(Versions in 中文)

“Shadow” banking: a surprisingly colorful term for our staid economics profession. Intended or not, it conjures images of dark, sinister, and even shady transactions. With a name like “shadow banking” it must be bad. This is unfair. While the profession lacks a uniform definition, the idea is financial intermediation that takes place outside of banks—and this can be good, bad, or otherwise.

Our goal here is to shine a light on shadow banking in China. We at the IMF have used many terms. Last year, we had a descriptive one, albeit a mouthful—off-balance sheet and nonbank financial intermediation. The April 2014 Global Financial Sector Report (GFSR) called it nonbank intermediation. This year our China Article IV report used the term shadow banking.

What's in a name

“That which we call a rose, by any other name would smell as sweet.” Taking a cue from Shakespeare’s Juliet, let us not worry about the label and instead focus on the facts.

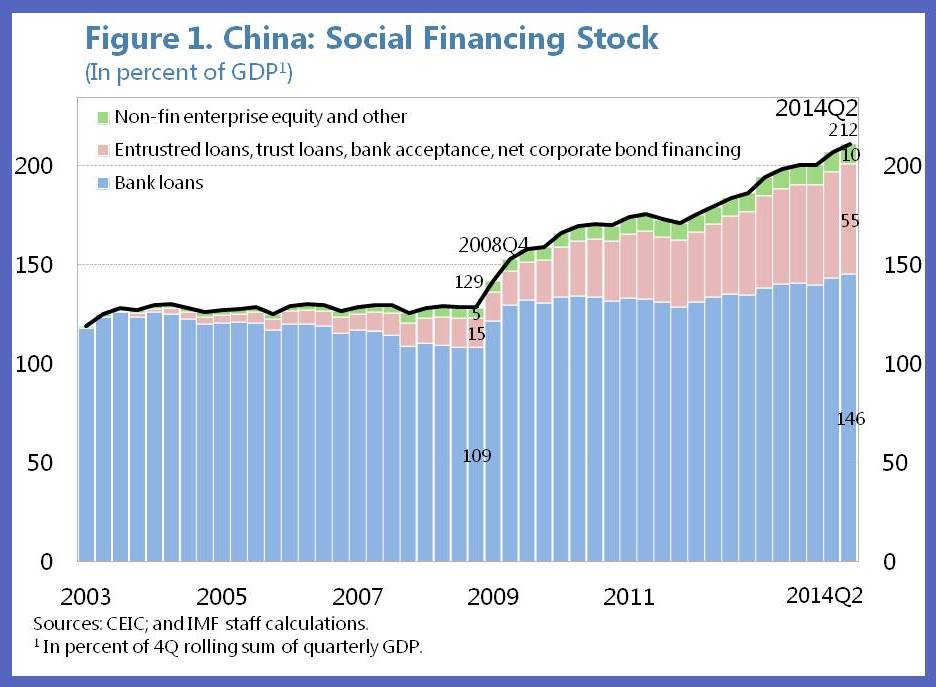

Interest in China’s shadow banking…eh, nonbank intermediation…stems mainly from its rapid growth since the global financial crisis in 2008. This is the pink part in Figure 1 which has more than tripled since 2008, albeit from a low base. It has also accounted for half of the increase in overall credit to the economy or total social financing—even more than bank loans.

[caption id="attachment_8104" align="aligncenter" width="400"] Shadow banks have dominated total credit growth since 2009[/caption]

Shadow banks have dominated total credit growth since 2009[/caption]

In China, shadow banking is often defined as total social financing less bank loans. We tend to exclude equity issuance—firms raising money by selling stock (as this is not credit)—which is the green part in Figure 1. Thus, we focus on the pink part.

