Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Latin America: With Economy Humming, Good Time to Pursue Reforms

April 19, 2013

- Region buoyed by easy financing conditions and high commodity prices

- Fallout from euro area crisis and U.S. fiscal tightening are main near-term risks

- Key policy challenges: rebuild policy buffers, safeguard financial stability

With many of the region’s economies doing well, policymakers in Latin America should take advantage of the current favorable economic conditions to lay the foundations for strong and sustainable growth, said Alejandro Werner, head of the IMF’s Western Hemisphere Department.

Unloading oranges in Limeira, Brazil. Growth in Latin America is expected to remain solid in 2014 (photo: Paulo Whitaker/Reuters/Newscom)

IMF-World Bank Spring Meetings

“In particular, it must work harder at strengthening policy buffers and at safeguarding financial stability,” Werner said, referring to the need for fiscal consolidation to shield economies from external shocks in the future. He spoke at a press briefing held as part of the IMF-World Bank Spring Meetings.

Werner noted that the current juncture also provides an opportunity to carry out growth-enhancing structural reforms that could support growth over the medium term if and when the tailwinds ease.

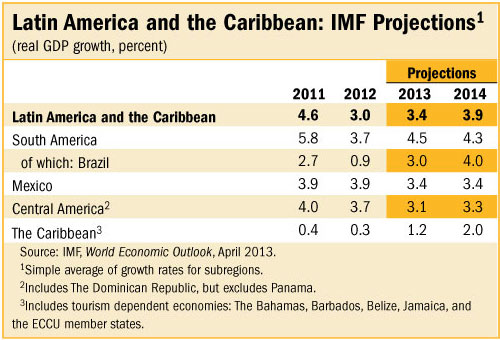

Growth in Latin America and the Caribbean is projected to pick up from 3 percent in 2012 to about 3½ percent in 2013, supported by the gradual global recovery, continuation of easy financing conditions and high commodity prices, as well as the effects of ongoing policy easing in some countries. Brazil, the region’s largest economy, is expected to rebound from under 1 percent in 2012 to about 3 percent this year.

Risks to growth

While economic conditions remain favorable for much of the region, Werner pointed out that the outlook is subject to considerable risks, particularly over the medium-term.

“An escalation of the crisis in the euro area, which would have negative effects on global confidence, trade and external financing flows, cannot be ruled out,” Werner warned. And a larger-than-expected fiscal tightening in the United States could hinder the pickup in economic activity expected in 2014, hurting growth in economies with close ties to the United States.

In addition, medium-term risks persist. Lack of decisive actions in key advanced economies to put their public finances on a sustainable path could trigger an increase in sovereign and corporate risk premiums, with large spillovers on confidence and global activity. “Sharply lower growth in emerging economies, particularly in Asia, would reduce global growth, with large knock on effects on commodities prices,” Werner pointed out.

Key policy challenges

Werner stressed that Latin America should take advantage of the still relatively favorable external conditions to rebuild policy space and safeguard financial sector stability.

With output gaps closed in most countries, a more prudent fiscal stance would ease pressures on capacity and arrest the widening of current account deficits. Stronger fiscal balances would reduce the burden on monetary policy, and increase flexibility to respond to changing economic circumstances. Exchange rate flexibility should continue to be used to discourage speculative capital flows. And it may have to be complemented by prudential measures to safeguard financial stability in the face of rapid credit growth

Commodity exporting countries with weaker policy frameworks should save their commodity revenues. Challenges are particularly pressing in some countries, where tighter macroeconomic policies are necessary to contain growing external imbalances and bring down inflation from high levels.

Countries in Central America need to reduce public debt to around pre-Lehman (2008) levels and address growing external imbalances. “Stronger efforts are needed to mobilize revenues and replace broad-based subsidies with well-targeted support schemes,” Werner said.

In much of the Caribbean, high debt and weak external demand continue to constrain growth. “The challenges remain the same as in the past few years—reducing high public debt, strengthening competitiveness, and addressing financial sector vulnerabilities,” Werner noted.

The IMF’s Regional Economic Outlook for the Western Hemisphere will be published on May 6.