Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Latin America and the Caribbean: Growth Still in Low Gear

October 11, 2013

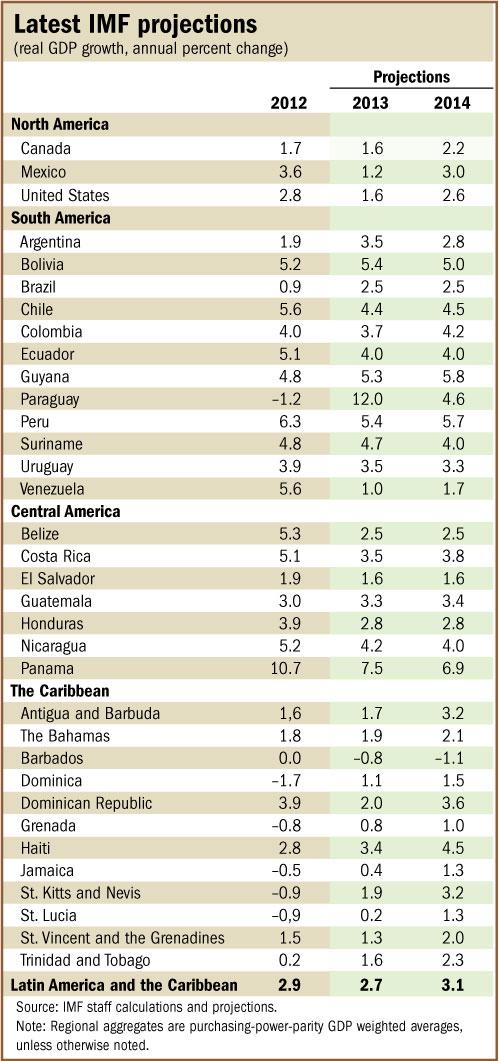

- Region expected to grow by 2¾ percent in 2013 and 3 percent in 2014

- Weaker growth in emerging markets, rise in U.S. interest rates are biggest concerns

- Key challenge is to preserve macroeconomic and financial stability in leaner times

The economies of Latin America and the Caribbean remain in low gear, held back by a less favorable external environment and, in some cases, domestic supply constraints, the IMF said.

Auto factory in Puebla, Mexico, where economic activity suffered an unexpectedly sharp downturn, says the IMF (photo: Imelda Medina/Reuters)

IMF-WORLD BANK ANNUAL MEETINGS

Output in the region is projected to expand by 2¾ percent in 2013, the lowest rate in four years, with domestic demand remaining the main driver. Going forward, growth will edge up to 3 percent in 2014 as external demand strengthens gradually, but remain below the average growth rate of the last decade, the IMF said in its Regional Economic Outlook Update for the Western Hemisphere, released October 11 in Washington, D.C.

In the first half of this year, Mexico suffered an unexpectedly sharp downturn in activity, while Brazil continued to recover gradually from a slowdown that started in mid-2011, the report indicated. In the rest of Latin America, economic activity has moderated.

Growth has been restrained by sluggish external demand and, in some cases, domestic supply constraints, which have proven more binding than previously anticipated. Domestic demand growth is also moderating from cyclical highs.

“The main challenge for our region in the coming years is to preserve macroeconomic and financial stability in what is likely to be a less favorable external environment, and to build strong foundations for sustainable growth,” said Alejandro Werner, Director of the IMF’s Western Hemisphere Department, at a press briefing as part of the IMF-World Bank Annual Meetings.

Risks on the horizon

According to the report, downside risks continue to dominate the outlook. Of particular concern is the possibility of weaker-than-expected growth in large emerging economies. In China, a key market for Latin America’s commodity exports, growth is projected to ease further to 7¼ percent in 2014 from 7½ percent this year. Lower medium-term growth expectations for China have been a key driver of the decline in commodity prices since the beginning of the year, although they remain at relatively high levels from a historical perspective.

Another concern is the uncertainty regarding the pace of normalization of U.S. monetary policy, which may cause new bouts of market volatility and more intense capital outflow pressures. If these risks materialize, policies in emerging markets may have to strike the right balance between supporting domestic demand and containing capital outflows.

“In addition, failure to promptly raise the debt ceiling in the United States next week could inflict a serious damage to the global economy,” Werner said.

Reform, not stimulus

As the twin tailwinds of high commodity prices and very low external financing costs subside, the key challenge for policymakers is to manage a smooth transition to more sustainable growth rates. This adjustment to leaner times requires efforts in several areas, the report pointed out.

First, macroeconomic policies need to be calibrated appropriately. Policymakers should resist the temptation of adopting expansionary fiscal policies to counter the growth moderation. Output is close to potential in many countries, external current account deficits have continued to widen, and fiscal balances are generally weaker than they were before the global financial crisis. Thus, gradual fiscal consolidation remains appropriate for most countries.

Second, strong financial sector regulation and supervision will be critical to safeguard domestic financial stability in an environment of slower growth and more volatile capital flows.

Third, countries should advance structural reforms to raise productivity and stimulate domestic saving in order to boost potential growth in the medium term.

In Central America, gradual fiscal consolidation is necessary to reduce public debt and increase fiscal space in most countries. The authorities will have to exercise expenditure restraint, including a reduction in untargeted oil subsidies. In some counties, mobilizing revenues to meet infrastructure and social needs will also be important.

In the Caribbean, fiscal, external, and financial vulnerabilities remain significant in the tourism-dependent economies. Fiscal consolidation is inevitable but will have to be supported by measures to address chronically weak competitiveness to unlock the region’s growth potential.