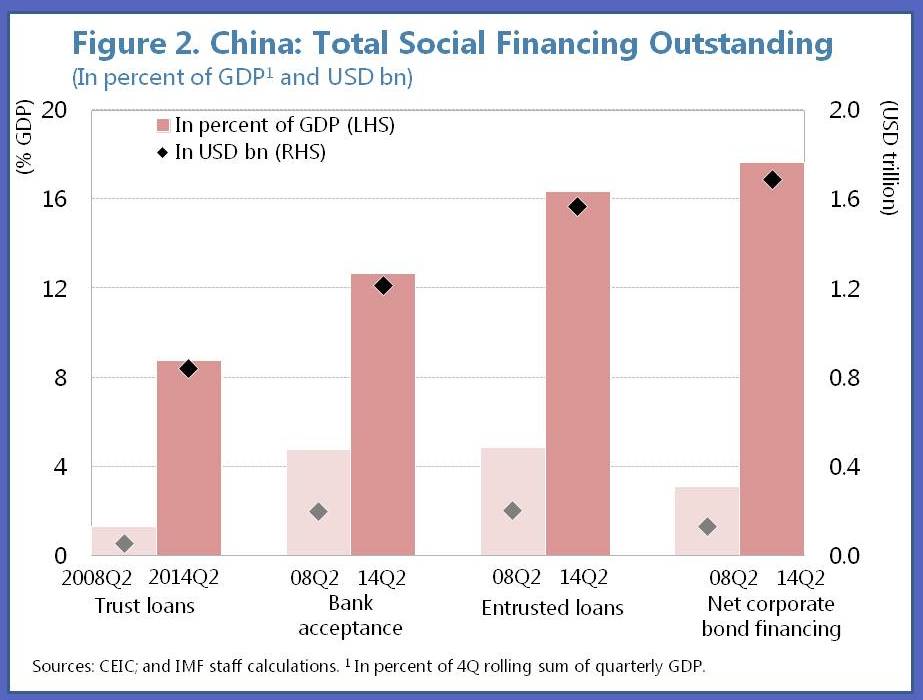

[caption id="attachment_8105" align="aligncenter" width="400"] Trusts, which seem to play a “bank-like” role in lending, have grown assets quickly[/caption]

Trusts, which seem to play a “bank-like” role in lending, have grown assets quickly[/caption]

The pink part—that is shadow bank or nonbank intermediation—consists of the four components in Figure 2:

- Corporate bonds. Yes, corporate bonds are the largest component of so-called shadow banking.

- Entrusted loans. These are corporate to corporate loans, administered by a bank. Company A has excess cash, it lends to company B. The bank is just a necessary bookkeeper with no “skin in the game,” but a needed one, since in China’s system, A cannot directly lend to B.

- Bankers’ acceptances. These are letters of guarantee issued by a bank that its customers can use to finance a transaction. These are “undiscounted” as the bank is issuing a guarantee rather than an actual loan. Once “discounted,” this form of credit is recorded in bank loans.

- Trust loans. This is lending by trust companies. Unlike a bank loan, though, on paper the trust company just brings the borrower and investor together for a fee.

