Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Exchange Rates Still Matter For Trade

September 28, 2015

- Large currency movements sparked a debate about a disconnect between exchange rates and trade

- IMF study finds that exchange rates still matter, little sign of disconnect over time

- Recent currency changes imply sizable cross-country redistribution of net exports

Exchange rate movements still have sizable effects on exports and imports, according to new research from the International Monetary Fund.

Welder welding chain on dock. IMF study confirms that exchange rate movements still have sizable effects on exports and imports (photo: Leon Sosra/Corbis)

WORLD ECONOMIC OUTLOOK ANALYSIS

Recent currency movements have been unusually large. The U.S. dollar is up more than 10 percent in real effective terms since mid-2014. The yen is down more than 30 percent since mid-2012 and the euro by more than 10 percent since early 2014. Brazil, China, and India have also seen unusually large changes in their currency values.

Not surprisingly, these movements have kindled a debate on their likely effects on trade. Some predict strong effects on exports and imports, based on conventional economic models. Others argue that the increasing fragmentation of production across different countries––the so-called rise of global value chains––means that exchange rates matter far less than they used to for trade, and may have disconnected altogether.

This is an important debate, says Daniel Leigh, Deputy Division Chief in the Research Department, and lead author of the report. “A disconnect between exchange rates and trade would complicate policymaking. It could weaken a key channel for the transmission of monetary policy, and complicate the reduction of trade imbalances, as in the case of imports exceeding exports, via the adjustment of relative trade prices.”

From exchange rates to trade: lessons from history

Concerns about a disconnect between exchange rates and trade are not new. Back in the 1980s, the U.S. dollar depreciated, and the yen appreciated sharply after the 1985 Plaza Accord, but trade volumes were slow to adjust. Some commentators then suggested a disconnect between exchange rates and trade. But by the early 1990s, U.S. and Japanese trade balances had adjusted, largely in line with the predictions of conventional models.

The question is whether this time is different, or whether the apparent disconnect between exchange rates and trade will once again dissipate.

A new study, for the October 2015 World Economic Outlook, contributes to the debate by taking stock of the relationship between exchange rate movements and exports and imports.

The study examines the experience of both advanced and emerging market and developing economies over the past three decades—a broader sample than is typically examined. It uses both standard trade equations and an analysis of historical cases of large exchange rate movements.

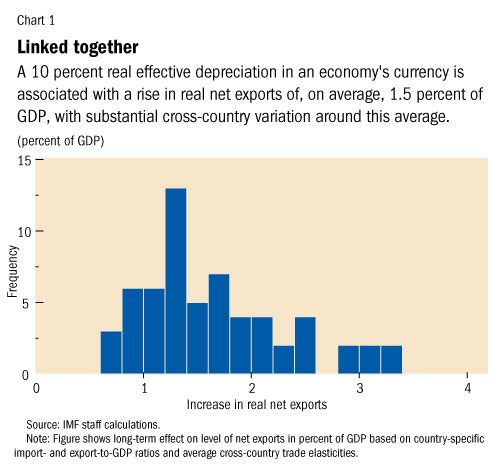

“We find that, on average, a 10 percent real effective exchange rate depreciation comes with a rise in real net exports of 1.5 percent of GDP,” says Leigh, noting that there is substantial variation around this average (Chart 1). “Although it takes some years for the effects to fully materialize, much of the adjustment occurs in the first year,” he says.

Among economies experiencing currency depreciation, the rise in exports tends to be greatest for those with slack in the domestic economy and financial systems operating normally.

Disconnect or stability?

The study also finds little sign of a breakdown in the relationship between exchange rates and exports and imports.

There is some evidence, however, that the rise of global value chains, with different stages of production located across different countries, has weakened the relationship between exchange rates and trade in intermediate products used as inputs into other economies’ exports. This is particularly relevant for economies such as Hungary, Romania, Mexico, and Thailand, which have substantially increased their participation in global value chains.

But this finding needs to be seen in perspective: global-value-chain-related trade has increased only gradually through the decades and appears to have decelerated, and the bulk of global trade still consists of conventional trade.

There is also little sign, at least so far, of a generalized weakening in the relationship between exchange rates and total exports and imports. There is little evidence of disconnect for various country groups, including Asia and Europe, where the process of production fragmentation across countries has been particularly noticeable, as well as for samples of economies used in other recent studies.

Importantly, the rising size of exports and imports in GDP means that even a weaker relation between exchange rates and trade volumes could be consistent with exchange rate mattering more for trade in percent of GDP than before.

A key exception to this pattern of broad stability is Japan, which displays some evidence of disconnect. Export growth has been weaker than expected, despite substantial exchange rate depreciation. However, this weak export growth reflects a number of Japan-specific factors that have partly offset the positive impact of yen depreciation on exports and that do not necessarily apply elsewhere. These include, in particular, the sharp acceleration in production off-shoring since the global financial crisis and the 2011 earthquake, which created uncertainty about energy supply.

Redistributing net exports

These results are important because they mean that recent currency movements are shifting net exports from some economies to others. But this only speaks to the direct effects of exchange rate movements.

Overall changes in exports and imports also reflect shifts in the underlying fundamentals driving exchange rates themselves. These include demand growth at home and in trading partners, and movements in commodity prices.

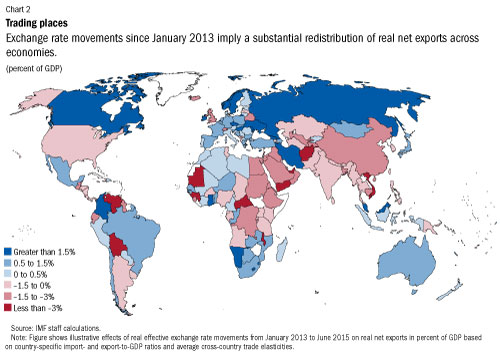

But, in terms of the direct effects, the currency movements since January 2013 point to a shift of real net exports from the United States and economies whose currencies move with the dollar to the euro area, to Japan, and to economies whose currencies move with the euro and the yen (Chart 2).

“For policymakers, a key implication of these results is that exchange rate adjustments can still help to reduce trade imbalances,” says Leigh. Exchange rate changes also continue to have strong effects on export and import prices, with implications for inflation dynamics and the transmission of monetary policy.

In sum, exchange rates still matter!

The authors of this study are Daniel Leigh (team lead), WeichengLian, Marcos Poplawski-Ribeiro, and Viktor Tsyrennikov, with support from Olivia Ma, Rachel Szymanski, and Hong Yang.