Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Mideast Sees Fragile Recovery Amid Conflicts and Transitions

October 27, 2014

- Political uncertainty and deepening of conflicts weigh on growth

- Oil exporters need to diversify further, reduce reliance on oil-funded spending

- Oil importers’ modest prospects call for reforms to improve living standards

The Middle East and North Africa region continues to experience lackluster growth for the fourth year in a row, the IMF said in its latest regional assessment.

A displaced family in Mosul, Iraq. Regional conflicts weigh on growth in the Mideast as they put pressure on budgets, labor markets, and social cohesion (photo: Sebastian Backhaus/Corbis News)

REGIONAL ECONOMIC OUTLOOK

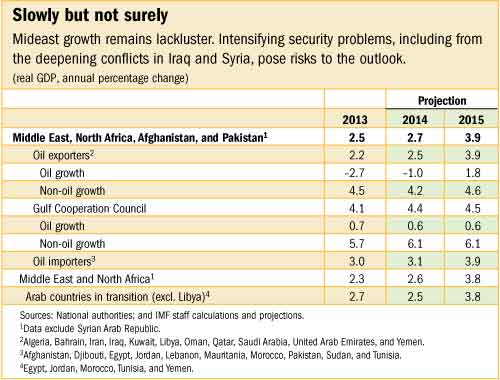

The IMF’s Regional Economic Outlook, released on October 27, projects growth to increase slightly to 2.6 percent this year (see table). Growth could pick up in 2015 if security conditions improve.

“Intensifying security problems, including from the deepening conflicts in Iraq and Syria, pose downside risks to the outlook. The regional economic impact has been limited so far, but an estimated 11 million of displaced persons are already putting pressure on budgets, labor markets, and social cohesion in neighboring countries,” said IMF Middle East Department Director Masood Ahmed who unveiled the report in Dubai.

“The region needs sustained, stronger and more inclusive growth to markedly reduce unemployment—a critical issue facing nearly all countries in the region,” Ahmed added.

Oil-exporters need a new growth model

The IMF expects overall growth of the region’s oil exporters to remain subdued at 2.5 percent this year owing to the deterioration of security conditions, mainly in Iraq and Libya. Growth could pick up next year, but a possible further deterioration in security conditions in Iraq, Libya, or Yemen, could deepen economic disruptions and derail the projected recovery.

The IMF cautioned that, on current fiscal policies, oil exporters’ fiscal surpluses are set to vanish by 2017 and noted that all countries outside the Gulf Cooperation Council and Bahrain are running fiscal deficits already (see chart 1). The marked decline in oil prices by 20 percent over the last two months adds to fiscal risks.

“If oil prices stay at current lows for a prolonged period, oil exporters on aggregate could move from fiscal surplus to deficit already next year,” Ahmed told reporters. For countries that have buffers, it will be important to adjust their fiscal positions gradually to limit the drag on economic growth, he added.

Key reasons behind weakening fiscal and external balances are large energy subsidy and wage bills. These countries need to contain government spending to ensure fiscal sustainability and to bequeath future generations an equitable share of the resource wealth, says the report.

Oil exporting countries have been relying on a growth model that was dependent on growth of government spending on the back of rising oil prices. To transition to a more diversified, private sector-driven model, Ahmed said that countries of the Gulf Cooperation Council in particular would benefit from the following reforms:

• Encouraging the efficient production of tradable goods and services rather than activity in non-tradable sectors with low productivity growth;

• Reducing distortions in labor markets that foster the private sector’s reliance on foreign labor; and

• Improving the quality of education so that it better matches private-sector needs.

Priorities in countries outside the Gulf Cooperation Council include improving the business environment, addressing infrastructure bottlenecks, and enhancing private firms’ access to finance, says the IMF.

Oil importers need reforms to create jobs

The IMF highlighted some positive trends in the region’s oil importing countries. Exports, tourism, and foreign direct investment are gradually improving in some cases as political uncertainties ease.

In addition, many countries—most notably Egypt, Jordan, Mauritania, Morocco, Pakistan, Sudan, and Tunisia—have made progress in containing their energy subsidy bills. The objective has generally been to re-channel part of the savings to support growth and reduce poverty through better-targeted social safety nets and growth-generating investments in infrastructure, healthcare and education. Countries are also using part of the savings from subsidy reform to rein in fiscal deficits, says the report.

Nonetheless, the combination of deep-rooted socio-political tensions, structural bottlenecks, as well as spillovers from intensifying regional conflicts, has been holding back growth from reaching the levels needed to reduce the prevailing high rates of unemployment, the IMF says.

Against this backdrop, the IMF expects economic activity in these countries to remain lackluster this year at about 3 percent, and to pick up to about 4 percent in 2015. However, this outlook still faces significant risks.

“Spillovers from regional conflicts, setbacks in political transitions, as well as lower-than-expected growth in key trading partners could undermine even the modest recovery that we are expecting for the region,” Ahmed said.

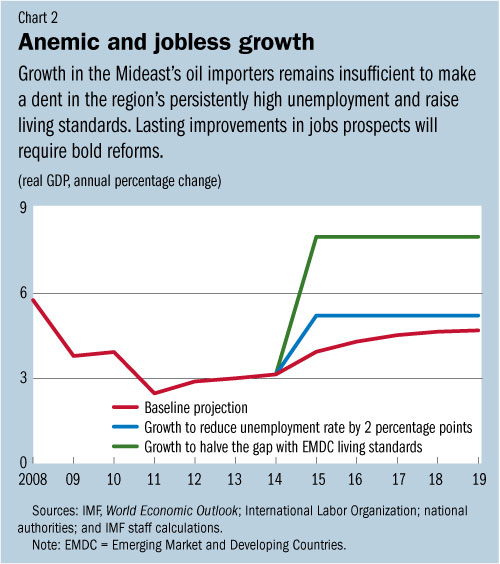

The report also cautioned that debt-to-GDP ratios are still rising and gross external financing needs for this group of countries are expected to reach $100 billion next year. The IMF urges many of the oil importing countries to maintain the reform momentum going forward to bring down high unemployment rates (see chart 2).

“For most people in the region, improvements in their living standards are not being felt yet as some reforms take time to bear fruit,” Ahmed told the conference. Building on the efforts underway would help ensure a sustainable public debt path and promote confidence in the future, which in turn would help boost growth and create job opportunities, he added.

The IMF emphasized that lasting improvements in medium-term growth and job prospects will require deep, multifaceted transformation to spark economic dynamism in the private sector, leading to higher growth potential, more jobs, and less inequity.

“To enable this transformation, policymakers should articulate and implement a bold and credible economic reform agenda that enjoys broad public support. Giving priority to reforms in the business environment, education, and labor market efficiency will be critical to boosting potential growth,” said Ahmed.

The report added that additional financing from the international community, a focus on capacity building, and enhanced trade access would support countries’ reform efforts and allow for more gradual and less painful macroeconomic adjustment. The Fund remains strongly engaged with the region through policy advice, financial support, and technical assistance.