(Versions in Español)

Much has been said lately about growing private sector debt in emerging market economies. In our recent analysis, we examined the corporate sector in a number of countries and found their rising levels of debt could make them vulnerable.

Low global interest rates in the aftermath of the global financial crisis and ample amounts of money pouring in from foreign investors have enabled nonfinancial corporations to raise record levels of debt.

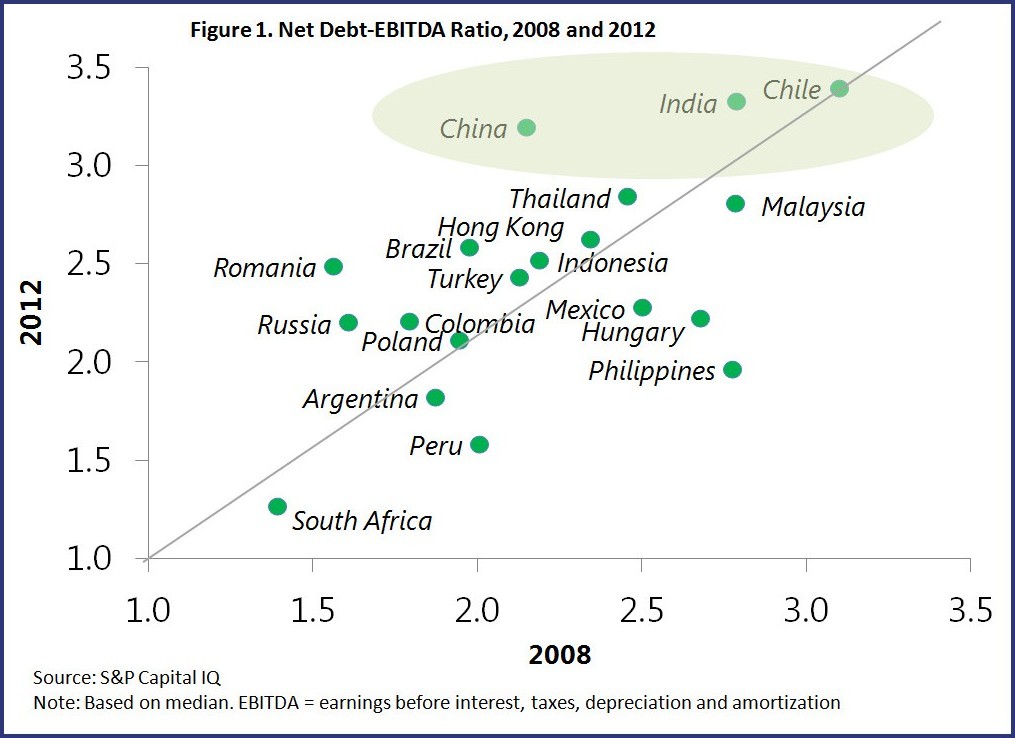

Credit was readily available in the aftermath of the crisis, and economic expansion enabled earnings to grow healthily, thus helping to prevent leverage from rising too far and too fast. Recently though, slowing growth prospects are beginning to put pressure on firms’ profitability. Moreover, higher debt loads have led to growing interest expense, despite low interest rates. As a result, the ability of firms to service their debt has weakened (Figure 1).

Vulnerable to a slowing economy

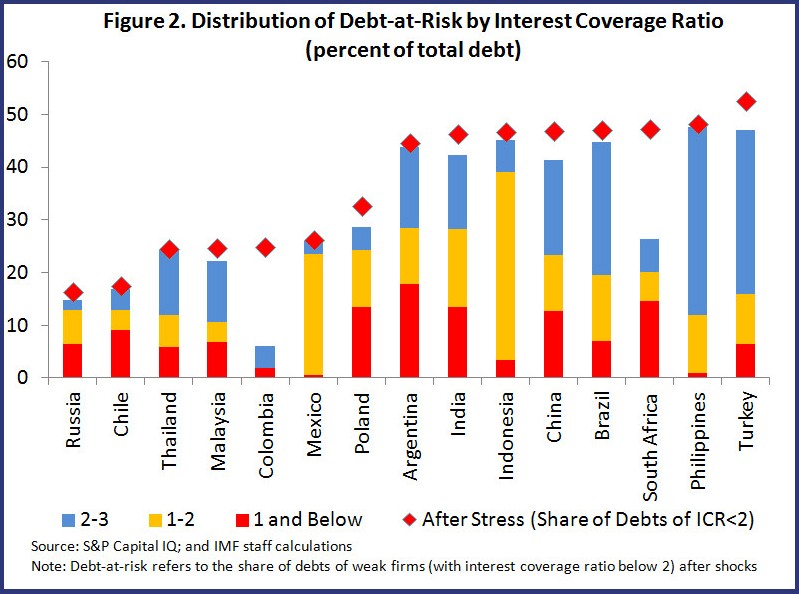

These debt servicing pressures have left companies more vulnerable to shocks, such as large withdrawals of foreign capital, geopolitical uncertainties, or a sharp rise in interest rates. In such situations, firms’ earnings could be severely dented, while borrowing costs could escalate. Our analysis of a sample of 15,000 large and small companies in emerging markets suggests that a combination of a 25 percent decline in earnings and 25 percent increase in borrowing costs could amplify the proportion of weak firms and their debt service ability (Figure 2).

