Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Sri Lanka to Reboot Economic Policies

June 14, 2016

- IMF loan to help Sri Lanka navigate macroeconomic policy adjustments and a more difficult external environment

- Focus on strengthening fiscal policy by raising tax revenues and bolstering public financial management

- Reforms to address state enterprises, move to a more flexible exchange rate, and improve competitiveness

The IMF approved on June 3 a three-year, $1.5 billion loan for Sri Lanka under the Extended Fund Facility (EFF) to support the country’s economic reform agenda.

Shipping containers in Colombo, Sri Lanka: weaker growth in the manufacturing sector reflects the negative effects of slowing world trade (photo: Dinuka Liyanawatte/Reuters/Newscom)

Extended Fund Facility

Sri Lanka has gone through a significant political transition against the backdrop of an increasingly difficult external environment. Two major elections in 2015 brought a new government to the helm, major constitutional changes (trimming the power of the presidency) and a reorganization of ministerial agency portfolios. At the same time, surging imports, falling exports, slowing remittances, tepid foreign direct investment, and a steady outward march of capital from government securities markets gave rise to macroeconomic imbalances.

Real GDP growth was 4.8 percent in 2015 (broadly unchanged from 2014), thanks to strong growth in services and agriculture, as well as a positive, albeit declining, contribution from manufacturing. Similarly, the negative growth in construction and weaker growth in manufacturing were indicative of a slowdown in public and private investment, as well as the negative effects of slowing world trade.

Policies to support adjustment and reform

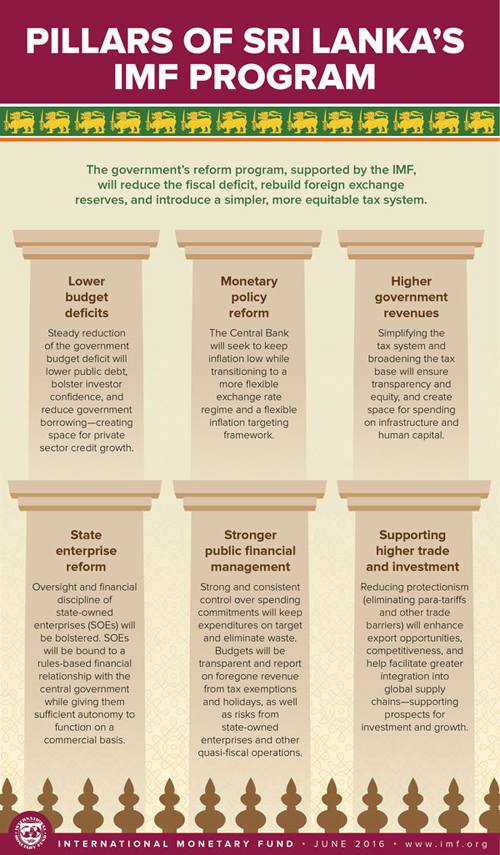

The government’s strategy to address short-term imbalances and medium-term challenges rests on six pillars:

• Fiscal consolidation. Steady reduction of the government budget deficit to lower public debt, bolster investor confidence, and reduce government borrowing.

• Revenue mobilization. Simplifying the tax system and broadening the tax base to ensure transparency and equity, and create space for spending on infrastructure and human capital.

• Public financial management. Strong and consistent control over spending commitments to keep expenditures on target and eliminate waste. Budgets will be transparent and report on foregone revenue from tax exemptions and holidays, as well as risks from state-owned enterprises.

• State enterprise reform. Oversight and financial discipline of state-owned enterprises (SOEs) will be bolstered. SOEs will be bound to a rules-based financial relationship with the central government while giving them sufficient autonomy to function on a commercial basis.

• Enhancing monetary policy. The Central Bank of Sri Lanka will seek to keep inflation low while transitioning to a more flexible exchange rate regime and a flexible inflation targeting framework.

• Trade and investment facilitation. Reducing protectionism to enhance export opportunities, competitiveness, and help facilitate greater integration into global supply chains—supporting prospects for investment and growth.

Capacity development will be a key element in ensuring a successful reform program. Technical assistance from the IMF will focus on tax policy, revenue administration, public financial management, foreign exchange, capital market, and financial sector oversight, as well as government financial and economic statistics.

Strong potential

Tapping into Sri Lanka’s considerable potential will require a mix of sound macroeconomic policies—applied consistently over time—together with efforts to boost economic resilience and move toward greater integration with regional and global markets. Sri Lanka’s economic potential is considerable. The country has a strong base of human capital and reliable infrastructure. It also occupies a strategic position in Asia, the fastest growing region in the world, and investments over the last decade (particularly in ports and other transport-related facilities) can take advantage of this opportunity.

Some features of a new economic landscape for Sri Lanka at the end of the medium-term program would be:

• A fiscal deficit of 3.5 percent of GDP by 2020—sustained or lowered over the longer term to ensure the debt-to-GDP ratio continues to fall.

• An increase in the tax-to-GDP ratio from 10.1 percent in 2014 to about 15 percent by 2020.

• A reduction in public debt to about 68 percent of GDP by 2020.

• An increase in foreign exchange reserves of the central bank to about 5 months of import cover by the end of the medium-term.

Support from development partners

The IMF’s assistance also serves as a catalyst to mobilize additional support from other bilateral and multilateral institutions. Sri Lanka expects some $650 million in new development and policy loans from such institutions as the World Bank, the Asian Development Bank, the Japan International Cooperation Agency, and others over the next three years, along with a steady pipeline of technical assistance in key reform areas.