Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : External Shocks Hurt Growth in Caucasus, Central Asia

April 25, 2016

- Oil price drop, Russia’s recession continue to weigh on growth

- Inflation and financial sector vulnerabilities have increased

- Shocks underscore the urgency of reducing reliance on commodities, remittances

Growth in the Caucasus and Central Asia (CCA) this year is expected to slow to a two-decade low as a result of a sustained decline in the prices of key commodities, spillovers from Russia’s recession, and China’s slowdown, the IMF said in its latest assessment.

Cotton farmer in Urgench, Uzbekistan. Countries in the region will need to diversify away from commodities and implement reforms to help create jobs, the IMF report says (photo: Marc Dozier/Corbis)

Regional Economic Outlook

The IMF’s Regional Economic Outlook Update for the Middle East and Central Asia, released on April 25, predicts growth in the CCA region to decline to 1.2 percent in 2016 (see table). This is a sharp drop from the 3 percent growth rate the region experienced last year, and much weaker than the 8.3 percent average in 2000-14.

These large and persistent external shocks have exposed vulnerabilities in the CCA economies. Although currency weakening and fiscal easing have helped mitigate the impact of these shocks, inflation and financial sector vulnerabilities have risen.

Shocks diminishing growth prospects

The challenging external environment of low oil prices, which are projected to average around $35 a barrel in 2016, and Russia’s deteriorating outlook, have significantly affected the CCA’s growth prospects through a number of channels, including reduced trade, remittances, and overall investment to the region.

China’s slowdown is also expected to weaken external demand—both directly, as the region has seen its share of exports to China increase sharply in the past decade, and indirectly, through other commodity prices and investor confidence.

Therefore, the CCA’s oil-exporting countries—Azerbaijan, Kazakhstan, Turkmenistan, and Uzbekistan—will see growth decline to 1.1 percent this year, down from 3.2 percent in 2015. For the oil importers—Armenia, Georgia, the Kyrgyz Republic, and Tajikistan—growth will slow to 2.6 percent this year, down from 3 percent in 2015.

External balances face lower oil prices, exports, and remittances

For the CCA oil exporters, the weakening in oil prices has had a significant impact on export revenues. As a result, the combined current account deficit is projected to widen to 4 percent this year, from 2.7 percent last year, says the IMF.

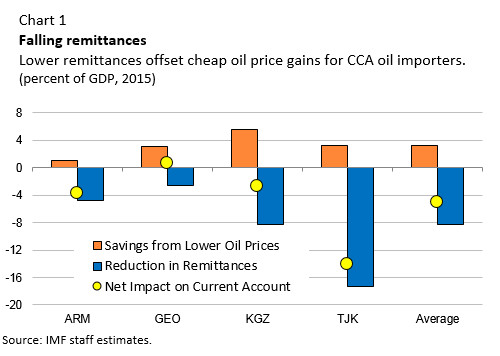

Lower oil prices are also hurting the CCA’s oil importers through their close linkages with Russia, a key trading partner and significant source of remittances, especially for Armenia, the Kyrgyz Republic, and Tajikistan. For these countries, the sharp drop in remittances is erasing the positive economic gains from lower oil prices (see Chart 1). As a result, the current account deficit for CCA’s oil importers is set to remain high at 9.6 percent of GDP this year.

Lower demand from China and a drop in prices for non-oil commodities, such as copper, aluminum, and cotton, are also weighing on the outlook for these countries.

Inflationary pressures

Currency weakening has heightened inflationary pressures, especially in countries where inflation has historically been higher.

In oil exporters, such as Azerbaijan and Kazakhstan, inflation has reached double digits for the first time in more than 15 years. In oil importers, where currency depreciations have been smaller, lower food and fuel prices, along with weak domestic demand, have helped to contain inflationary pressures.

The report recommends that country authorities modernize their exchange rate and monetary policy frameworks, including by replacing the exchange rate as the nominal anchor with an effective interest rate instrument to help curb inflationary pressures.

Financial sector risks

The region’s financial sectors are also experiencing repercussions from the challenging external environment. The highly dollarized balance sheets of the region’s banks are likely to continue to weaken. Liquidity is declining, largely because of slowing foreign currency earnings and capital flight, exacerbated by increasing deposit dollarization. Credit risks are on the rise, partly as a result of slower growth and weaker currencies.

Countries have taken some measures in response to these developments, but more is needed to minimize the risks to financial stability. Stronger financial sector surveillance and supervision will be essential, the IMF report says.

Preserving stability and supporting growth

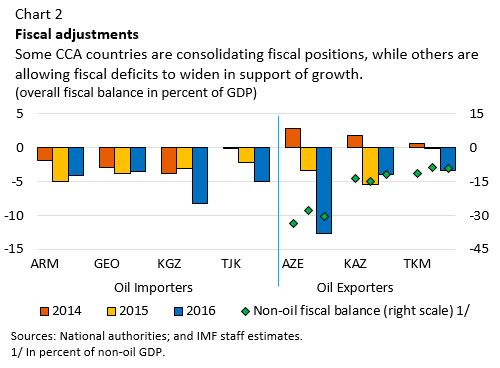

Many countries in the region have allowed their budget deficits to widen, by dipping into savings and increasing public spending to support economic activity. Fiscal deficits for the oil-exporting countries are projected to widen by 1.7 percentage points of GDP to 4.9 percent in 2016. In oil importers, deficits are projected to reach 4.9 percent of GDP, 1.4 percentage points higher than in 2015 (see Chart 2).

With sustained low oil prices and increasing debt, countries will need to start fiscal consolidation as soon as conditions allow. Countries with larger fiscal cushions can choose a slower pace of consolidation. But in all cases, countries should be mindful of the need to preserve targeted social spending, while, at the same time, avoiding spending cuts that harm medium-term growth prospects, the report says.

Over the longer term, the region will need to find a new growth model, the IMF says. The recent shocks highlight the urgency of diversifying these countries away from commodities and reducing their reliance on remittances.

Policymakers are encouraged to implement reforms that help raise the quality of education, strengthen governance, and increase access to finance, the report says. Fostering private entrepreneurship will also help to create much-needed jobs and alleviate poverty, while improving the overall economic environment.

Otherwise, much of the gains made in catching up with emerging markets will be lost over the next two decades, the IMF says.