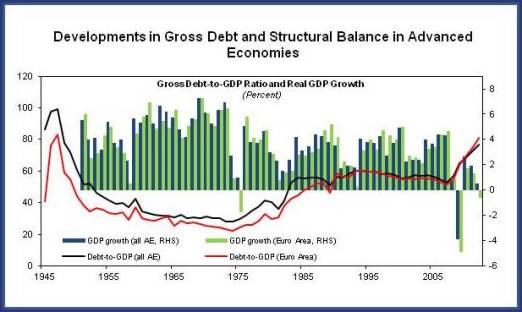

Sooner or later, and one way or the other, government debt in advanced economies will have to come down from the record levels reached in the wake of the global economic and euro area crises.  There is no magic number for how much sovereign debt an economy can shoulder. And, as bringing down debt by cutting government spending or raising taxes comes at the risk of reducing growth and employment in the short term, there are arguments to not proceed too hastily. But eventually debt will have to be put back on a downward path in many countries. This will help rebuild fiscal buffers and cope with the costs of aging. So, what should governments do?

There is no magic number for how much sovereign debt an economy can shoulder. And, as bringing down debt by cutting government spending or raising taxes comes at the risk of reducing growth and employment in the short term, there are arguments to not proceed too hastily. But eventually debt will have to be put back on a downward path in many countries. This will help rebuild fiscal buffers and cope with the costs of aging. So, what should governments do?

Our new analysis takes a closer look at the historical record and key trade-offs. The bottom line: it is possible to reduce debt when growth is low. Ultimately perseverance should pay off.

The ins and outs of debt reduction

Contrary to common wisdom, there is a silver bullet to bring down government debt without pain—at least in principle. Higher economic growth, if it could be conjured, would do the trick. The faster GDP expands, the more revenues flow into the government budget, the less unemployment benefits are due, and the lower is the ratio of debt to GDP. But the current environment does not promise this kind of growth. On the contrary, worried about their own debt overhang, many households are spending cautiously; and where bank balance sheets are stretched, credit flows sparingly, holding back investment. Inflation is low, and attempts to raise it to lower the real value of debt could get out of hand if inflation expectations are not well anchored.

This narrows the available debt-reduction paths down to the long, hard slog of fiscal consolidation—that is, government deficits will have to come down. And there are complications. In many cases, and especially when growth is weak and debt is high, fiscal adjustment can push the debt-to-GDP ratio in the opposite direction at first, as demand falls and growth drops. This recessionary impact lowers not only public revenue, but also the denominator in the debt ratio. While the cost of debt may fall if resolute consolidation signals credibility to investors, this effect rarely compensates for the lower demand in the short-run. Instead, if medium term fiscal plans are clear and strong budget institutions guarantee their implementation, a path of steady adjustment is preferable. Of course, if a country is at the brink of losing financial market access, there may be no option but to front-load fiscal effort.

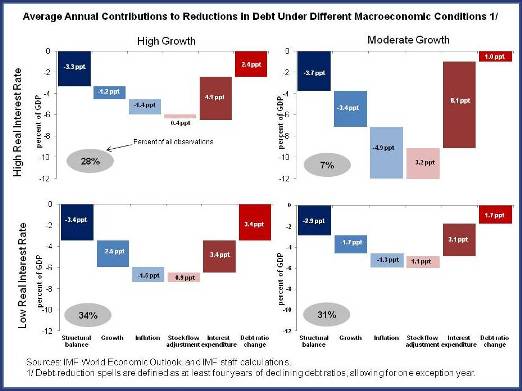

So, will fiscal effort pay off? The historical record argues that it will, eventually, but it also shows that it won’t be easy when growth is low. For example, when looking at what drives changes in the debt-to-GDP ratios across advanced economies in the last few decades, fiscal balances play a key role—but so does growth. Indeed, debt reductions tend to be larger when growth rates are high and interest rates are low (see the bottom, left quadrant in the figure below). Debt reversals are fewer and smaller in an environment characterized by both low growth and high interest rates (top, right quadrant).

Just as importantly, a government making a push to bring down debt is more likely to be successful in actually lowering debt when growth is high: only 26 percent of fiscal consolidation efforts (defined as a large adjustment in fiscal balances ignoring interest rate payments) were successful when growth is below a country’s historical average. In contrast, when growth is above average, the success rate increases to 41 percent.

Past experience—reducing debt when growth is low is possible

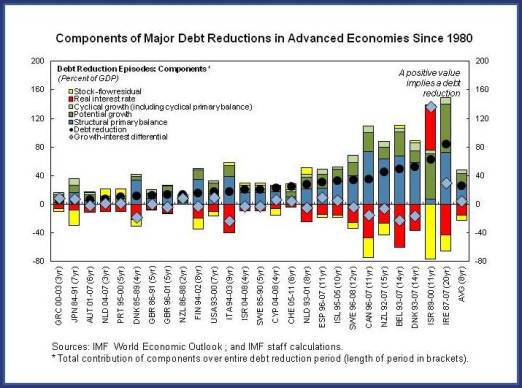

Another way to learn from past experiences is to concentrate solely on countries that managed to bring down public debt in a significant fashion. Looking at 26 episodes of debt reductions in advanced economies since 1980 confirms that growth and fiscal effort are the main drivers. The more surprising finding is that there are some episodes where large debt reductions were achieved despite very difficult starting conditions of anemic growth and a very high debt burdens. So how was this done?

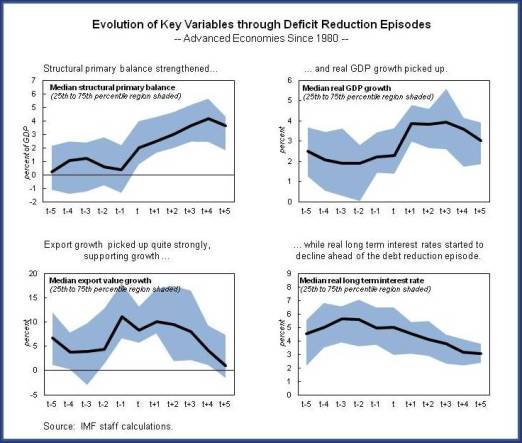

A number of factors were at play, but hard work and a bit of luck played their parts. Most countries started to consolidate early, continued through the initial period of weak growth, and did not stop as growth recovered and debt began to fall. In many cases countries also profited from improving conditions in the form of falling short-term interest rates and the lift from a depreciating exchange rate and solid export growth—channels that are largely blocked for many countries in the current environment of near-zero central bank interest rates and slow global trade.

Bottom line: make haste, slowly

This leaves us with good and bad news. The good news is that high debt can be tamed even when growth is low. The bad news is that, fiscal consolidation will likely come with an initial price of lowering growth. This means that, where possible, consolidation should happen gradually, supported by credible medium-term plans that help to spread the effort over time. Any measures to increase medium-term growth, such as structural reforms, should also be enacted now. And, in some economies, there might be room to reduce the need for consolidation by privatizing government assets. But, if the past is any guide, for most countries bringing down the public debt-ratio will involve a good fiscal effort for a number of years.