Such shocks are plausible given that earnings have declined 20–30 percent in the weaker firms, while interest expense rose 10–50 percent in the aftermath of U.S. investment bank Lehman Brothers’ bankruptcy. Within our sample of 15 countries, the debts of highly leveraged and weak firms could increase two-fold by $740 billion, rising to 35 percent of total corporate debt from 17% currently.

Exposures to currency losses

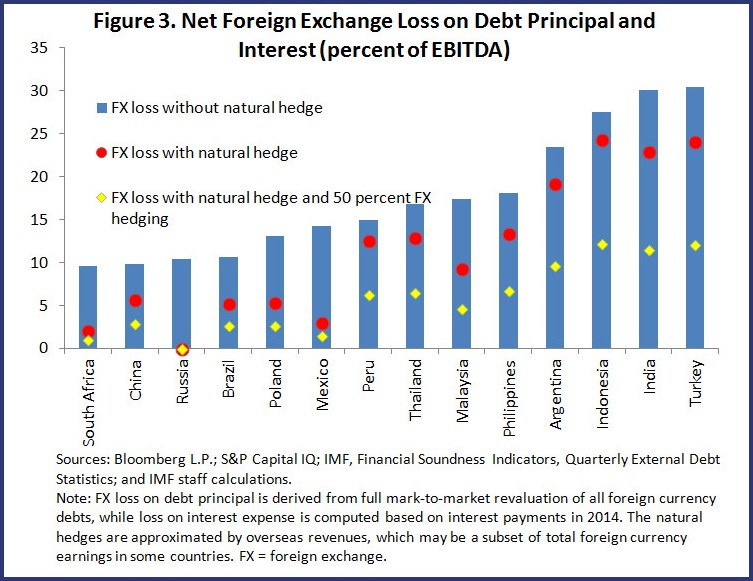

Another source of vulnerability stems from firms’ exposure to exchange rate risks. External debt has been rising, and now comprises more than one-quarter of total corporate debt in a number of countries. Since the market turbulence in May 2013, currencies have dipped by up to 30 percent, while long term government bond yields have increased nearly 150 bps, on average.

Corporations with high foreign currency debts may run the risk of a “triple whammy”: foreign exchange losses from debt principal and interest payments; lower revenues; and higher refinancing costs.

Our analysis shows that a 30 percent depreciation in nominal exchange rates could erode 20–30 percent of earnings in some countries, even after accounting for natural hedges from overseas earnings (Figure 3).

Are banks vulnerable?

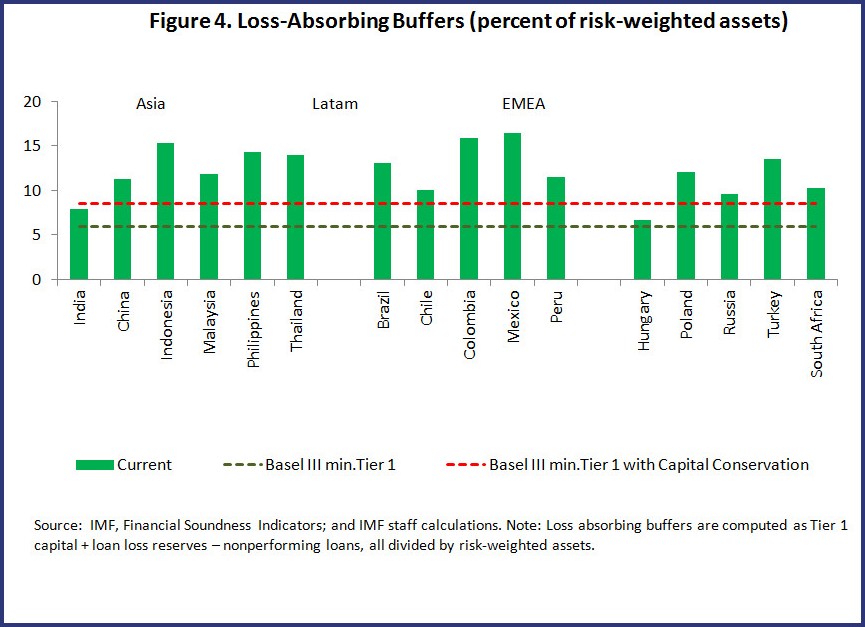

For most countries, the banking sector appears healthy with sufficient levels of capital buffers. However, lax recognition of doubtful assets and loan forbearance may mask the true extent of asset quality risk in a few countries. In such cases, there is a danger that high corporate loan losses could overwhelm what were thought to be adequate levels of balance sheet equity capital and loan loss buffers. Countries with weak bank provisioning and thin loss absorbing buffers are at risk (Figure 4).

Policy suggestions

The good news is that corporate leverage has yet to reach precarious levels in most countries. As such, preemptive policy actions could help to alleviate systemic risks.

Policymakers should focus on a number of issues:

- Containing the rapid growth of corporate leverage, particularly in foreign currencies

- Implementing stronger macroprudential policies in countries where large capital inflows have fueled growth

- Improving data collection while mandating better corporate disclosure of foreign currency liabilities, and bolstering banks’ resilience through active provisioning and the buildup of more capital.

In the case of emerging market companies, a stitch in time could save billions.