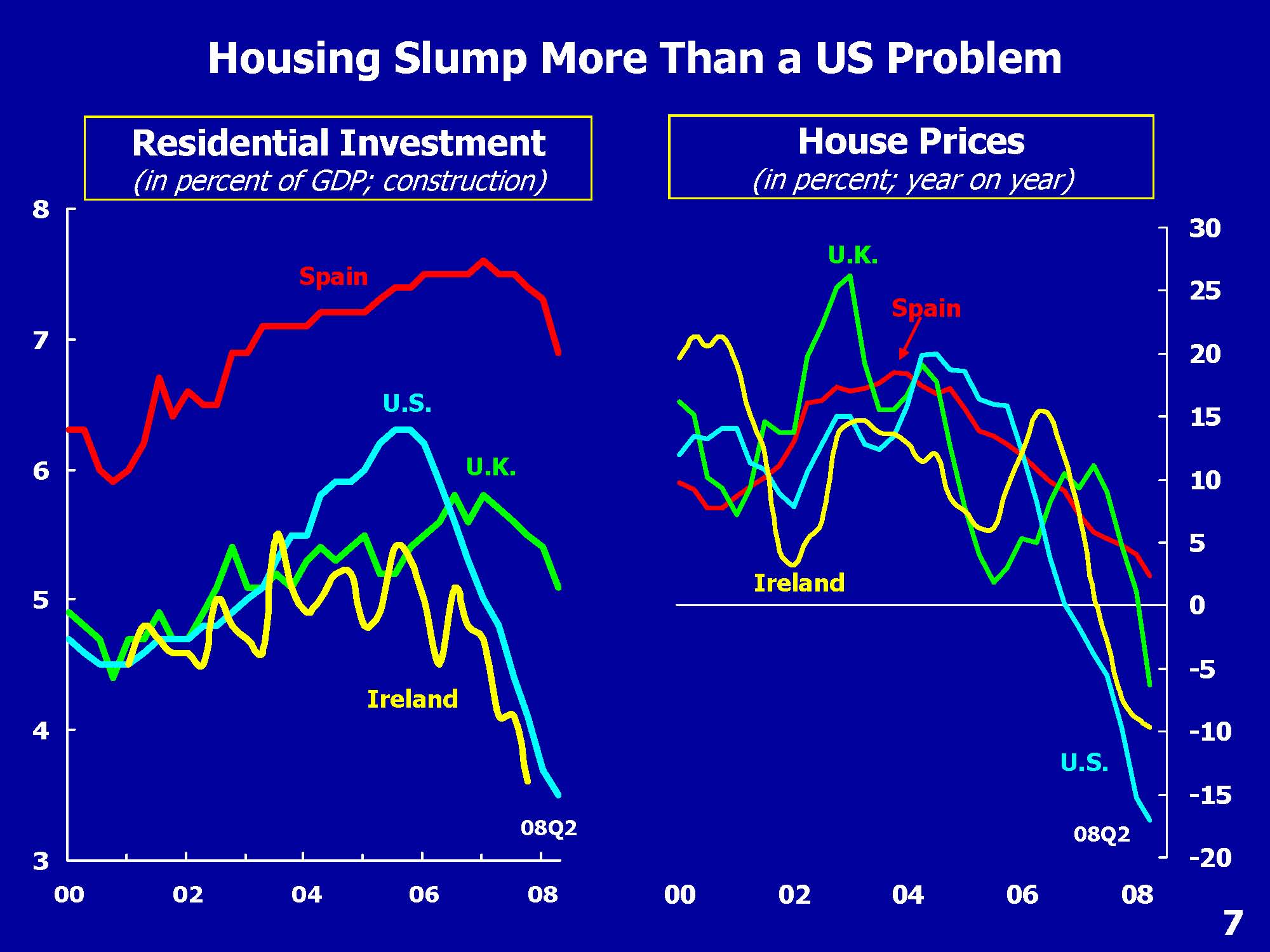

Global growth likely will slow further, before a gradual recovery gets underway during next year's second half. However, the degree of deceleration is expected to vary across regions. Growth in advanced economies is slowing markedly to rates well below potential. The United States economy was more resilient than anticipated in the first half of 2008, in part reflecting strong support from aggressive monetary easing and fiscal stimulus. In addition, the non-financial corporate sector entered this period of financial turbulence in a relatively strong position of high profits and profit margins and relatively low leverage. However, the drag from residential investment on GDP growth is likely to continue into 2009. At the same time, the loss in household net worth from falling asset prices is weakening consumption spending. Thus, there is a real risk that output will shrink somewhat in the next few quarters, before turning up later next year.

Global growth likely will slow further, before a gradual recovery gets underway during next year's second half. However, the degree of deceleration is expected to vary across regions. Growth in advanced economies is slowing markedly to rates well below potential. The United States economy was more resilient than anticipated in the first half of 2008, in part reflecting strong support from aggressive monetary easing and fiscal stimulus. In addition, the non-financial corporate sector entered this period of financial turbulence in a relatively strong position of high profits and profit margins and relatively low leverage. However, the drag from residential investment on GDP growth is likely to continue into 2009. At the same time, the loss in household net worth from falling asset prices is weakening consumption spending. Thus, there is a real risk that output will shrink somewhat in the next few quarters, before turning up later next year.

