Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Slowing Global Growth has Varied Effects on Low-Income Countries

December 17, 2015

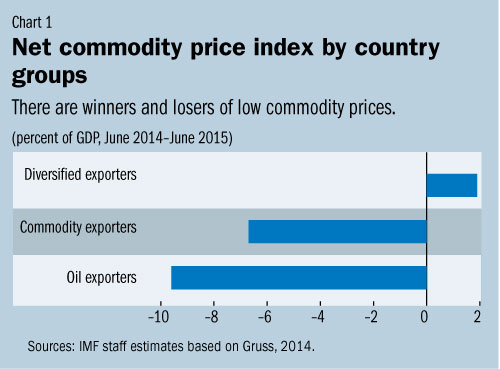

- Lower commodity prices: some lose, some gain

- Countries with diversified exports fared better than commodity exporters

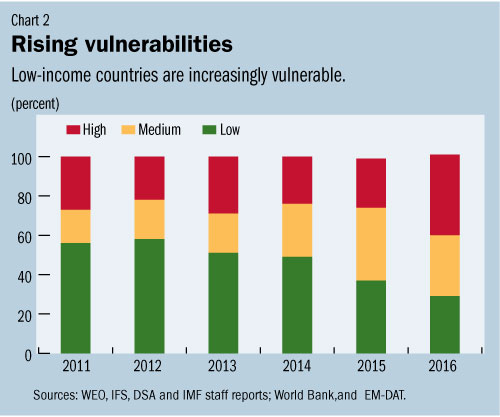

- Rising vulnerabilities in many countries, including to climate change

Low-income developing countries have seen weakened external conditions over the past eighteen months, but the net impact has varied significantly across these countries, according to a new study by the IMF.

Pipelines near Port Harcourt, Nigeria, deliver oil to tankers for export. Countries heavily dependent on commodity exports are hardest hit by low commodity prices (photo: George Steinmetz/Corbis)

LOW-INCOME COUNTRIES

While all of the 60 IMF member countries classified as low income countries have been affected by slowing global growth, the key shock has been the dramatic drop in commodity prices over the past eighteen months. The report says while commodity-dependent exporting countries (especially oil exporters) are being adversely affected, countries that are more diversified in their exports have benefited from lower prices and continue to record robust growth.

Macroeconomic Developments and Prospects in Low-Income Developing Countries: 2015, analyzes recent events and looks at the near-term prospects for this group of countries, almost all of which are eligible for concessional IMF financing.

“While the global economic environment has weakened, especially in regard to commodity prices, the effects on low-income countries has varied with differences in country-specific exposures and domestic policy conditions,” said Seán Nolan, Deputy Director of the IMF’s Strategy, Policy, and Review Department who oversaw the production of the report. “Policy responses need to be tailored to country circumstances,” Nolan emphasized.

Varied impact of falling commodity prices

Hardest hit by low commodity prices are commodity exporters, particularly oil exporters, with growth, on average, set to decline from 5.7 percent in 2014 to 3.0 percent in 2015. By contrast, countries less dependent on commodities for export revenues, and that have benefited from lower fuel bills, for example, are expected to see growth as high as 6 percent in 2014-15.

The study shows a diverse picture when looking at the net impact of commodity price movements, even within country subgroups. While countries like Cambodia, Nicaragua, and Senegal have benefited, terms-of-trade losses are disproportionally high for some large oil exporters like Nigeria, for example (Chart 1).

Rising vulnerabilities

The report says economic vulnerabilities in low-income developing countries have increased steadily over the past two years, with some 40 percent of countries now deemed to be highly vulnerable to growth shocks, up from 25-30 percent in recent years and the highest level recorded since the global financial crisis (Chart 2).

Key drivers are the drop in commodity prices, which has led to weaker fiscal and external balances, along with the gradual erosion of policy buffers over time. Diversified exporters have fared better than commodity exporters, but vulnerabilities are still rising in some cases.

The report emphasizes the need for commodity exporters to adjust to what is expected to be an extended period of relatively low commodity prices and to strengthen fiscal and external positions over time. Where growth has been strong but vulnerabilities have been rising, early action to rebuild policy buffers is now needed.

The report lists climate change as an additional risk for low-income developing countries in the longer term. These countries are already more vulnerable to natural disasters than are countries at higher income levels. They are also projected to suffer more over time from the effects of global warming, given their geographic location (typically in already hot climates) and the large share of GDP accounted for by the weather-sensitive agricultural sector.

“Low income developing countries will need significant external financial support for national programs to adapt to climate change—otherwise, attaining ambitious development objectives will be very difficult over the longer term,” said Seán Nolan.

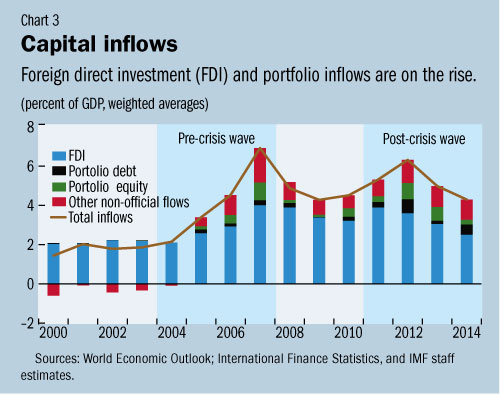

Capital inflows continue

Capital inflows to low-income developing countries have increased sharply in recent years, the report says, especially portfolio inflows to frontier-market economies (Chart 3). These frontier markets have typically liberalized their capital accounts more quickly than other low-income countries, and many are now as open as emerging market economies.

Capital inflows have boosted domestic demand, with the use of external financing in consumption versus investment depending on national policy choices. In a few cases, the higher external financing of domestic spending has coincided with reduced public saving and increased public consumption.

Pointing to the tightening of financing conditions, the report sounds a cautionary message on tapping portfolio inflows. “Countries that are increasing their reliance on access to external funding thus face an additional risk—shifts in the external environment—and need to place a high premium on maintaining solid economic fundamentals, including strong public debt management capacity,” the study says.