Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Turkey: Increasing Saving to Reduce Vulnerabilities

December 20, 2013

- Need for tighter monetary and fiscal policy to counter possible volatility

- Raising domestic savings important to reduce dependence on external financing

- Labor market and education reforms key

Turkey’s economy holds much promise, but the country will have to make its economy competitive and reduce its external deficit in order to join the ranks of high-income countries, the IMF says.

Grand Bazaar in Istanbul. Turkey needs to engage in reforms that would make the economy more competitive (photo: Ramin Talaie/Corbis)

Turkey’s Economy

In an interview about the IMF’s regular annual report of the Turkish economy, mission chief Ernesto Ramirez Rigo said that Turkey’s geographical location, young population, and vibrant private sector provide the basis for a promising outlook.

But faced with market turbulence and a recent slowdown in economic activity, Ramirez Rigo said, Turkey would do well to raise domestic savings, make progress on key structural reforms, and take steps to guard against possible shocks.

IMF Survey: Could you briefly review Turkey’s economic performance so far in 2013?

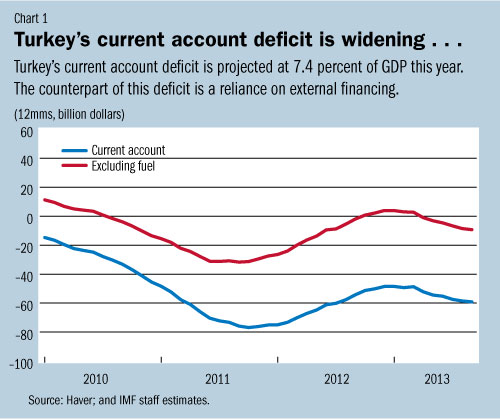

Economic activity picked up in the first quarter of this year due to successive interest rate reductions by the central bank and increased public sector infrastructure spending. The first half of the year saw growth accelerate to 3.7 percent, supported by the policy stimulus. The increase in economic activity was accompanied by an increase in imports which, together with still-subdued growth in exports, has led to a widening current account deficit. However, in the first 5 months of the year, the good performance of the economy and a second investment credit upgrade provided ample external financing.

The picture changed in late May, when fears that the U.S. Federal Reserve would begin to taper its bond-buying program caused a large swing in market sentiment that affected most emerging markets, including Turkey. The currency depreciated, interest rates increased, and financing conditions tightened.

However, despite the turbulence and consequent slowdown in economic activity, Turkey is likely to experience growth of close to 4 percent in 2013. This performance is among the best compared with peer countries, although it comes with a deteriorating external account and higher-than-desirable inflation.

IMF Survey: What are the main policy priorities—and principal motors of growth--for Turkey, given an uncertain external environment?

The priorities are very clear given Turkey’s desire to maintain strong and sustainable economic and jobs growth.

As a first step, and to guard against the volatility induced by the possibility of Fed tapering, the central bank should continue normalizing its monetary policy. This will help support stability in the short term, and investment and competitiveness in the medium term.

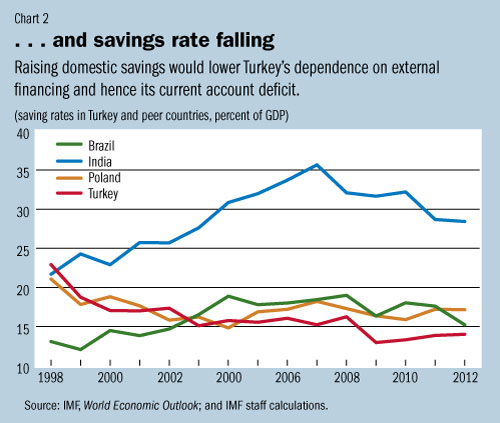

The second critical step, which will have a more important bearing on the medium-term outlook, is for the government to increase savings. The authorities have already recognized the need to raise domestic savings in their 10th Development Plan and 2014-16 Medium-Term Plan. However, more needs to be done to ensure that investment is high, while the external deficit is reduced. This can only be achieved with higher domestic savings—and this is an area where the public sector must play a larger role.

These macroeconomic reforms, coupled with further progress on key structural reforms—for example, boosting human capital, strengthening the business environment, and improving the functioning of the labor market—will be important to achieving what we all want: an increasingly sophisticated economy based on high-value added manufacturing and services that produces a continued rise in incomes, jobs, and the standard of living.

IMF Survey: You mention the need to boost Turkey’s domestic savings rate, which has fallen dramatically over the last 15 years. How big a source of concern is that?

Private sector savings has indeed fallen significantly in recent years. As a result, the low domestic savings—which has as counterpart a large external deficit—places limits on Turkey’s growth in the medium term. This is why it is a source of concern.

In order for Turkey to grow at 4 percent in a sustained manner, it needs to maintain investment close to 21 percent of GDP. With the savings rate at about 14 percent of GDP, however, the country has to fill this saving deficit of about 7 percent of GDP through external financing, which often is only available in the form of volatile portfolio inflows or short-term borrowing, and hard to sustain over time.

Thus, Turkey would need to raise domestic savings to about 18 percent to sustain high growth, while reducing its dependence on external financing.

IMF Survey: Turkey’s monetary policy framework is not always well understood. What are its key elements and is it delivering as it could be on its objectives?

The monetary framework was a response to multiple objectives that naturally required several instruments. A simple explanation is that it aims to maintain price and financial stability, while also discouraging volatility in short-term capital inflows, which can be very destabilizing.

However, while the framework has been useful in some respects, it has not allowed the central bank to meet its inflation target of 5 percent. In addition, its complexity makes it difficult to communicate policy intentions to markets and to manage expectations. Although this may not have been a major problem in the pre-Fed tapering period, the change in circumstances warrants a different approach at this stage. In this connection, the central bank has taken initial steps to address this and I expect the reduced policy uncertainty and further gradual tightening will help steer inflation expectations lower.

IMF Survey: Is Turkey able to withstand an eventual normalization of the U.S. Fed policy, or are we to expect more volatility?

Turkey’s balance sheets generally remain sound, although the external imbalance requires very careful calibration of economic policies in the period ahead. In particularly, there is a need for tighter monetary and fiscal stance to ensure a decline in the current account deficit and inflation. But in both the private and public sector, Turkey has buffers in place, which provide protection against a plausible growth and exchange rate shock that could result from normalization of the Federal Reserve’s monetary policy.

All the same, if Turkey’s external deficit remains unaddressed as the Fed exits from its expansionary monetary policy, the economy could face volatility, as is the case with a number of other emerging markets.

IMF Survey: Continued economic success depends on structural changes. What is the most important structural issue that country needs to focus on?

There is not one single reform that needs to be undertaken. Turkey needs to prioritize and sequence its reforms in such a way that the competitiveness challenge is addressed and domestic savings increased. Labor market and education reforms are particularly important areas, and should also help make Turkey a more attractive destination for foreign direct investment.

IMF Survey: What can Turkey do to retain its place among the most promising emerging economies?

Turkey’s geographical location, young population, and vibrant private sector provide the necessary base for a promising outlook. In addition, the reforms of the last ten years, together with the strengthening of the macroeconomic policy framework during that period, create the necessary foundations for Turkey to reach its goal of becoming a high-income economy. However, Turkey will have to address expeditiously its competitiveness challenges and reduce its external deficit. These two aspects are intimately linked. Raising domestic savings, maintaining a strong nominal anchor through a normalized monetary framework, and ensuring that structural reforms result in attracting more foreign direct investment, are all the critical components that will assure Turkey’s place as one of the world’s most promising emerging economies.