Economic growth in Western Europe has slowed sharply. Business and consumer sentiment there has deteriorated notably in recent months while industrial activity has slowed, reflecting tighter credit conditions, weaker global growth, and the negative impact of the stronger euro on exports. High oil and food prices are undercutting real disposable incomes, while financial strains are slowing investment. Declining housing markets increasingly are acting as a drag on domestic demand in several European countries, including in Spain, the United Kingdom, and Ireland. Japan's economy also slowed substantially in the second quarter of 2008. Proxies for industrial activity and household consumption point towards a further slowdown in the period ahead, with GDP projected to grow below potential in both 2008 and 2009.

Emerging market economies have not been at the forefront of the turmoil, but have been significantly affected by the latest bout of financial disruption. Momentum in emerging economies is moderating although growth remains robust. Nonetheless, annualized growth in these economies has decelerated from an 8¼ percent annual rate in the middle quarters of 2007 to close to 7 percent in the past three quarters, largely reflecting slower export growth as a result of weaker demand from advanced economies, and further slowdown is expected in the next few quarters.

Signs of deceleration are most pronounced for countries in Emerging Asia outside China that are tightly linked to the global manufacturing cycle, including the Philippines, Thailand, Malaysia, Taiwan, Singapore, Hong Kong, and—to a lesser extent—India. Headwinds to activity have also intensified for Emerging Europe and Latin America, owing to the regions' exposure to the euro area and the United States through trade and financial channels.

