The time has come to end hand wringing on climate strategy, particularly controlling carbon dioxide (CO2) emissions. We need an approach that builds on national self-interest and spurs a race to the top in low-carbon energy solutions. Our findings here at the IMF—that carbon pricing is practical, raises revenue that permits tax reductions in other areas, and is often in countries’ own interests—should strike a chord at the United Nations Climate Summit in New York next week. Let me explain how.

Ever since the 1992 Earth Summit, policymakers have struggled to agree on an international regime for controlling emissions, but with limited success. Presently, only around 12 percent of global emissions are covered by pricing programs, such as taxes on the carbon content of fossil fuels or permit trading programs that put a price on emissions. Reducing CO2 emissions is widely seen as a classic “free-rider” problem. Why should an individual country suffer the cost of cutting its emissions when the benefits largely accrue to other countries and, given the long life of emissions and the gradual adjustment of the climate system, future generations?

From burden to benefits

This argument crucially ignores immediate domestic environmental benefits from reducing CO2. Fossil fuel combustion, especially coal, is a leading cause of local outdoor air pollution which, according to World Health Organization figures, is estimated to cause over 3 million premature deaths a year worldwide—through increasing the risk of heart disease, lung cancer, and so on. Taxing the carbon content of coal will increase its price, and decrease its use, leading to both fewer CO2 emissions and better public health due to cleaner air. A carbon tax would also increase motor fuel prices, which will reduce traffic congestion and accidents as people economize a bit on their use of vehicles. This again spurs domestic economic benefits, at least in countries where people are not already fully charged for these adverse effects through existing motor fuel excises. These health and other “co-benefits” from reducing fossil fuel use add to the gains in economic efficiency that start with pricing CO2 emissions.

Ideally, governments would use other policies to address domestic environmental problems, like charges for local air pollution. However, until these policies are fully implemented (likely a long time), policymakers should look at how the indirect impact of CO2 pricing can help alleviate these problems when they consider shorter-term climate policies.

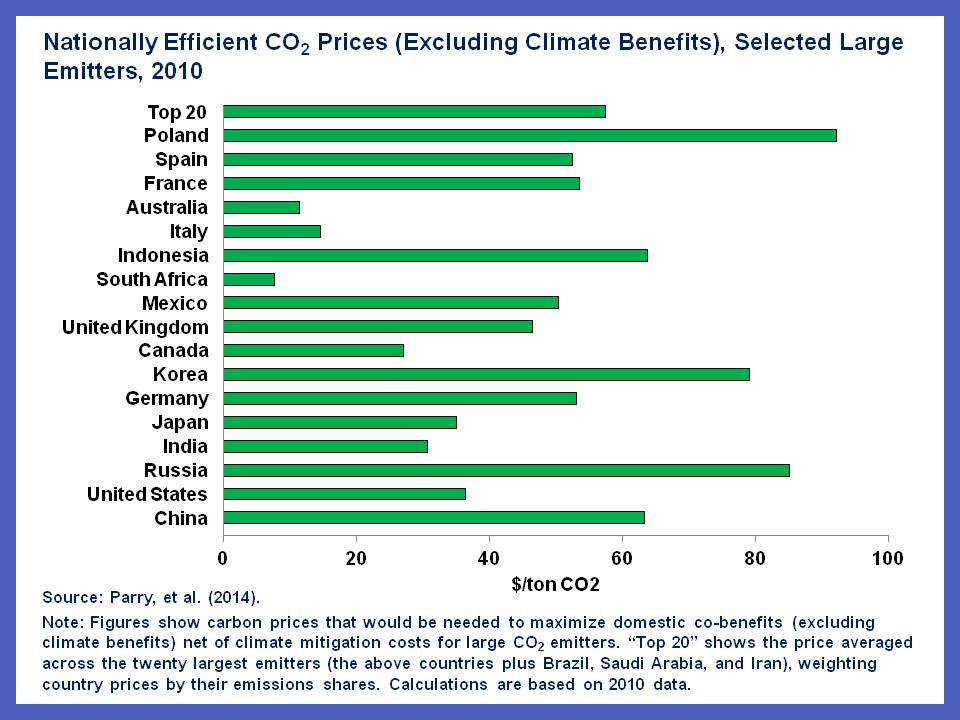

So how important are these domestic co-benefits? A new IMF working paper assesses how much CO2 pricing is in countries’ own national interests by looking at the domestic co-benefits alone—before even counting the climate benefits. The findings, summarized in the chart below, are striking in two regards.

First, a substantial carbon tax (or CO2 pricing through trading systems) is justified by national interests, on average $57.5 per ton of CO2 across the top twenty emitters. This is several times the recent prices in the European Union’s Emissions Trading System, and 60 percent higher than the climate damages per ton of CO2 estimated by an inter-agency group for the U.S. government. The implication is that countries need not wait on an international agreement to move ahead with their own CO2 pricing schemes.

Second, prices that are efficient from a national perspective vary considerably across countries. For example, they are relatively high in China and Poland—where most of the CO2 reduction would come from less reliance on coal and there is high population exposure to coal pollution—and they are relatively low in Australia, where population exposure is far more limited. The implication here is that any international regime should be flexible, allowing some countries (with high co-benefits) to set higher CO2 prices than others (similar to value-added and excise taxes in the European Union, for which member states can set tax rates higher than the agreed upon floor).

A Message for Finance Ministers

CO2 pricing through carbon taxes or trading systems with allowance auctions would also raise significant new government revenues. And, as with any new tax, it is important to use these revenues productively—most obviously to lower the burden of other taxes. Environmental tax reform is generally about smarter taxes not higher overall taxes.

This last point underscores the potentially pivotal role of finance ministries, which to date have largely taken a back seat in climate negotiations, in integrating carbon pricing into broader fiscal reforms. They have good reason to urge effective carbon pricing, and this may not happen without their strong advocacy. And carbon taxes, in particular, would represent a straightforward extension of existing motor fuel excises, which are well established in many countries and among the easiest of taxes to administer, by building a carbon charge into them and applying similar charges to other fossil fuel products.

New York, Paris, and beyond

These findings complement other important work in the area, such as the report recently issued by the Global Commission on the Economy and Climate. They should also hearten participants at next week’s Climate Summit, which is set to catalyze commitments ahead of the pivotal December 2015 meetings in Paris, at which policymakers hope to finalize an international climate agreement. There is no need for action to await coordinated measures adopted by many countries—a lot can be achieved simply by looking at national self-interest.

[youtube https://www.youtube.com/watch?v=nCCkKu09CJE?rel=0&w=560&h=315]