(Version in Español and Português)

The prospects for global growth have brightened in recent months, led by a stronger recovery in the advanced economies. Yet in Latin America and the Caribbean, growth will probably continue to slow, although some countries will do better than others. We analyze the challenges facing the region in our latest Regional Economic Outlook and discuss how policymakers can best deal with them.

Still losing speed

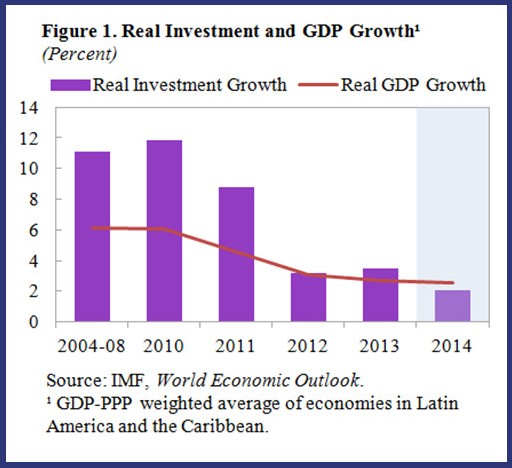

Growth in the region has been on the decline since 2010. 2014 is unlikely to be an exception. Based on our latest projections, regional output will expand by just 2½ percent, the lowest rate in eleven years—excluding 2009, when the global financial crisis took its toll. The slowdown in investment over the past few years has been even more pronounced (Figure 1).

We project that not all countries will decelerate in 2014. In fact, Mexico and a number of economies in Central America and the Caribbean are primed to benefit from stronger U.S. growth. Yet the pickup in these countries will probably not be strong enough to offset the slowdown in several of the larger South American economies.

Headwinds from lower commodity prices

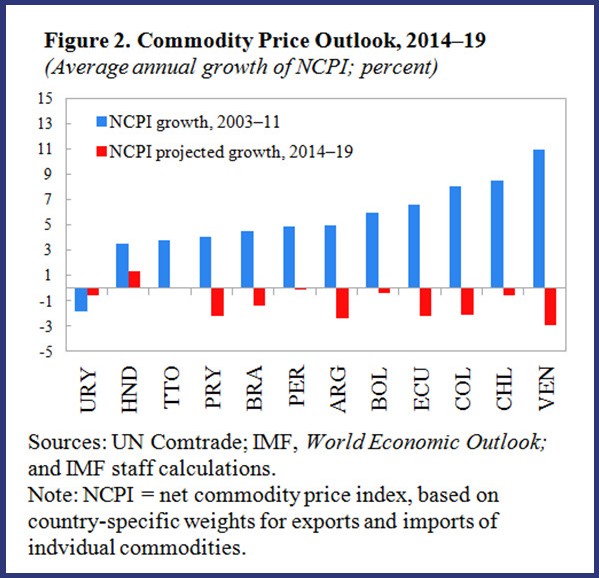

One crucial factor weighing on regional growth is the weakening of global commodity prices. Our research suggests that output growth in commodity exporters like Chile, Colombia, or Peru may be significantly lower than during the boom years of 2003–11 even if commodity prices remain stable at their current and still-high levels over the next few years. The reason is that the strongest impulse to growth appears to come from a steady rise in prices, not from high prices per se. And current forecasts clearly suggest that the period of ever-increasing commodity prices is over (Figure 2).

A sharper-than-expected slowdown in major commodity-importing economies would make things worse. According to our analysis, a decline of China’s GDP by 1 percent relative to baseline could reduce net commodity price indices across relevant countries in the region by between 1 and 8 percent.

Possible turbulence as U.S. interest rates go up

Another factor to watch is the normalization of U.S. monetary policy that started with the tapering of the Federal Reserve’s bond purchases earlier this year. Several arguments suggest that the region should be able to manage an orderly normalization of U.S. monetary policy:

- Even though policy has started to normalize, we forecast U.S. interest rates to remain relatively low for some time.

- The stronger U.S. recovery that underpins expectations of rising interest rates would bolster activity especially in the northern part of the region.

- Most governments in the region have significantly reduced their direct exposure to U.S. interest rates, by shifting public debt into domestic currencies.