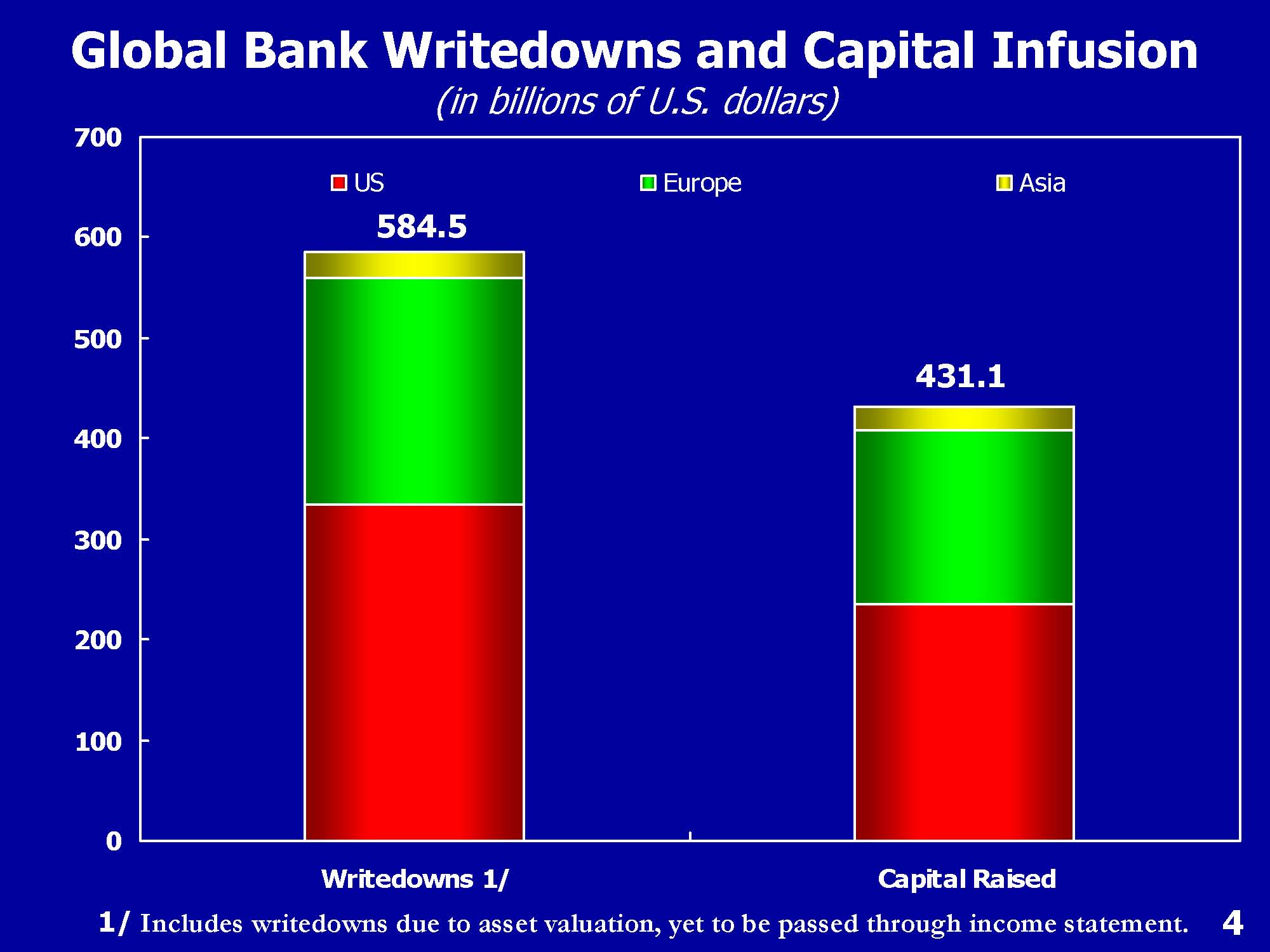

As we know, financial institutions—especially in mature economies—have had to make significant adjustments over the past six months and more will be needed. Substantial amounts of capital have been raised.

Banks have tried to widen their sources of funding to compensate for impaired securitization and interbank funding market difficulties. Some banks have sold liquid assets and absorbed off-balance sheet structured investment vehicles (SIVs) and conduits, while attempting to reduce balance sheet risk and strengthen liquidity buffers. Others are allowing illiquid assets to run off at maturity, but this takes time.

Banks have tried to widen their sources of funding to compensate for impaired securitization and interbank funding market difficulties. Some banks have sold liquid assets and absorbed off-balance sheet structured investment vehicles (SIVs) and conduits, while attempting to reduce balance sheet risk and strengthen liquidity buffers. Others are allowing illiquid assets to run off at maturity, but this takes time.

Financial institutions are in the midst of a significant deleveraging process—a process that accelerated a month ago and that has by no means run its course.

