Academics and policy-makers alike have long struggled with the question of whether to use monetary policy to dampen asset price booms – whether to “lean against the wind” or not. Can officials identify emerging asset price bubbles, what are the implications of bursting them, and is monetary policy the appropriate response to potential bubbles? These questions have become even more important to the policy debate in the wake of the global financial crisis, which was preceded by an unsustainable boom in sub-prime mortgage lending and housing prices.

Given over six years of near zero policy interest rates, should the U.S. Fed now use interest rates to lean against potential financial stability risks that may have built up?

We argue the answer is “no.”

Rather, the Fed (and other U.S. officials) should gear their efforts toward strengthening the network of policies, rules and regulations to keep the financial system as a whole safer—known as macroprudential policy. They should also address gaps in regulation and supervision. Our recent study, provides a framework for thinking about this issue.

In theory, a potential benefit from leaning against financial risks

We find that an unexpected increase of policy interest rates—for example to prick an emerging asset price bubble—does not reduce risks to the financial system. Such a policy reduces output, inflation, and asset prices without fundamentally mitigating financial risks.

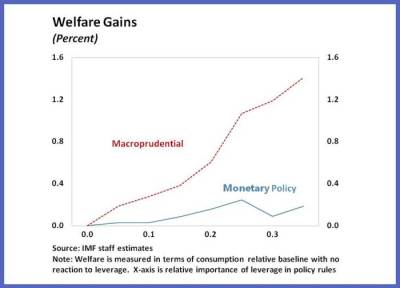

However, using monetary policy systematically to react to financial risks, such as excessive risk-taking, as they build over time could be worthwhile. Financial market participants respond to the expectation of future monetary policy actions by taking fewer risks in the first place. As a result, a simple policy rule that responds to higher financial sector “leverage”,— using borrowed funds to finance investments—could improve economic outcomes (see figure). Sacrificing a modest amount of growth today would reduce the risk of economically costly financial crises in the future.

In practice, still a ways to go

As is often the case, the theoretical findings turn out to be easier said than done in practice.

- First, for the policy to work, financial sector leverage needs to be pro-cyclical. However, here the evidence is mixed. Leverage tends to move with the economic cycle during some periods and for some types of intermediation. But this is not always and everywhere true. Another paper by our colleagues, for example, finds that the nature of credit cycles varies a lot depending on whether we are talking about commercial banks, investment banks, insurance, asset management or other sources of financial intermediation.

- Second, for the policy to be effective, it requires a clear diagnostic as to why leverage is increasing that is available with sufficient foresight to head problems off early, before they impact the financial system as a whole. Misreading the reason for the increase in leverage can lead to costly policy mistakes.

- Third, targeted macroprudential policy appears to generate better results (see figure), largely because, unlike policy interest rates, it is unburdened with trying to also achieve inflation and output objectives at the same time.

- Finally, a systematic leaning-against-the-wind policy requires a credible policy framework. The central bank needs to clearly communicate its objectives, making clear it is willing and able to react to what it views as financial excesses.

To sum up, the Fed should deploy supervisory and regulatory tools to build financial resilience and manage risks to the financial system. Our framework suggests that while there are, in theory, potential benefits from monetary policy leaning against the wind, more work is needed to make this a viable option in practice. Therefore, priority should be giving to accelerating research on the theoretical and empirical nexus between interest rate changes and financial vulnerabilities, working to identify appropriate measures of the financial cycle, and expanding our understanding on how and when monetary policy might best be used to tackle financial stability risks.