Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Chad Reaps Benefits of High Oil Prices, Oil-related Projects

March 27, 2014

- New schools, hospitals, roads, more power generation boost infrastructure

- Volatile, exhaustible oil revenues justify sustained fiscal adjustment

- Diversification should raise growth inclusiveness, debt sustainability

Chad’s GDP growth rate is set to spike above 10 percent in 2014 from 3.6 percent last year, helped by high oil prices, the coming on stream of new oil-related projects, and strong agricultural production.

Oil pipeline in Badila, Chad: state finances, local banks highly exposed to oil price risk (photo: Brahim Adjibrahim/AFP/Getty Images/Newscom)

ECONOMIC HEALTH CHECK

In its regular assessment of the Central African nation’s economy, the IMF noted that visible progress in the development of infrastructure—notably schools, hospitals, and roads—and the broadening of the country’s industrial base were also features of Chad’s economic performance.

Chad’s per capita income has more than doubled since the start of oil production in 2003. Industrial advances include an oil refinery opened in June 2011 and related increased electricity generation capacity, and a cement factory inaugurated in February 2012.

At the same time, Chad has achieved limited progress in overall poverty reduction and in improving access to public services. The poverty rate has dropped only moderately—from 54.8 percent in 2003 to 46.7 percent in 2011—and unevenly, with urban poverty falling faster than rural poverty.

Positive growth outlook

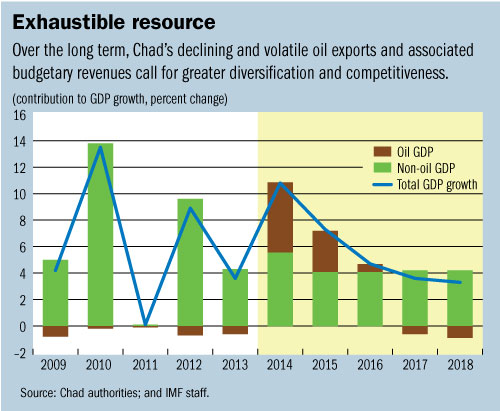

While non-oil GDP, supported by increased mechanization of agriculture and subsidized inputs for farming, will boost GDP growth over the medium term, oil GDP is projected to peak in 2016 and fall steadily thereafter absent new oil discoveries (see chart).

Chad needs to use this oil windfall judiciously in tackling its vast development needs, by anchoring fiscal policy on a sustained reduction in the non-oil primary deficit. This move will build fiscal room for maneuver to cushion against oil revenue volatility.

At the same time, development plans will need to increasingly rely on increases in non-oil revenue and in the quality of spending. Over the long term, declining and volatile oil exports and associated budgetary revenues call for greater diversification and competitiveness of Chad’s economy through

• An improved business environment for private sector development;

• Sustained promotion of the agricultural sector;

• Increased government effectiveness in the provision of basic services; and

• Expanded financial intermediation and access.

Muted inflation

Inflation fell sharply to around 0.2 percent in 2013 from 7.7 percent in 2012. Such deceleration resulted mainly from a sizable fall in food prices and took place despite the fact that some prices, notably cement and fuel products, were liberalized or increased to cost-recovery levels.

Although Chad is enjoying its longest period of domestic political stability since independence in 1960, the country faces recurrent spending pressures from border security costs. Specifically, the authorities have funded assistance to refugees from neighboring Niger, Nigeria, Sudan, Libya, and, in particular, the Central African Republic, from where many Chadian citizens have had to be repatriated. Chad has also contributed to international efforts to restore order in Mali.

In 2014 the IMF conducted its regular annual health check on Chad’s economy and, in cooperation with the World Bank, also assessed the country’s debt sustainability prospects. At the IMF Executive Board meeting on February 21, Directors commended the Chadian authorities for their strong macroeconomic performance in 2013 in spite of a volatile regional security environment.

But the Board urged the authorities to tackle Chad’s developmental needs and stay the course of fiscal adjustment while building fiscal buffers against oil revenue volatility, ensuring debt sustainability, and promoting diversified and inclusive growth.

Oil price risk

Given current and projected high oil prices, the health of both government finances and local banks is more than ever exposed to oil price risk.

An oil price drop like that experienced in 2009 would cause a significant loss of revenue. Without a savings buffer, that would require the government to slow down its ambitious public investment program and would make it tougher to pay suppliers in full and on time. In turn, suppliers would find it harder to service their debts and commercial banks’ nonperforming loans could rise.

Food security

Chad’s food security was a major source of concern prior to 2013. The 2011 drought—which caused a 50 percent drop in cereal production— and floods in 2012 prompted the authorities to define a national strategy to strengthen the resilience of the Chadian economy to weather shocks.

The new approach, which was developed in 2012 in collaboration with international partners including the Food and Agriculture Organization and the World Food Program, focuses on improving water management, warehouse capacity, and information systems for the government, development partners, and farmers. Based on developments in food prices last year, the new strategy appears to have put Chad on the path to food resilience.

Efforts to boost capacity

Over the last few years, Chad has begun public financial management reforms aimed at improving budget operations; building better links between annual allocations, medium-term policy objectives, and performance indicators; and computerizing budget management and expenditure controls.

International agencies including the IMF, the World Bank, the African Development Bank, and the United Nations Development Program—and donors including the EU and France—are devoting funding and expertise to bolstering Chad’s capacity to manage its public finances and to analyze and conduct economic policy. These partners are supporting efforts to improve debt management, public procurement, non-oil tax policy and collection, public expenditure effectiveness, banking supervision, and data collection and dissemination.