Bank balance sheets are under significant strain as some near-bank funding structures contract and credit is reintermediated, some of which comes from firms drawing down pre-negotiated credit lines. Confidence in securitization markets remains impaired, and regulators, credit rating agencies, and markets are re-evaluating how banks should be restructured to cope with the risks revealed during the crisis.

Bank balance sheets are under significant strain as some near-bank funding structures contract and credit is reintermediated, some of which comes from firms drawing down pre-negotiated credit lines. Confidence in securitization markets remains impaired, and regulators, credit rating agencies, and markets are re-evaluating how banks should be restructured to cope with the risks revealed during the crisis.

There is no doubt that the financial sector in general is still overscaled. At the same time, the sector is in the midst of a high-speed restructuring in terms of both institutions and instruments. Policy makers are trying to ensure market functionality and at the same time bolster confidence. But they recognize that the deleveraging process is inevitable. As a result the pace of deleveraging is very difficult to anticipate with any confidence, as the challenges are unprecedented.

In the last few weeks, extraordinary measures by central banks and governments around the globe have been adopted in order to avoid a pervasive loss of confidence and to counteract the emergence of significant systemic risks.

Let me now turn to some of the specific challenges posed by the deleveraging process currently underway.

It is clear that financial institutions' inevitable deleveraging will involve three aspects: reducing assets, raising capital, and, ultimately, implementing new business models. Deleveraging by reducing assets has proven problematic for banks. Selling assets in illiquid market conditions may induce losses that deplete capital. Distressed sale prices can establish a fresh benchmark to which remaining assets are marked, potentially affecting large parts of the banking system and providing a further adverse feedback loop. Thus, policy makers in many economies are implementing policies or programs that will allow the removal of distressed assets from balance sheets while attempting to control the negative impact.

As has become obvious, raising capital is becoming more onerous through financial institutions, already they have managed to raise some capital to bolster their balance sheets, even as they reveal losses, the amounts raised so far have not been nearly adequate, and prospects for further issuance have diminished. Moreover, the bar is being set higher as regulators and market participants seem to agree that higher levels and quality of capital are warranted. In the interim, some governments have opted for providing capital themselves to some of the systematically important ailing institutions.

