Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Paraguay Resilient Amid Regional Slowdown

June 1, 2016

- Paraguay’s economy remains strong, with growth forecast at 3 percent in 2016

- Regional dynamics and external risks could affect country’s economic future

- Addressing structural weaknesses key to boost growth, reduce poverty

Paraguay’s economy is expected to remain resilient this year and next, but it will be tested as commodity prices stay weak and Brazil’s economy remains in recession, the IMF said in its latest annual assessment of the economy.

A popular market in Asunción: Paraguay has one of the highest growth rates in the region (Alberto Peña/EFE/Newscom)

Economic Health Check

Speaking to IMF Survey, IMF Mission Chief for Paraguay, Hamid Faruqee, said that, with several countries in Latin America experiencing economic slowdowns or even contractions, Paraguay has managed to buck this trend, with one of the highest growth rates in the region. Going forward, he outlines a number of measures to help Paraguay maintain macroeconomic stability, reduce poverty, and promote inclusive growth.

IMF Survey: Paraguay is doing relatively well, compared with other countries in the region. What explains this good performance?

Faruqee: If I were to summarize, I would say that Paraguay’s economy has been resilient, especially when you consider the neighborhood it’s in. According to our estimates, regional growth is likely to be negative for a second year in a row. Brazil, which is Paraguay’s largest trading partner, is in a deep recession. So, with that as a backdrop, we see Paraguay growing solidly by about 3 percent this year, essentially the same as last year.

In terms of what explains that resiliency, I would just mention three things—generally good macroeconomic policies, sound fundamentals, and a bit of good luck.

Paraguay has been fiscally prudent for a number of years. It has very low public debt (under 25 percent GDP) and a fiscal responsibility law that came into effect last year. On the monetary side, inflation pressures have been contained and expectations are stable. The Central Bank was actually able to reduce interest rates several times last year and again at their most recent policy meeting in May. The overall stance of monetary policy remains accommodative.

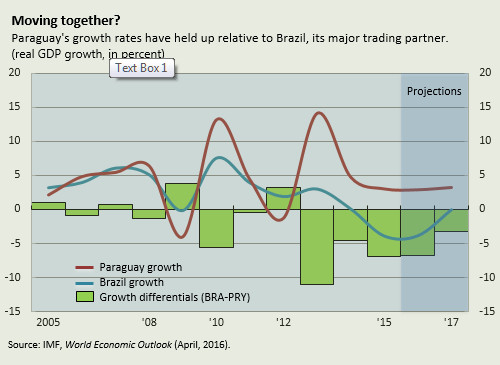

Paraguay has been lucky as well. Favorable weather conditions have helped agriculture as well as electricity production. These factors have been contributors to growth and have partly offset the effects of the contraction in Brazil. Growth in these two countries has tended to move together until recently when growth differentials widened noticeably (see chart).

IMF Survey: What is the outlook for Paraguay's economy? What are the biggest risks?

Faruqee: We expect growth to remain solid—around 3 percent in 2016 and 3¼ percent in 2017—led by agriculture and construction. The soy harvest—Paraguay’s major export crop—is expected to be very good this year. Even though commodity prices are low, on the quantity side, the production numbers should be fairly strong. Construction was weak in the fourth quarter of 2015 but we think it will rebound. We also expect a gradual turnaround in the trade sensitive sectors of the economy, as the Brazilian economy starts to stabilize toward the end of this year. That should also provide some additional lift for Paraguay.

From the demand side, consumption is doing reasonably well in Paraguay, although we’ve seen some weakness in agricultural investment given lower commodity prices and tighter profit margins.

In terms of risks, we see them as mainly external—lower commodity prices and the situation in Brazil. Our analysis suggests that when the Brazilian economy is not doing well, there can be a significant impact on Paraguay.

On the domestic front, I would say that there are constraints on administering and executing public investment. That also represents a downside risk to growth. The country has large infrastructure needs, so it’s important for Paraguay to move forward on implementing key projects.

IMF Survey: Paraguay has recently implemented a set of fiscal rules to improve fiscal behavior and transparency. Are these measures having a positive impact?

Faruqee: The Fiscal Responsibility Law (FRL), which came into force last year, was an important achievement for Paraguay in terms of strengthening the fiscal framework. In addition to the numerical targets, the law introduced elements of medium-term budgeting and greater transparency.

The first year was complex in terms of implementation, in particular on whether there is enough room for capital spending given Paraguay’s infrastructure gap and how this would be treated under the rules, but we’ve seen signs of increased effectiveness with the FRL in the 2016 budget.

Despite some design and implementation issues, from our perspective, we favor sticking with this current law and building a solid track record. But if the authorities were to consider amending the law, we would advocate for a balanced approach wherein modifications that make the fiscal rules more flexible would be matched by a number of safeguards that enhance its credibility.

IMF Survey: Credit growth has been growing rapidly over the past few years. What’s behind this and are you concerned?

Faruqee: Yes, you are certainly right about the very rapid credit growth. This partly reflects financial deepening. For example, if you look at how much private credit outstanding there is in the economy, Paraguay has now moved more or less in line with peers with similar income levels. Having said that, we do have some concerns. We have seen some worsening in credit quality. This is not surprising, given slower growth and lower commodity prices. We also need to watch nonperforming loans, which are rising although from low levels.

Overall, the banking system appears sound. Compared with other banking systems in the region, Paraguay is doing well in terms of bank balance sheets and bank profits. Our staff report mentions giving some consideration to macroprudential policies to help contain financial sector risks given slower growth and weaker external conditions.

IMF Survey: Paraguay has developed an ambitious reform agenda to raise living standards and boost potential growth. What reforms are being implemented and how are they making a difference?

Faruqee: Paraguay’s National Development Plan has three core objectives—poverty reduction, fostering inclusive growth, and integration of Paraguay into global markets. I would say that the biggest efforts they have made are in the first two areas. Let me give you an example. Paraguay has an umbrella program called “Sowing Opportunities.” It is a program aimed at both poverty reduction and inclusive growth. It includes a conditional cash transfer program, Tekopora, which has been very successful. In fact, they are now expanding and complimenting it with a new program, Tenondera, to assist those who are receiving the cash transfers to develop and enhance skills needed to generate their own income.

Another important area is transparency. Paraguay has introduced a law of free access to public information to ensure greater transparency and accountability of the government. This law is improving engagement with civil society on how the government works and the authorities feel this is a first step toward improving their institutional strength on a lasting basis.