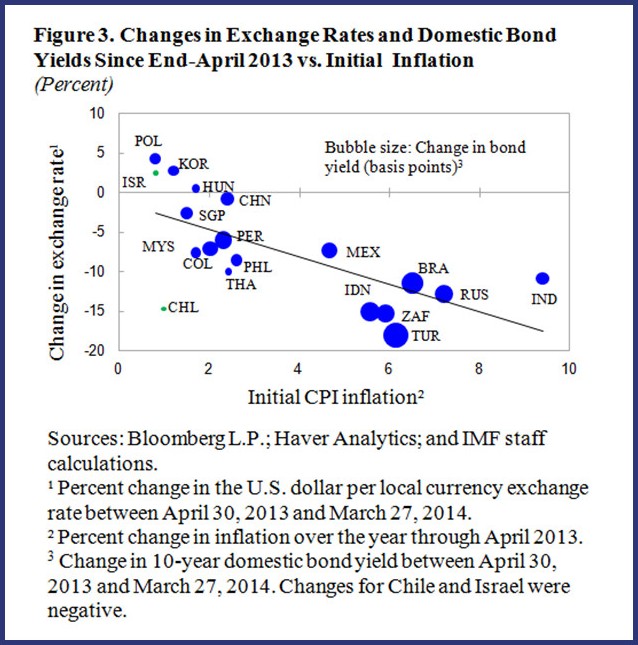

Nonetheless, the market turmoil of mid-2013 provides a warning that the adjustment to tighter external financing conditions could make for a bumpy ride. New surprises to the outlook for U.S. monetary policy, or a general rise in risk premiums could spark fresh volatility and cause capital outflows from the region.

Based on recent experience, the most affected would likely be economies with weaker external positions and domestic policy challenges. Specifically, bond yields have risen the most since the May 2013 ”taper tantrum” in countries facing a combination of inflation and foreign exchange market pressures, often related to elevated current account deficits (Figure 3).

Less fuel in the tank

But not all challenges facing the region are external—domestic factors constraining growth are also at play.

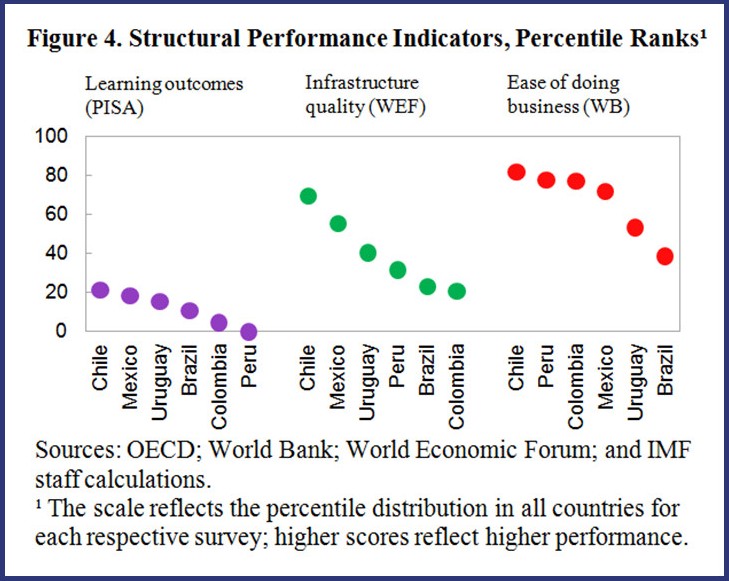

Labor markets in most of the larger economies are tight, suggesting less space for output to grow. Significant infrastructure bottlenecks (such as congested roads and ports) and long-standing underperformance of education systems further heighten this challenge in many countries. (Figure 4). Without progress in these areas, the region may well continue to lack the thrust for sustained rapid growth.

Policies for a successful onward journey

Faced with lower commodity prices, higher external funding costs, and slowing growth, it may be tempting for policymakers to try and boost activity with fresh fiscal stimulus.

Doing so, however, would very likely be counterproductive, as most economies remain close to full capacity, and fiscal buffers, if anything, need strengthening to prepare for more adverse shocks in the future. Otherwise, the region might soon lose its recently gained capacity for countercyclical policy again.

A more promising strategy is to focus on structural reforms that remove bottlenecks to growth. Priorities include directing scarce resources toward critical infrastructure needs, enhancing educational outcomes, and fostering a business environment that encourages investment and innovation.

Meanwhile, credible policy frameworks, flexible exchange rates, and prudent supervision of the financial sector should play key roles in buffering external shocks and maintaining financial stability. With these elements in place, the next leg of the journey for the region has every chance to remain safe and successful, even in more challenging conditions.