Cutting Through the Maze: A Simple Expenditure Rule, Remarks by Vitor Gaspar at the European Political Strategy Centre, Brussels, June 4, 2015

June 4, 2015

Brussels, June 4, 2015

Many thanks to the European Political Strategy Centre for hosting this event.

It is a pleasure to be here today to discuss how to “refine Euro Area fiscal frameworks.” This is a very relevant and timely policy question.

The global financial crisis revealed many gaps in fiscal frameworks in Europe, and today’s panel will allow us to have a fruitful debate on the way forward.

In my intervention, I will start with a diagnosis of the European fiscal framework. I will then discuss a proposal for a simple rule. I will make the point that the enforcement and design of the rule should be national but, at the same time, deliver on commitments to the European framework. I will then conclude.

My presentation will draw extensively on a recent IMF Staff Discussion Note on “Reforming Fiscal Governance in the European Union.”

Over the years, the European fiscal framework has undergone successive reforms. These changes were well grounded from a macroeconomic viewpoint.

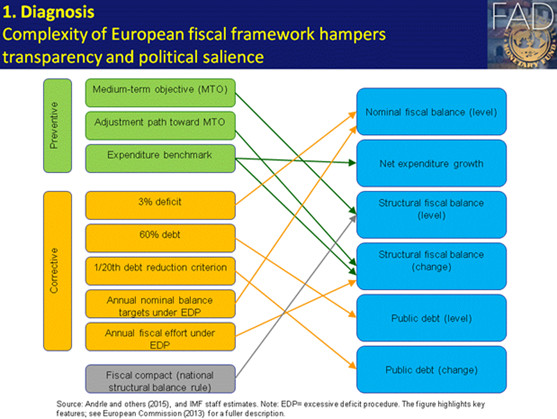

However, they also increased the complexity of the framework. The slide presents a simplified version of the current framework. It shows that the framework involves multiple rules that are overlapping, over-specified and divert attention from the ultimate objective: bringing debt to safer levels.

Complexity makes effective monitoring more challenging. From complexity stems lack of transparency and broken communication with the general public. Political salience becomes impossible. Complexity also allows considerable discretion in the application of the rules.

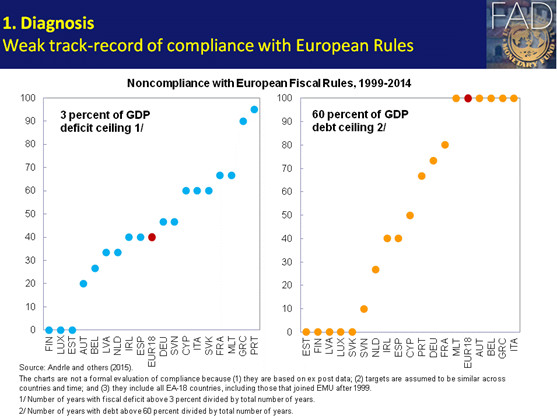

The track-record of compliance is quite weak.

The chart on the left illustrates the high frequency of deficits above 3 percent of GDP. The chart on the right shows the high frequency of debt above 60 percent of GDP.

Europe needs a governance framework that anchors public debt while retaining flexibility against cyclical shocks. It needs a framework that it is less complex and easier to communicate than the current regime.

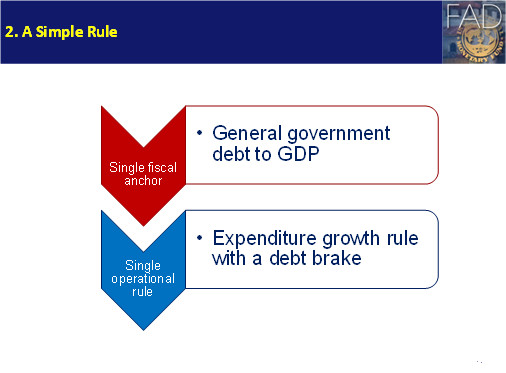

We propose a fiscal framework with a single fiscal anchor and a single operational rule.

Specifically, debt to GDP can serve as the anchor. The ultimate objective is to ensure that debt is brought down to safe levels. Debt-to-GDP captures fiscal slippages that flow variables, like the budget deficit, may miss.

An expenditure growth rule with a debt brake can serve as the instrument. It is the lever to move public debt toward the anchor.

An expenditure rule has many desirable features as a policy instrument. Let me highlight three.

First, expenditure rules aim directly at mitigating spending pressures. This is the right focus in Europe given the already high levels of taxation. According to Eurostat, taxation in the euro area reached 41 percent of GDP in 2014, above the average for the European Union. Within the euro area, France has the highest rate at close to 48 percent of GDP. As for the European Union, taxation in Denmark reached close to 52 percent of GDP, an unprecedented level among advanced economies.

Second, expenditure rules allow automatic stabilizers to operate, making them growth-friendly.

Third, expenditure rules can map directly into the formulation of the annual budget. This contributes to enforceability.

