Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Inflation Likely to Remain Stable, IMF Study Concludes

April 9, 2013

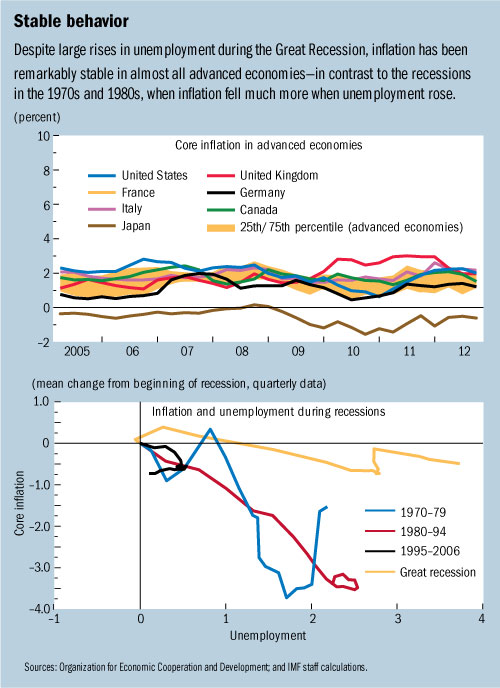

- Inflation barely budged during Great Recession despite rising unemployment

- Independent central banks reduce risk that policies to stimulate economy will ignite prices

- Inflation expectations anchored, but asset prices still vulnerable to increase

In contrast to previous recessions, inflation has not fallen sharply during the Great Recession, and it is unlikely to spike as the recovery strengthens, according to a new study by the International Monetary Fund (IMF). There is little risk of monetary policy repeating the mistakes of the 1970s and igniting stagflation.

People walk near almost empty apartment blocks in Sesena, near Madrid, Spain. Housing prices in Spain fell about 30 percent since the bursting of the property bubble in 2007 (photo: Andrea Comas/Reuters/Newscom)

WORLD ECONOMIC OUTLOOK

The stability of inflation in recent years reflects two key factors, concludes the research published in the IMF’s most recent World Economic Outlook report. The chapter uses econometric analysis and case studies to examine the drivers of price behavior.

First, inflation expectations have become more strongly anchored, or resistant to change, reflecting people’s confidence that inflation will remain close to the targets set by national central banks (see chart). Second, the response of inflation to changes in cyclical unemployment has become more muted.

Not only has inflation been stable during the recession, inflation was also remarkably steady during the strong economic expansion in the early 2000s. This was the case even in Spain, which by joining the euro area became subject to monetary policies that were too stimulative for its domestic economy. Despite the dramatic reduction in unemployment that resulted, inflation expectations, as well as actual inflation, remained remarkably well anchored.

“An essential element behind the anchoring of inflation expectations is the independence of central banks,” explains John Simon, lead author of the study.

Illustrating this point, the study compared the divergent experiences of the Bundesbank and U.S. Federal Reserve (Fed) in the 1970s. Even though both overestimated cyclical unemployment and were keen on maintaining economic growth, the Bundesbank managed to keep inflation in the single digits while the Fed saw it rise to almost 15 percent. The difference was that while the Bundesbank clearly demonstrated its independence from the rest of government, the Fed felt a responsibility to create a monetary environment that accommodated the upward pressures on prices from government action. Only when the Fed achieved real independence with the appointment of Chairman Volcker in 1979 did inflation begin to fall in the United States.

The study concludes that as long as central banks are free from political constraints, stimulatory monetary policy is entirely appropriate given the economic slack in most advanced economies today. The combination of a relatively flat Phillips curve—that is, a small response of inflation to unemployment fluctuations—and strongly anchored inflation expectations implies that any temporary overstimulation of the economy would have only small effects on inflation. Conversely, the costs of ongoing high unemployment are likely to be much greater.

But the fact that monetary stimulus is unlikely to cause strong inflationary pressures should not induce complacency, the study warns. Indeed, the experiences of Spain and Ireland in the 2000s dramatically illustrate that despite low consumer price inflation, economic imbalances grew, as reflected in rampant inflation of asset prices including for housing.