Size of China’s Shadow banking

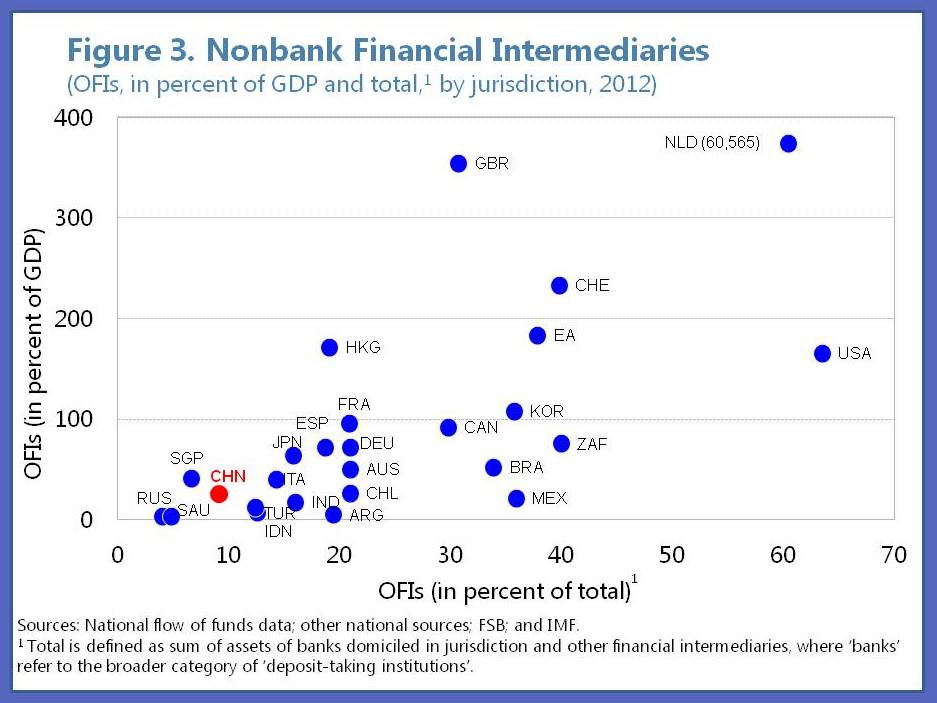

The Financial Stability Board suggests that China’s shadow banking sector is quite small, as in many other emerging market economies. Figure 3 shows that shadow banking in China is relatively low both as a share of GDP and as a share of financial intermediation. But the Financial Stability Board filters out of its estimates those parts of the nonbank financial system that are not formally involved in “credit intermediation.” And there’s the rub. In China, it is often not clear whether shadow banks, such as trusts, really are just loan arrangers or whether they are lending like a bank and taking on credit risk. Reflecting this uncertainty, shadow banking in China could be measured more broadly. Specifically, the pink area in Figure 1 (55 percent of GDP). The forthcoming October Global Financial Stability Report uses an estimate of 35 percent of GDP, as it subtracts corporate bonds (nearly 20 percent of GDP) from the pink area.

[caption id="attachment_8106" align="aligncenter" width="400"] China’s shadow banks, while expanding fast, are still modest in size when compared internationally[/caption]

China’s shadow banks, while expanding fast, are still modest in size when compared internationally[/caption]

Bottom-line: is Shadow Banking a Sweet Smelling Flower or a Thorny Bush?

Both. On the plus side, the expansion of nonbank intermediation marks progress in financial development. It benefits companies by providing alternative ways to borrow. And, it benefits households, by giving them more investment opportunities, which is especially important given the ceiling on deposit interest rates. Therein, however, also lays the thorn.

Shadow banking provides an opportunity to circumvent regulations, such as the deposit interest rate ceiling (but there are many others). For example, rather than putting money in a deposit, a bank’s customer could buy a wealth management product from the bank that offers a higher return. This wealth management product, in turn, may invest in equities and bonds but can also, subject to a limit, invest through shadow banks in assets that look a lot like bank loans.

More broadly, shadow banking moves intermediation outside of formal banking—which has safeguards such as capital requirements, provisions against loan losses, loan to deposit ratios, well-established supervision and regulation—to more uncharted territory. The regulators and supervisors are trying to keep up with this fast-moving sector, with some recent success, but it remains a huge challenge.

At the same time, investors appear to have been largely protected from the inevitable losses that should come with risky lending. It is hard to find a case, for example, of investors in a fixed income trust or wealth management product incurring any losses. This perpetuates the perception that the trust company and/or selling bank, perhaps for reputational reasons, is implicitly guaranteeing the investment. Meanwhile, investors may not appreciate the underlying risk of such products and invest too much of their saving in them.

And, this is just the tip of the iceberg in assessing the benefits, costs, and risks of shadow banking, which is a topic for another day.

The forthcoming October issue of the Global Financial Stability Report will have a broader discussion of shadow banking in China and elsewhere. You can also listen to this recent podcast on shadow banking.