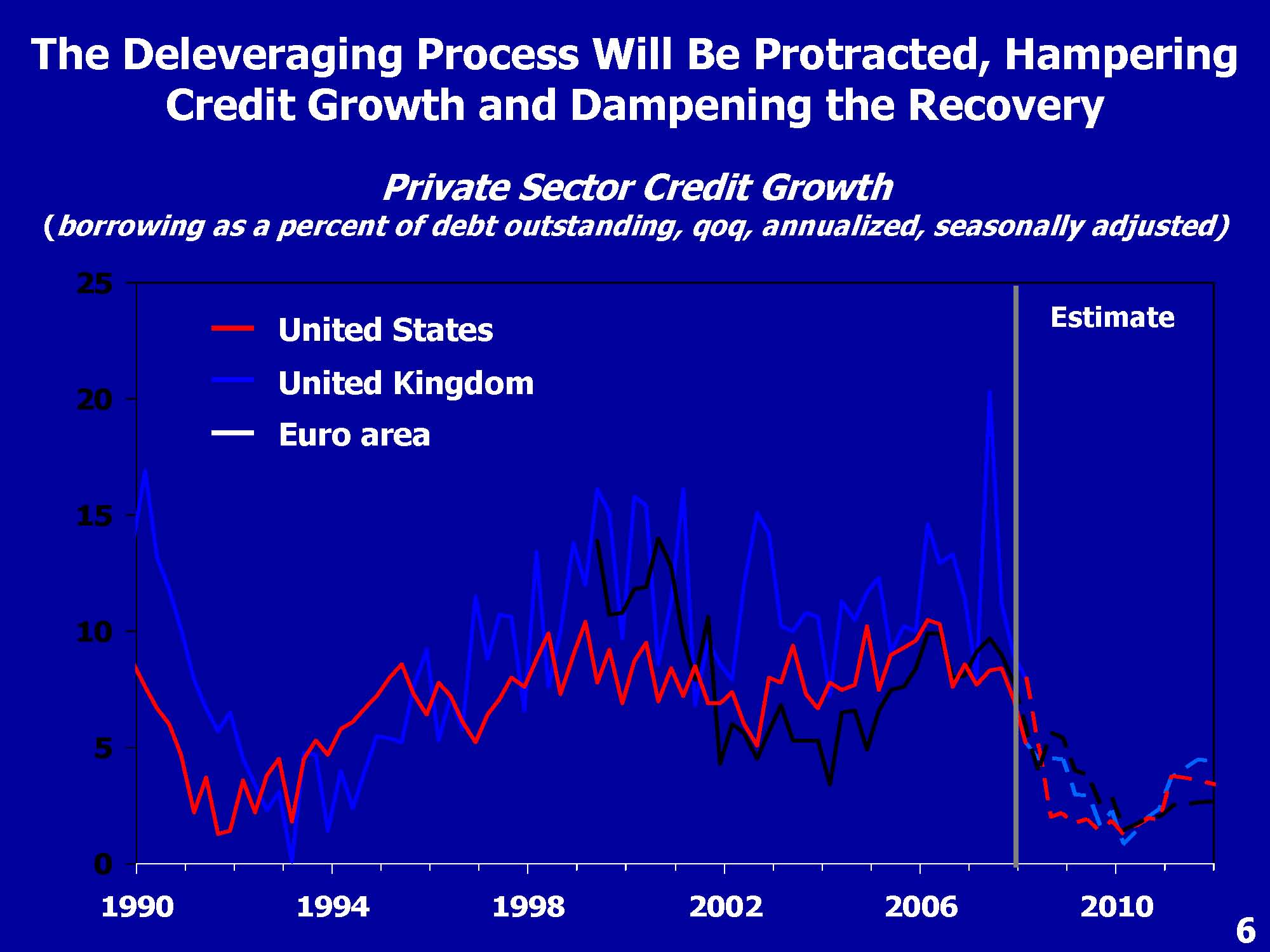

The difficult and protracted nature of this deleveraging process is likely to keep credit growth under pressure for some time, representing a drag on the economic recovery. Until recently, credit growth has held up as bank balance sheets have continued to swell as off-balance sheet vehicles are absorbed and customers tap credit lines. But, the deleveraging likely will take a toll on credit growth to the private sector in the coming months. Household credit growth already has slowed significantly, and the growth in corporate lending is likely to abate once existing loan commitments have matured or been drawn down. In Europe, some forms of household credit growth are also slowing—mainly for mortgages. In Ireland and the United Kingdom, corporate loan growth has begun to slow as earnings prospects have dimmed in tandem with a slow down in economic growth.

Containing the deterioration in credit quality remains a challenge—not just in the United States but elsewhere as well. In the United States, credit deterioration is spreading to higher quality residential mortgages, and to consumer and corporate loans as the economy slows.

Pressures also are emerging in Europe, as house prices in some countries decline, economic growth falters, and lending conditions tighten.

Pressures also are emerging in Europe, as house prices in some countries decline, economic growth falters, and lending conditions tighten.

The resilience of emerging markets to the financial turmoil in mature markets also is being tested. Although emerging markets had been fairly resilient to the global credit turmoil, the dramatic reduction in investors' risk appetite has led to a reversal in some capital inflows, exerting pressure on local markets. Deleveraging by global financial institutions has reduced the availability of external financing and raised its costs. At the same time, policy makers in many emerging economies are coping with the pass through of inflation risks on the back of the earlier rise in commodity and oil prices.

