It’s hard to pick up a newspaper these days (or, more likely for readers of blogs, to skim one online) without finding another story about some multinational corporation managing, as if by magic, to pay little corporate tax. What lets them do this, of course, are the tax rules that countries themselves set. A new paper takes a closer look at this issue, which is at the heart of the IMF’s mandate: the way tax rules spill over national boundaries, and what this means for macroeconomic performance and economic development. These effects, the paper argues, are pretty powerful and need to be discussed on a global level.

Follow the money

Take, for instance, international capital movements. Though tax is not the only explanation, the foreign direct investment (FDI) positions shown in Table 1 are hard to understand without also knowing that tax arrangements in several of these countries make them attractive conduits through which to route investments. In its share of the world’s FDI, for example, the Netherlands leads the world; and tiny Mauritius is home to FDI 25 times the size of its economy.

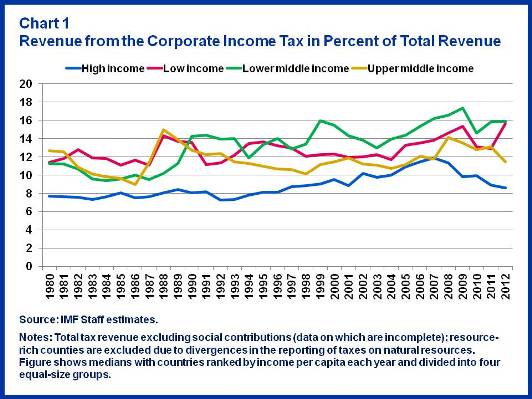

The tax revenues (or absence thereof) associated with the exploitation of gaps in the interaction between national tax systems can sometimes be very large—especially for developing countries. At the broadest level, these countries actually have more at stake than advanced ones, in that they raise a larger revenue share from corporate taxation (Chart 1). While at first glance this may seem like an added advantage of tax-induced FDI, it also constitutes risks. In the IMF’s work, we sometimes come across countries in which revenue collected from a handful of foreign companies is large not just relative to corporate tax but relative to all tax revenue: 10–15 percent in some cases. New evidence in the paper shows that these patterns are systematic: developing countries seem to be much more affected by spillovers from other countries' tax systems than advanced economies. This makes them overly vulnerable to taxation changes elsewhere.

Problems for developing countries

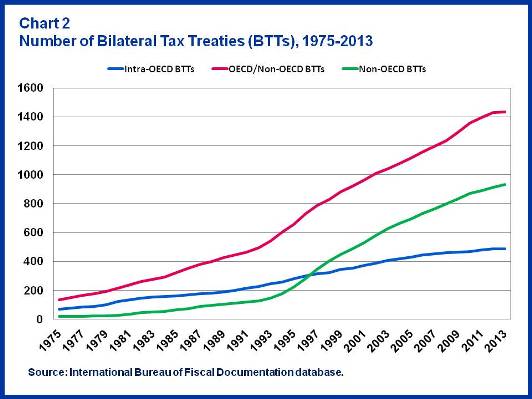

One particular concern for developing countries is how tax treaties cede taxing rights in an attempt to attract investment and jobs. Over the past two decades or so, developing countries have signed a huge number (Chart 2). But the evidence on whether such accords actually deliver the benefits hoped for is, at best, mixed. What we do see close up in our country work is a sometimes significant leakage of revenue through treaty provisions. This has, for some time, led the IMF to urge great care in ceding tax discretion by signing tax treaties—a view that is now much more widely accepted.

Spillovers and a tax system for the 21st century

The basic problem in all this is one of spillovers—one country taking decisions with impact on others. These take various and sometimes complicated forms. Most obviously, a low or zero tax rate on income can make country an attractive place into which to shift profits through essentially paper transactions. And that can lead to lower tax bases in other countries: our preliminary estimates, set out in the paper suggest these effects to be both strongly significant and large. To address these and other shortcomings, one has to start by looking at the basic architecture of international taxation.

The present framework emerged from the League of Nations nearly a century ago. Since then, the world has been transformed by the growth of intra-firm trade, massively increased importance of services and intangibles (patents and the like), and increased digitalization. Recognizing this, an ambitious G20-OECD Action Plan on Base Erosion and Profit Shifting (BEPS) aims to address many current problems.

Welcome and crucial though BEPS is, a lively debate on more fundamental reform has emerged. For instance, some have suggested that multinationals should be taxed on a consolidated basis, so that transfer pricing—putting prices on transactions within the group—would no longer be needed; and their total income could then be apportioned across countries based, say, on shares of assets, payroll, and/or sales located in each. The paper stresses, however, that such “formula apportionment” could create significant new problems (and might not, as some have assumed, benefit developing countries). Other fundamental reforms touched on in the paper are still very tentative. Nice though that would be, the Fund has no simple solutions (nor, by the way, does anyone else).

But one thing in the emerging debate is certain: these basic questions, and the need for hands-on advice to countries trying to cope with the daily challenges of taxing multinationals, are not going away any time soon. The IMF’s experience, mandate, and global membership make its presence in this technically challenging but hugely important policy debate increasingly important.