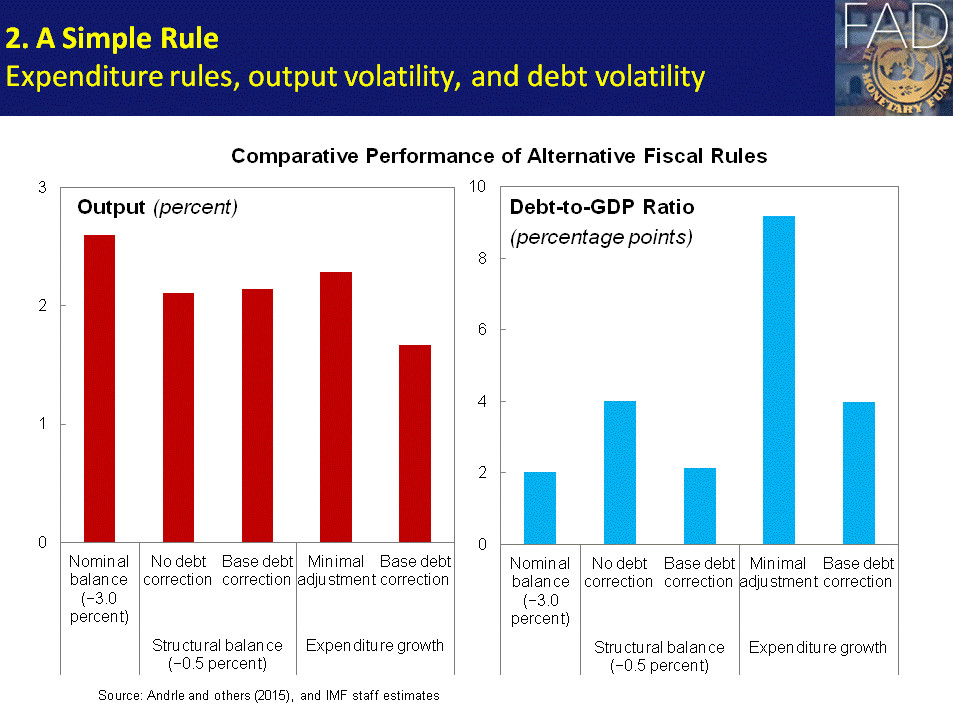

We evaluated how different rules perform, using a stochastic analysis based on a stylized model of a country in the euro area.

We looked at their performance in terms of output volatility and debt volatility. Note, however, that for debt the decisive consideration is convergence to safe levels. That is achieved, eventually, by all rules considered.

We looked at three rules: the overall balance, the structural balance, and real expenditure growth. We also consider variants where a debt brake is included.

The chart on the left shows that output volatility is the lowest for the expenditure growth rule combined with a debt brake.

The chart on the right shows that the expenditure growth rule results in higher debt volatility. But it falls substantially as long as the debt brake term is added. Moreover, as already emphasized, for debt the crucial consideration is convergence to safe levels.

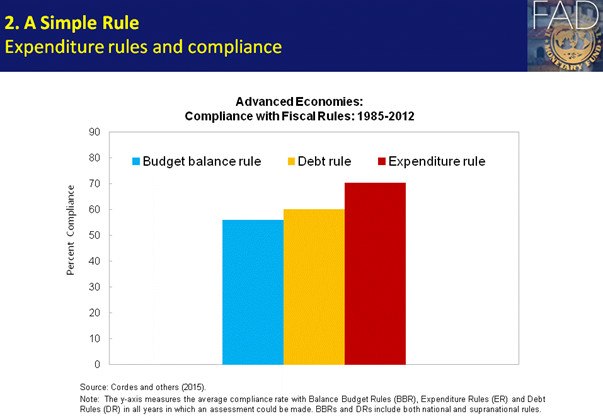

In a recent Working Paper by FAD staff, we looked at the performance of expenditure rules in the real world.

We find that expenditure rules have a better compliance record than budget balance and debt rules, as shown here.

To promote political salience of the rule and support accountability, expenditure rules could be adopted at the national level.

This would require that the rule be calibrated to the national case. The rule would need to be designed to ensure compliance with the European framework.

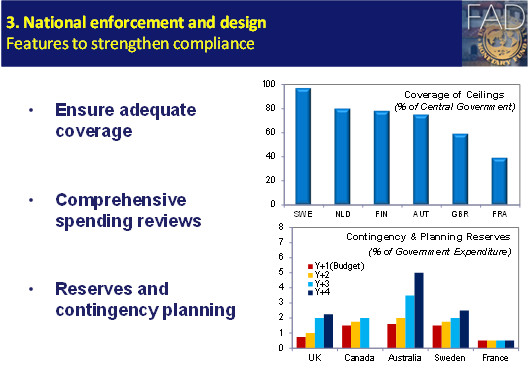

Rules should be accompanied by certain features to strengthen compliance.

One key factor is coverage. The most effective expenditure rules tend to cover at least ¾ of central government expenditure and have a clearly-defined set of criteria for exclusion of expenditure items.

Successful implementation of an expenditure rule also requires regular, comprehensive reviews of government expenditure.

Finally, governments need to leave themselves some room for maneuver within their expenditure plans in the form of contingency reserves and contingency planning. If the regular process fails to deliver, then automatic options for spending cuts would be triggered.

The European Commission can evaluate the design of national rules to ensure their ability to deliver compliance with the European framework. If that is the case, it would also provide guidance and clarity in the use of discretionary judgment on the part of the European Commission.

Focusing on what is controllable by governments would substantially simplify the workings of the system.

Let me recap.

The fiscal framework should focus on a single anchor and a single rule. Basically, government debt to GDP as the anchor, and an expenditure growth rule with a debt brake as the instrumental variable.

Appropriate design of national expenditure rules would deliver compliance with the European framework and provide guidance to the Commission when exercising judgment.

A single anchor and a single rule would allow a focal point to cut through complexity and opacity.

National adoption and implementation would promote political salience, accountability and compliance.

IMF COMMUNICATIONS DEPARTMENT

| Public Affairs | Media Relations | |||

|---|---|---|---|---|

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

| Fax: | 202-623-6220 | Phone: | 202-623-7100 | |