A sharp slowdown could be more difficult to avoid in those cases in which the domestic banking system relies on cross-border financing. Domestic banks in central and eastern Europe have built up large negative net foreign positions vis-à-vis international lenders, where the maintenance of credit growth hinges crucially on cross-border lending by foreign parent banks to local subsidiaries. Those parent banks are starting to feel significant funding pressures, as they remain vulnerable to market sentiment since they obtain a substantial part of their funding from international wholesale markets.

A continued reversal of capital flows to emerging markets poses challenges for countries with large external deficits and a lower level of reserves relative to short-term debt. Mutual and pension funds have scaled back emerging market exposure in response to rising emerging market vulnerabilities. Flows into emerging equity markets have slowed or reversed since the beginning of the year, amid investor concerns about emerging market inflation and exposure to a slowing global business cycle.

Policy reflections

In sum, the strains and fragility resulting from the financial crisis remain serious. The deterioration in the global economic outlook, with a deepening housing downturn, tighter credit conditions, and heightened inflation risks, has both narrowed the policy options and added to financial stress. In mature economies, the cost of credit for corporations and households has risen, hurting economic activity and credit quality. And, as recent developments have demonstrated, the emerging economies are by no means immune to these setbacks. Responses to specific financial stress events are likely to differ across time and locations. However, given the increased global linkages, it is hard to envision global economic divergence on a sustained basis. Our lowered global growth forecast reflects this reality.

In sum, the strains and fragility resulting from the financial crisis remain serious. The deterioration in the global economic outlook, with a deepening housing downturn, tighter credit conditions, and heightened inflation risks, has both narrowed the policy options and added to financial stress. In mature economies, the cost of credit for corporations and households has risen, hurting economic activity and credit quality. And, as recent developments have demonstrated, the emerging economies are by no means immune to these setbacks. Responses to specific financial stress events are likely to differ across time and locations. However, given the increased global linkages, it is hard to envision global economic divergence on a sustained basis. Our lowered global growth forecast reflects this reality.

The preeminent policy challenge we face is to mitigate the intensification of a negative feedback loop between the financial system and the economy in the near term, while establishing a clear road to recovery for both the financial system and the global economy.

Policymakers recently have taken several significant actions to break the negative feedback loop and to stabilize confidence in financial markets. Most recently, these have included in the United States the passage of the Emergency Economic Stabilization Act, and more generally the expansion of deposit insurance schemes in the United States, and now in many European countries. Many countries also have chosen either to lend directly or inject equity into what are deemed to be systemically-important institutions or else to nationalize them. Although these steps have not yet succeeded in fully bolstering market sentiment, they should allow for a more orderly deleveraging process.

