Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Middle East Outlook Sees Modest Improvement, But Risks Remain

May 5, 2015

- Steady growth in oil exporters despite oil price plunge, but they will need to curb spending

- Higher growth expected in oil importers; spillovers from regional conflicts pose risk

- Region needs structural, fiscal reforms to create jobs and lift growth

The Middle East and North Africa region is experiencing a modest economic recovery, despite the sharp drop in oil prices and deepening conflicts, the IMF says in its latest regional assessment.

Abu Dhabi skyline: Given the new realities of the global oil market, the region’s oil-exporters should move to diversify their economies, IMF says (photo: Newscom)

REGIONAL ECONOMIC OUTLOOK

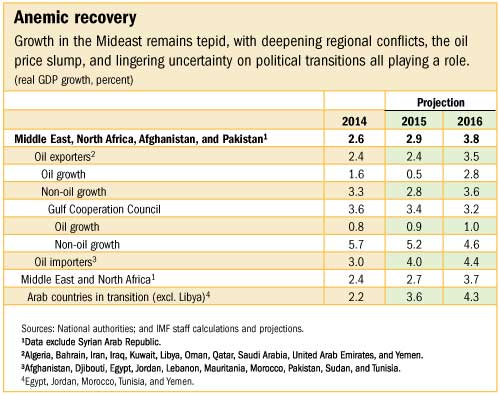

The Regional Economic Outlook Update, released on May 5, projects that growth will increase slightly to about 3 percent in 2015 (see table). But growth rates, although rising, remain too low to reduce the region’s persistently high unemployment in a meaningful way.

“Although the region’s countries have made progress in implementing reforms, there is still more that can be done—not just to stabilize the economy but to raise economic prospects in a sustainable, inclusive manner,” Masood Ahmed, Director of the IMF’s Middle East and Central Asia Department, told reporters at a briefing in Dubai.

Moreover, he said, the recent intensification of conflicts in Iraq, Libya, Syria, and Yemen is undermining economic activity and dampening confidence, posing a significant risk to the region’s prospects.

Oil exporters see surpluses erode

According to the IMF, growth in the region’s oil-exporting countries reached about 2½ percent in 2014 and is expected to remain at this level in 2015. Next year, growth is projected to rise to 3½ percent, but this forecast is predicated on the assumption that security conditions will stabilize and oil production will recover in oil exporters outside the Gulf Cooperation Council.

Despite the fact that oil prices halved between July 2014 and April 2015, oil-exporting countries have managed to keep growth steady by using the financial cushions that they have built up over the past decade, Ahmed said.

These countries are experiencing a substantial weakening of export earnings, however. The oil price decline will turn the longstanding current account surplus of the Middle Eastern and North African oil exporters into a deficit of $22 billion in 2015, with export earnings expected to be about $380 billion lower than projected before the oil price decline.

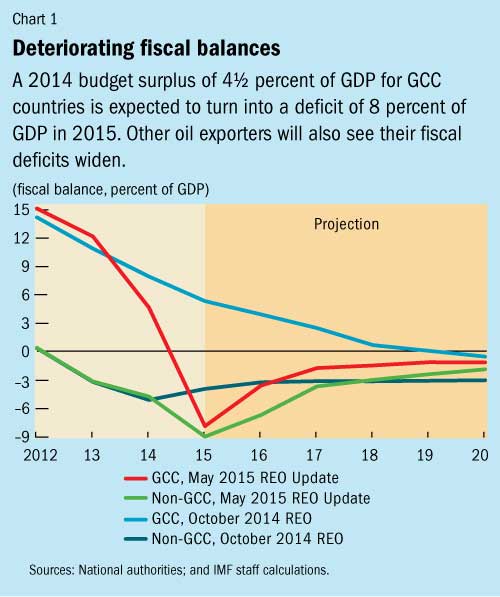

The budgets of oil-exporting countries are also severely affected by the oil price slump, with fiscal balances deteriorating to an average deficit of 8½ percent of GDP (see Chart 1). A sharp rise in spending in recent years has made budgets vulnerable to lower oil prices, Ahmed noted. “Most countries in the region cannot balance their budgets when oil prices approach $60 a barrel,” he said.

Ahmed highlighted a number of steps the region’s oil-exporting countries could take, both in response to oil price developments and for the long-term health of their economies. Since lower oil prices are expected to persist for some time, governments should begin to moderate the pace of their spending, he said. But because government spending is a key driver of non-oil growth, this fiscal consolidation should be done in a growth-friendly manner and gradually, fiscal space and available financing permitting.

Oil exporters could also seize the opportunity to reduce generalized energy subsidies—which remain large despite lower oil prices. And, given the new realities of the global oil market, it is even more urgent for these economies to begin moving away from the oil-based growth model toward a new model where economic growth and job creation are driven by a diversified private sector.

Oil importers see growth pick up, but face risks

The region’s oil-importing countries are seeing higher growth, owing to prudent economic management combined with a more favorable international environment, Ahmed said. Their economies have benefited from lower oil prices; however, because of limited pass-through to retail fuel prices, lower oil prices had only modest effects on reducing production costs and increasing disposable incomes.

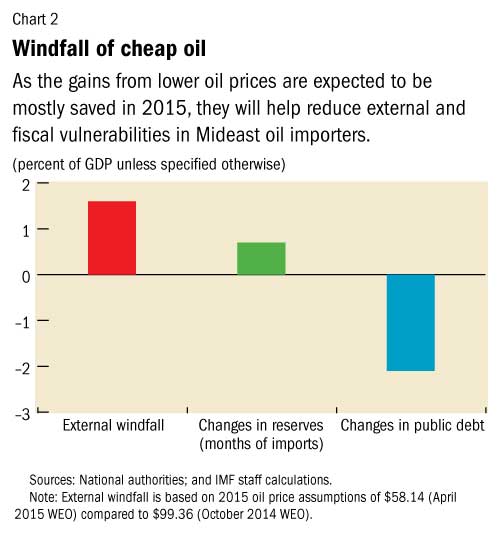

As a group, the oil importers will likely see their growth rate increase to about 4 percent this year from about 3 percent in 2014, Ahmed said. Countries have chosen for the most part to save the gains from lower oil prices, which has helped them reduce public debt and increase international reserves (see Chart 2). Signs of confidence—such as stock market gains and a pickup in credit growth—are emerging.

But there are significant risks to this outlook, he cautioned.

Security problems and spillovers from regional conflicts risk undermining the nascent recovery. Another risk is the movements of international exchange rates—in particular, the strengthening of the U.S. dollar—which could hurt the region’s competitiveness.

The report suggests that countries should continue to use the gains from lower oil prices to strengthen cushions for dealing with future unexpected shocks and to reduce public debt. As with the oil exporters, lower oil prices present this group of countries with the opportunity to move closer to eliminating costly and inefficient energy subsidies.

Governments in the region’s oil-importing countries are expected to continue fiscal consolidation in 2015, with a new focus on carrying out measures to increase revenue. The resulting higher revenue—together with savings from energy subsidy reform—could be channeled into higher spending on growth-enhancing initiatives in infrastructure development, education, and health care, the report notes.