Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Global Imbalances: Narrowing Flows, Widening Stocks

September 30, 2014

- Global flow imbalances have narrowed, primarily driven by contraction in demand

- Global stock imbalances have widened, leaving some economies vulnerable

- Demand rebalancing around the world remains a policy priority.

As global current account—or “flow”—imbalances wane, net creditor and debtor positions—“stock imbalances”—have diverged further, according to a new study just released in the IMF’s World Economic Outlook.

Container port in Qingdao, Shandong, China. The country’s surplus almost halved in relation to world GDP between 2008 and 2013 (photo: Yu Fangping/FeatureChina/Newscom)

WORLD ECONOMIC OUTLOOK RESEARCH

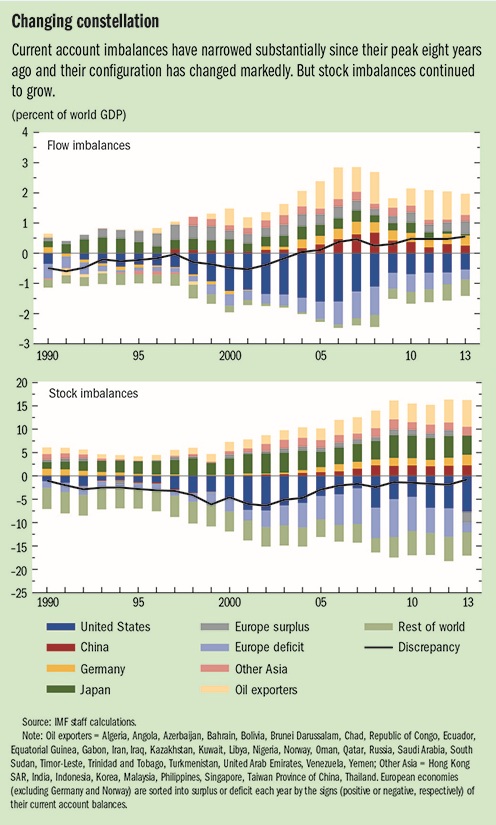

Flow imbalances have narrowed substantially since their peak in 2006 (see chart, top panel), diluting their concentration, reducing the size of systemic deficit and surplus and, therefore, diminishing concerns about these imbalances. But stock imbalances have continued to widen (see chart, bottom panel), leaving some debtor economies vulnerable.

In the process, a new constellation of current account deficits and surpluses has emerged. The large U.S. deficit shrank by almost two-thirds as a percent of world GDP, and some European economies that had had large deficits moved to small surplus positions. In the meantime, advanced economy commodity exporters and major emerging market economies (Brazil, India, Indonesia, Mexico, and Turkey), some of which had run surpluses in 2006, moved to be among the largest deficit economies in the world in 2013.

Among large surplus economies, China’s surplus almost halved in relation to world GDP and Japan’s almost disappeared. Oil exporters and northern European economies, by contrast, increased their already large surplus positions. While large surpluses present fewer systemic risks than deficits do, they too can be problematic if they arise in a world of deficient aggregate demand—which has been the case since the global financial crisis.

Adjusting the flow

The research finds that much of the reduction in flow imbalances was driven by expenditure reduction in deficit economies after the global financial crisis and by growth differentials related to the faster recovery of emerging markets and commodity exporters after the Great Recession compared with that of advanced economies.

Corrective movements in real exchange rates played a surprisingly limited role, with few exceptions (China and the United States being two important ones), and hence so has expenditure switching—that is, changes in an economy’s expenditure on foreign and domestic goods and services. Factors that have acted against anticipated exchange rate realignment include changes in investor sentiment (flows to safe havens after the crisis) and the fact that the euro area’s economic and monetary union includes both large surplus and large deficit economies.

The study notes that much of the observed narrowing in flow imbalances can be expected to last because the decrease in output due to subdued demand has likely been largely matched by a decrease in potential output in most advanced deficit economies. But there is some uncertainty about the latter, and there is the risk that flow imbalances will widen again.

Widening stock imbalances

Net creditor and debtor positions have diverged further thanks to reduced, but not reversed, flow imbalances. Persistently high ratios of net external liabilities to GDP in some advanced deficit economies also reflect the low output growth and low inflation. Given that net foreign assets and liabilities are slow-moving variables, the composition of large debtors and creditors has shown striking inertia.

Baseline projections underlying the World Economic Outlook suggest a further narrowing of flow imbalances together with an estimated further widening of stock imbalances. Under these projections the evolution of current account balances and net foreign asset positions suggest a reduction in external vulnerabilities in the coming years.

Nevertheless, several economies, including a few emerging market economies, remain vulnerable to shifts in market sentiment or to sudden increases in interest rates. In addition to the systematically large debtors, several smaller European economies and some frontier market economies remain vulnerable over the medium term.

To mitigate these vulnerabilities, debtor economies will ultimately need to improve their current account balances and strengthen their growth performance. Stronger external demand and more expenditure switching would help on both accounts. Policy measures to achieve stronger and more balanced growth in the major economies, including in large surplus economies, will also be beneficial.