Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : IMF Launches New Tool to Assess Public Debt in Market Access Countries

March 28, 2014

- New approach takes holistic view of debt sustainability

- Tool evaluates realism of economic projections, potential vulnerabilities

- Visual summaries highlight risks that are comparable across countries

The IMF has just released to the general public its new toolkit for assessing public debt sustainability in countries that have access to international capital markets.

Palacio de Bellas Artes, Mexico City: New tool suggests that Mexico’s public debt is sustainable even under shocks (photo: Lucas Vallecillos/VWPics)

PUBLIC DEBT SUSTAINABILITY

The tool improves upon the IMF’s previous method of evaluating how much public debt emerging market and advanced economies can safely carry. The new approach takes a more holistic view, assessing the level and trajectory of debt, government financing needs, and vulnerabilities in the debt structure.

The IMF has been working to overhaul its framework for public debt sustainability analysis in market access countries (MAC DSA) over the past two years as the issue of public debt has become increasingly prominent. The global financial crisis and more recent developments have exposed not only significant debt vulnerabilities—particularly in advanced economies, where such concerns had been minimal—but also gaps in the analytical capacity to assess and foresee such risks. The new DSA for market access countries aims to close those gaps by scrutinizing debt sustainability from several different perspectives.

More comprehensive risk assessment

The revamped DSA pushes the analytical frontier by introducing new tools for comprehensive risk assessment. In addition to evaluating debt trajectories, as was previously done, the new framework also assesses the solvency and liquidity risks stemming from high levels of public debt, gross financing requirements, and a country’s debt profile. For example, it compares the public debt, financing needs, and liquidity indicators to early warning benchmarks intended to flag potential vulnerabilities at an early stage.

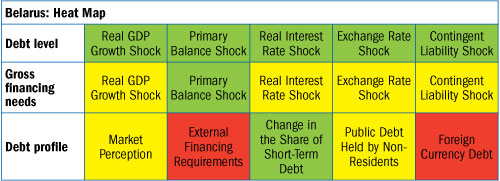

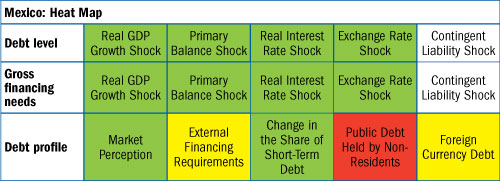

Clarity and transparency are key features of the new DSA framework. DSA results are displayed in standardized charts and tables, which facilitate cross-country comparison. A heat map objectively summarizes the analytical results, with red, yellow, and green cells indicating high, moderate, and low risks respectively. Standard output chart packages are available at this link. The final assessment of debt vulnerabilities is expected to reflect the country-specific context—therefore, where relevant, DSA results provide country-specific details and discuss factors that may amplify or mitigate certain risks (see box).

Use of heat maps in debt sustainability analysis

In IMF country reports, DSA outputs are summarized in a heat map and accompanied by a write-up. Heat map colors are determined by comparing debt levels, gross financing needs, and debt profile indicators against early warning benchmarks. Red cells in the first two rows indicate that baseline debt-to-GDP and gross financing needs-to-GDP ratios exceed benchmark levels. In the last row, the cell is green if its corresponding debt profile indicator value is less than the lower early warning benchmark, red if it exceeds the upper early warning benchmark, and yellow if it lies in between.

Belarus: “Assessing public sector debt dynamics … is complicated owing to the large contingent liabilities... Although the headline debt ratios remain moderate at around 25 percent of GDP in 2013, the medium term outlook is weighed down by risks stemming from quasi-fiscal operations, changes to the macroeconomic environment, large external financing requirements, and limited market access.”

Source: Republic of Belarus: Fifth Post-Program Monitoring Discussions, January 2014.

Mexico: “Gross debt levels in Mexico, at 45 percent of GDP projected by end-2013, remain moderate. The broad institutional coverage … provides reassurance that gross liabilities of the public sector are well captured… the different DSA scenarios … suggest that Mexico’s public debt is sustainable even under the most extreme shocks…”

Source: Mexico: Staff Report for the 2013 Article IV Consultation, November 2013.

The DSA tool also recognizes the critical importance of the macroeconomic assumptions that underpin the analysis. With a few charts, the DSA allows analysts to assess the accuracy of previous IMF forecasts for variables such as growth, inflation, and the primary balance, as well as the realism of projected fiscal adjustments. These tools aim to improve the realism of the projected macroeconomic variables, which in turn improves the realism of the DSA.

Published IMF country reports with MAC DSAs (as of mid-March 2014)

Country (Date of Publication)

Albania (Mar 2014)

Algeria (Feb 2014)

Australia (Feb 2014)

Bahamas (Mar 2014)

Barbados (Feb 2014)

Belarus (Jan 2014)

Belgium (Mar 2014)

Botswana (Sep 2013)

Bulgaria (Jan 2014)

Canada (Feb 2014)

India (Feb 2014)

Ireland (Dec 2013)

Israel (Feb 2014)

Italy (Sep 2013)

Jamaica (Dec 2013)

Macedonia (Feb 2014)

Malaysia (Mar 2014)

Mexico (Nov 2013)

Morocco (Mar 2014)

Namibia (Feb 2014)

Pakistan (Jan 2014)

Paraguay (Feb 2014)

Poland (Jan 2014)

Portugal (Feb 2014)

Slovenia (Jan 2014)

South Africa (Oct 2013)

Sweden (Sep 2013)

Turkey (Dec 2013)

Uruguay (Jan 2014)

The new tool pays particular attention to risks associated with the banking sector. The recent global financial crisis revealed the potential impact of governments’ financial sector rescue plans on public finances. To show how such interventions could affect public debt vulnerabilities, the DSA generates an additional stress test if developments in the banking sector point to a potential bubble. For example, a contingent liability shock could be triggered if there is a large increase in credit growth or a high loan-to-deposit ratio.

Practical, flexible design

The design of the new framework and the DSA template is both practical and flexible, its developers say. The framework is risk based in that more extensive analysis is required for countries with greater vulnerabilities. Based on a country’s debt burden indicators and access to IMF resources, the DSA template classifies it as lower or higher scrutiny.

For lower scrutiny countries—generally countries with low debt levels and gross financing needs—only a basic DSA is produced. For higher scrutiny countries, a richer and more detailed assessment is done and a wide range of tables and charts is generated for examining different aspects of debt developments. The template also offers users the flexibility to tailor stress test parameters to better reflect country-specific circumstances.

In analyzing how much public debt a country can carry, the IMF differentiates between market-access countries—those that typically have significant access to international capital markets—and low-income countries, which meet their external financing needs mostly through concessional resources. IMF economists began using the new public DSA framework for market-access countries on September 1, 2013. As of mid-March, the IMF has published debt sustainability analyses using the new framework for 29 countries in the context of its surveillance and program support work in advanced and emerging economies (see table).