Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Kenya Poised to Reap Rewards of Prudent Policies

October 2, 2014

- Growth spurs include foreign investor interest, information technology

- Economy vulnerable to risks affecting external and fiscal positions

- Oil and gas industry’s regulatory, fiscal regime requires modernization

Rising domestic and foreign investment are set to boost economic activity in Kenya, as the central African country reaps rewards of extensive institutional reforms and prudent macroeconomic policy, the IMF staff said.

Pottery in Nairobi, Kenya, where dynamic small business sector is benefiting from financial inclusion, access to credit (photo: Noor Khamis/Reuters/Corbis)

ECONOMIC HEALTH CHECK

In a regular review of Kenya’s economy, the IMF staff noted a surge in public investment in infrastructure, renewed interest of foreign investors, and lower transaction costs thanks to information technology.

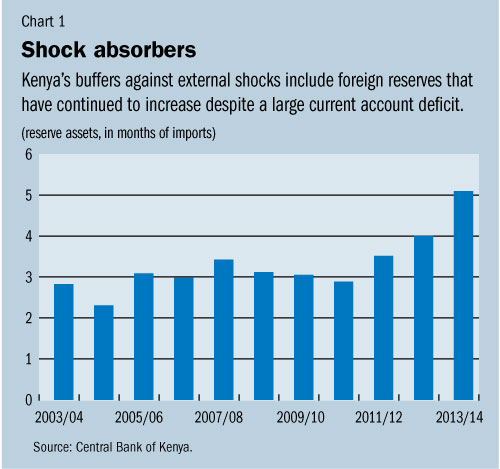

The IMF staff report projected higher growth in the Kenyan economy for a third straight year, at 5.8 percent in 2014/15 after an estimated 5 percent in 2013/14. Inflation remains moderate, but rising food prices and rapid credit growth may fuel inflation expectations. Foreign reserves have increased steadily and are broadly adequate (see Chart 1).

Kenya is taking steps to adapt its policies to middle income country–type challenges, the report said, noting the country’s market-friendly business environment. The country’s successful debut Eurobond issuance suggests a promising outlook for Kenya to further integrate with global financial markets and to reach, in time, emerging market status.

The staff report noted, however, that manufacturing, transport, and communications were the main supports of growth in early 2014, while the agricultural sector was relatively subdued due mainly to poor rains. In addition, security concerns following terrorist attacks and threats hit the tourism industry.

Oil discoveries

Promising commercial prospects of oil discoveries could potentially provide significant foreign exchange and fiscal resources, the report said. Kenya’s relatively high current account deficit, at 7.7 percent of GDP in 2013/14, reflects strong capital goods imports—in particular of equipment for oil exploration.

The Kenyan government has embarked on large-scale projects with sizable impact on domestic value added, the report said, citing construction of a railway between the capital, Nairobi, and the port city of Mombasa; geothermal power generation plants; irrigation projects; and new oil pipelines.

Drivers of growth

The report said there are five principal drivers of growth in Kenya that support positive projections of economic expansion.

• Improved business conditions arising from the removal of bottlenecks by increased infrastructure investment in energy and transportation;

• Expansion of the East African Community market thanks to decisive steps toward regional integration with neighboring Burundi, Rwanda, Tanzania, and Uganda;

• Reduced social strife as a result of devolution and central government transfers to 47 newly formed counties under the 2010 constitution;

• A more dynamic small and medium-sized enterprises sector arising from strong financial inclusion and small business access to credit;

• Higher agricultural productivity and reduced medium-term vulnerability of agricultural production to weather shocks, reflecting implementation of large irrigation projects.

A boost in investor confidence following the successful Eurobond issuance could further improve Kenya’s outlook. Accelerated regional integration, improved security conditions, and possible new discoveries of oil, gas, and other minerals could have a large impact on investor sentiment.

Nevertheless, the report added, the Kenyan economy is vulnerable to risks affecting the external and fiscal positions. Near-term risks include the potential for security conditions to deteriorate further, for poor rains followed by other weather-related shocks, and additional difficulties in implementing devolution that could complicate public finance management.

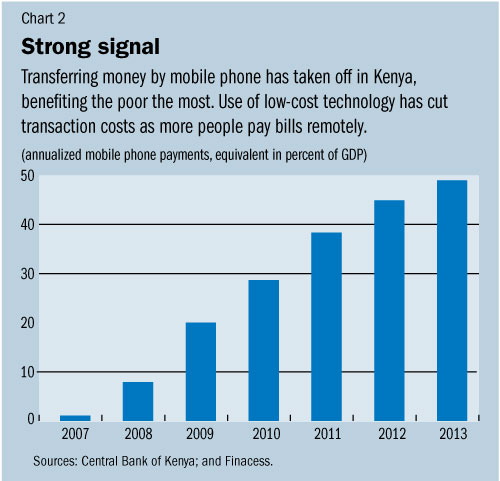

Banking by mobile phone

A section of the IMF staff report focused on financial inclusion—the general population’s access to banking and credit—and the contribution of banking by mobile phone. The low-cost technology of mobile banking has helped reduce overall transaction costs and has particularly benefited the poorest section of the population.

The M-Pesa network of money transfers by mobile phone has particularly boosted financial access, the report said. The number of micro accounts—holding deposits of less than $1,200—in formal financial institutions has increased more than tenfold in the past decade.

Lower transaction costs, higher financial access, and continuous innovation of the mobile payment platform have a positive impact on social welfare (see Chart 2). Farmers benefit from schemes to acquire capital equipment that allow repayment by mobile banking; solar panel installation can be financed by mobile phone; basic health care management can also be conducted by mobile phone.

Natural resource management

In a section on managing Kenya’s natural resource wealth, the report cited commercial estimates that put the country’s oil and gas reserves at levels similar to those of Equatorial Guinea and the Republic of Congo—respectively sub-Saharan Africa’s fourth- and fifth-largest oil producers. If these reserves are confirmed, they could bring Kenya’s external current account to surplus soon after exploitation starts.

Kenya’s government plans to reform the legal and regulatory framework for natural resources to enable prudent management of oil and gas resources. The report observed that Kenya’s petroleum regulatory and fiscal regime dates from 1986 and is in need of modernization.

Specifically, the production-sharing scheme for oil does not properly reflect costs, prices, and production volumes and should be revised; new production-sharing terms for gas need to be specified; and a full gas-specific regulatory framework is required. The report notes that work to enact most of these enhancements is under way, with the support of technical assistance from the IMF.