Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Gabon’s Priority: Use Resources to Become Emerging Economy

March 8, 2013

- Buoyed by large public investment plan, economic activity has been robust

- Low fiscal savings make fiscal position vulnerable to oil price volatility

- Better business climate, public investment key for inclusive growth

Gabon’s government has launched an ambitious public investment and reform program to transform the central African country into a diversified emerging market economy by 2025.

Logs in Owendo, Gabon: higher public investment has helped boost wood processing industry (photo: Steve Jordan/AFP/Getty Images)

ECONOMIC HEALTH CHECK

The key, the IMF said in its regular review of Gabon’s economy, lies in the efficient implementation of the program while managing downside risks.

While current economic conditions are supportive and Gabon has the fourth highest level of income per capita in sub-Saharan Africa, poverty and unemployment remain widespread. In this context, a critical issue for Gabon is how to use oil and mineral resources efficiently and in a transparent manner to support inclusive growth.

The IMF staff also noted that Gabon’s economy remains heavily dependent on oil, which makes it vulnerable to volatile oil prices.

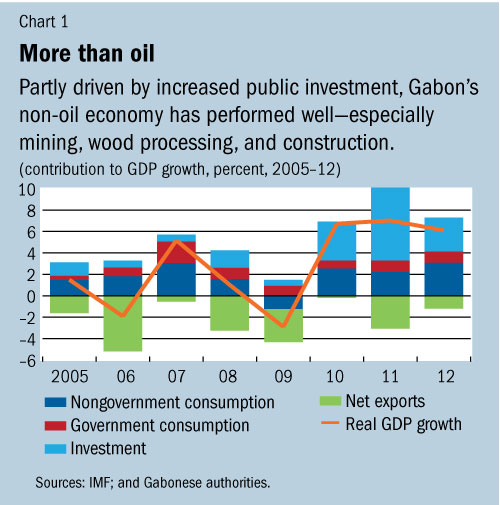

Partly driven by a large scaling up of public investment since 2009, the non-oil economy has performed well, in particular mining, wood processing and construction, helping to boost real GDP growth to 7 percent in 2010–11 (see Chart 1).

Risks to emerging market goal

As a member of the Central African Economic and Monetary Community’s currency union, fiscal policy is the main tool in the Gabonese authorities’ hands to ensure macroeconomic stability. However, anchoring fiscal policy is particularly challenging for Gabon because of the country’s heavy reliance on highly volatile oil revenue and its large development needs.

Moreover, despite decades of oil production, fiscal savings remain low. For the “Emerging Gabon” plan to be successful and to avoid disruptive procyclicality of spending, fiscal policy should be set in a medium-term sustainable framework that takes into account the volatility of oil receipts and allows the buildup of adequate fiscal buffers through better containment of nonproductive expenditure such as wages and subsidies.

The IMF report said a scaling up of public investment is necessary to improve currently weak infrastructure services. To maximize the returns of the recent massive and rapid increase in public investment and mitigate risks of waste, implementation of projects will need to be enhanced.

Work is being undertaken with the assistance of international experts to strengthen the selection, preparation, and execution of investment projects, including a reform of the public procurement code, stricter requirements for technical studies underpinning specific investment projects, and better controls of work completion before payments are made. However, progress to address past weaknesses in investment execution capacity is likely to be gradual and slow.

Better business climate

Beyond the investment scaling up to fill the infrastructure gap, comprehensive policies are needed to support diversified and more inclusive economic growth that is rich in employment opportunities. The role of the non-oil private sector will be all the more important given the prospective decline in oil production and the inability of this capital intensive sector to create many jobs.

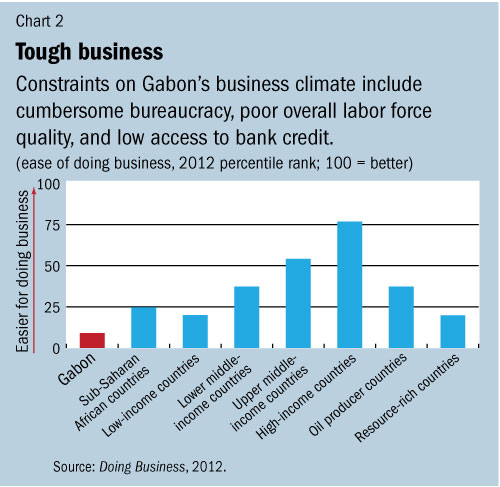

First, the business climate will need to be improved. The private sector in Gabon remains relatively narrow and fragmented, especially at the level of small and medium-sized enterprises.

Many constraints still weigh on the business climate, including cumbersome procedures for establishing businesses and getting land titles, overall poor quality of the labor force, and low access to bank credit. Efforts currently under way to address these contraints will be critical to facilitate private investment and sustain high growth in the medium term (see Chart 2).

Durable job opportunities

Second, employment policy measures will be necessary for better matching labor supply and demand. The education system needs reforming to reduce the current skills mistmatch, and vocational training programs should be developped to address the shortage in technically skilled workers.

Given the high level of wages in Gabon, making the supply of labor more competitive will require enhancing its productivity. These measures taken in combination will help the numerous young Gabonese entering the labor market over the next decade to access durable employment opportunities.

Third, financial intermediation and market depth need to be expanded to allow the sector to play its role in the financing of development. Despite recently strong credit growth, financial intermediation remains weak and very few small and medium-sized enterprises have access to bank financing for investment.

Building on recent efforts aimed at improving the institutional environment for credit will help highly liquid banks in better evaluating credit risks for small and medium-sized enterprises and in expanding investment financing. Enhancing access to mortgage credit and microfinance will also contribute to financial sector deepening.