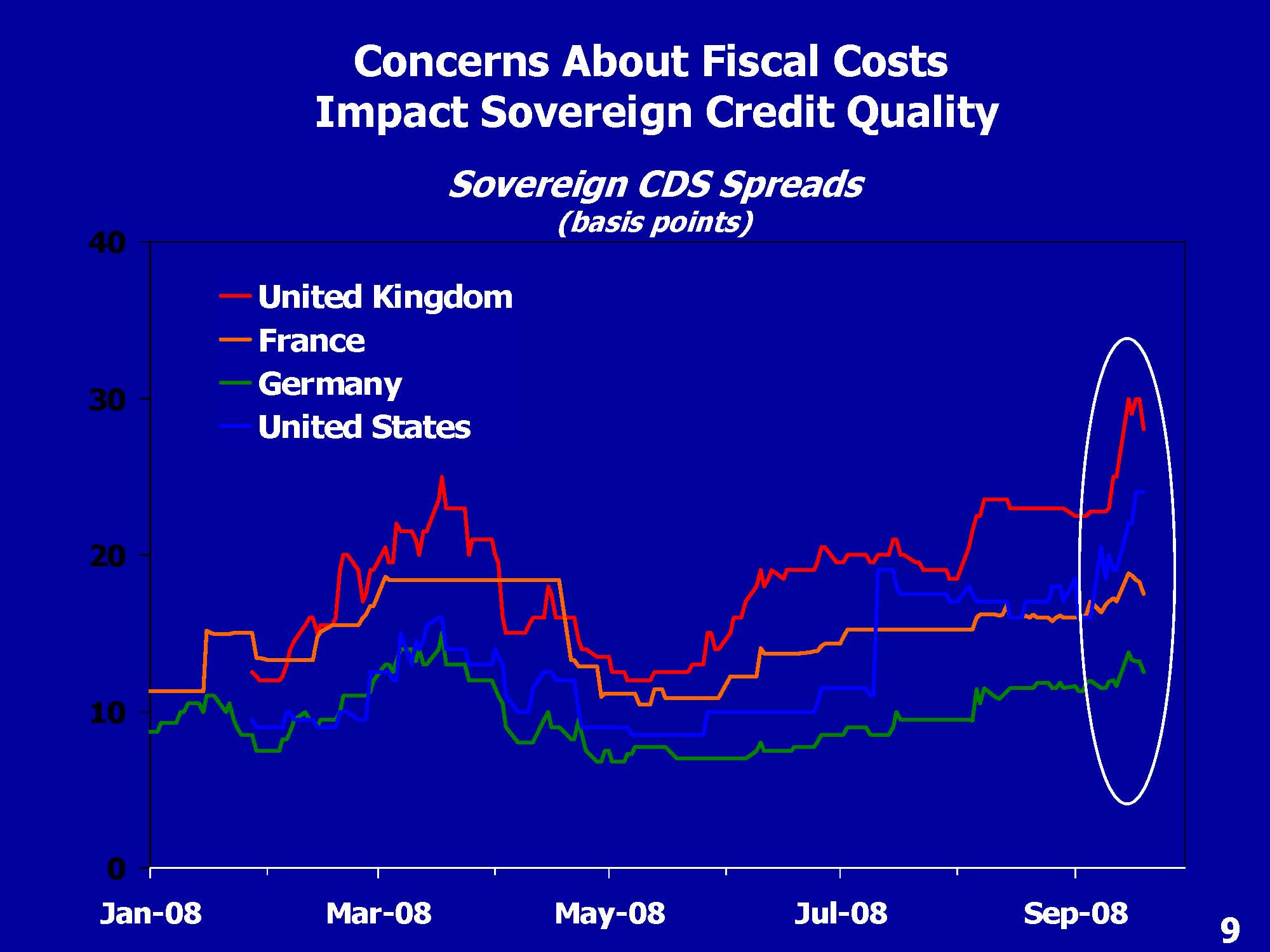

The experience of prior financial crises also suggests that interventions should aim at lowering future systemic risks while paying attention to limiting fiscal costs. In this regard, the longer-term role of the U.S. GSEs remains to be resolved. Ultimately the US government will need to determine the GSEs' status and role in the housing markets—issues that will be addressed once the Treasury's authority and the short-term credit facility expire and once the portfolios of the GSEs begin to shrink. Similarly, it remains to be established exactly how the capital injections contemplated under the new Emergency Economic Stabilization Act will be implemented. The goal is to help stabilize the U.S. financial system while minimizing downsize risks and preserving the prospect of eventual upside gains for the taxpayer. In any case, it appears that concerns about potential fiscal costs of financial sector support operations is having some impact on capital market participants' risk perceptions of sovereign borrowers.

The global market turmoil also has exposed a lack of clarity about the respective roles of regulators, supervisors, central banks, and fiscal authorities in the event of a systemic financial crisis. It has been recognized that achieving greater clarity over official responsibilities and objectives will help rebuild market confidence. As you probably are aware, this topic is being addressed by the Financial Stability Forum, and by other regulatory and standard-setting bodies around the world.

The failure, even among the most sophisticated market participants, to value and measure the risks underlying structured products also have highlighted the need for supervisors, accounting bodies, and market participants to search for better measurement and disclosure standards that are more consistent across firms and across borders in order to strengthen market discipline.

In this regard, it will be desirable that differences in regulatory structures be eliminated as much as possible. In the United States, the extension of various financial safety nets to non-bank entities provides further justification for seeking greater regulatory clarity and consolidation. One option would be to place all systemic U.S. financial intermediaries under a consistent set of regulations, perhaps under a single regulator.

Recent events have also highlighted the dilemma over capital adequacy. The build-up of excessive exposures occurred while US banks were still largely operating under the Basel I capital framework. Basel II will more appropriately align capital requirements with risks, but many observers and market participants are not convinced that application of Basel II standards would have prevented the current set of serious strains. Almost certainly, the re-examinations currently underway in many venues will result in additional measures to improve the measurement of risks relating to structured instruments, off-balance-sheet items, and contingent liquidity risks. The net result will be more robust regulatory capital requirements.

Weaknesses in liquidity management that have exacerbated the current crisis highlight the need to improve banks and securities firms' own liquidity management practices, raising their holdings of liquid assets, and limiting their reliance on central bank term financing as the backstop provider of liquidity.

Regulators have recognized the need for more rigorous standards for firms' liquidity plans, especially given the now-evident potential for major markets to remain illiquid for much longer periods than previously had been anticipated. The Basel Committee for Banking Supervision's revised guidelines on liquidity represent a welcome step forward, including the recommendation that national supervisors ensure compliance more closely than in the past.

The recent turmoil also has underscored the need for banks with significant cross-border activities to reassess the adequacy and robustness of their cross-border funding. In addition, national authorities, particularly in countries with large banking systems, understand more keenly that previously the need to have pre-existing plans for dealing with institutional strains involving large cross-border funding needs. The Federal Reserve's Term Auction Facility in December, accessible in Europe via ECB and Swiss National Bank swap operations, was a useful example of cross-border cooperation, as was the latest extension and introduction of the more recent facilities. Nonetheless, further thought needs to be given to how central banks and supervisors can best regularize procedures for future cooperation.

The turmoil has highlighted the need to work on cross-border cooperation and contingency planning for crisis management. Progress has been faster in information sharing and in the coordination of separate national responses to events than in more explicit cooperation and coherence in cross-border actions. The recent spate of emergency operations have emphasized the urgency of contingency planning work. Further international work to enhance the treatment of cross-border firms within bankruptcy laws and insolvency regimes is needed. Until then, we will be relying on more informal information-sharing and ad-hoc mechanisms for rapid cooperation.

The arrangements for coordination in deposit insurance for cross-border institutions also need to be clarified. Recent events have highlighted that, confidence can dissipate rapidly, even in the most sophisticated financial systems. All authorities should review their national deposit insurance schemes and, where needed, strengthen their scope and funding, while insuring that they are appropriately supported by prudential regimes and bank resolution procedures. Internationally, there are many unresolved questions about the workings of cross-border deposit insurance that may come to fore if the trolling for foreign retail deposits becomes more widespread. More broadly, authorities should, as a high priority agree a set of international principles for deposit insurance systems that at least set out a common core of objectives.

I would like to conclude with an important lesson of the recent financial turmoil; that is, the need for a strengthened multilateral effort. In an increasingly integrated financial system, economies increasingly are intertwined. Multilateral efforts to strengthen the regulatory framework in the face of very rapid financial innovation, the sharing of information to promote market discipline, and the cross-border cooperation and contingency planning for crisis management remain a priority. We have also noted that this recent financial turmoil had its genesis in a series protracted global imbalances, as underscored in the 2006-2007 IMF-sponsored Multilateral Consultations on Global Imbalances.

My concluding message is straightforward: Global challenges call for global solutions, and systemic issues need systemic solutions. The near-term dangers are self-evident. There is much work to do.

Thank you very much.

IMF EXTERNAL RELATIONS DEPARTMENT

| Public Affairs | Media Relations | |||

|---|---|---|---|---|

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

| Fax: | 202-623-6220 | Phone: | 202-623-7100 | |