A single policy could do it all for China. A carbon tax—an upstream tax on the carbon content of fossil fuel supply—could dramatically cut greenhouse gases, save millions of lives, soothe the government’s fiscal anxieties, and boost green growth.

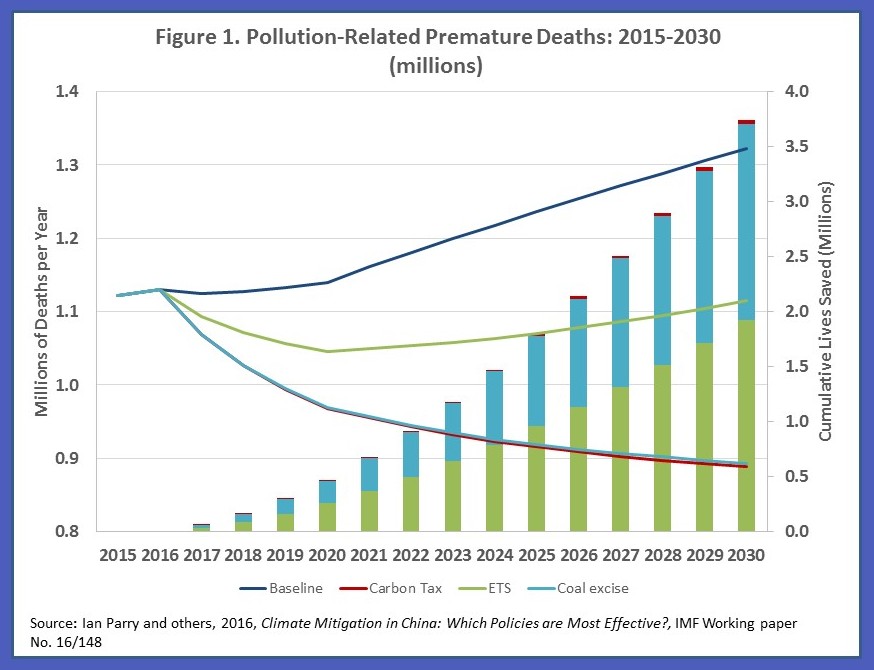

According to IMF estimates, a tax on carbon dioxide (CO2) emissions, rising by $5 per year between 2017 and 2030, could reduce CO2 emissions by 30 percent in 2030, well in excess of what is needed to fulfill China’s pledge for the 2015 Paris Agreement on climate change. The carbon tax could also save close to 4 million lives during this 14-year period (Figure 1), principally by deterring use of coal, the main source of the fine particulates that elevate the risk of strokes, heart, and lung diseases. And the tax would raise well over 2 percent of GDP in new revenue by 2030, a huge bonus which represents more than enough to double government spending on healthcare.

In fact, this is good news for the planet given that China is by far the world’s leading producer of CO2 emissions, contributing 25 percent to the global total in 2013, compared with 16 and 6 percent from the United States and India, respectively, the world’s second and third largest emitters.

Predicting the effects of a carbon tax

These findings are based on a new spreadsheet tool developed at the IMF, for projecting future fuel use by economic sector. Using assumptions about how fuel demand would respond to price changes, and previous IMF estimates of local air pollution deaths from fuel combustion for China, we are able to assess the carbon, public health, and fiscal impacts of carbon taxation. The future is of course inherently uncertain so the numbers should not be taken too literally, but they do at least provide a broad indication of the likely impacts of carbon taxes.

Moving it forward

Administering a carbon tax is straightforward. It involves a tax on fossil fuel products at their point of entry in the economy with rates levied on coal, petroleum products, and natural gas based on the tons of CO2 produced per unit of fuel. The government could collect the tax at the mine mouth for coal (where royalties are already collected) or at coal processing plants, at the refinery for petroleum products, at the border for imported fuel products, and so on.

Yes, downsides exist, but they are manageable. The most difficult challenge is dealing with the burden of higher energy prices on vulnerable groups, though impacts should not be overstated—in 2020, for example, the carbon tax raises electricity prices by around 5 percent.

Our analysis reveals that a carbon tax imposes a disproportionately large burden on low income households, 50 and 25 percent larger for the lowest 20 percent of income earners, compared with the top ten percent of income earners, given that low income households spend a greater share of their budget on energy. The good news is that only about 5 percent of the carbon tax revenues would be needed to compensate the bottom twenty percent, for example, through reduced social security contributions and increased welfare and social spending (areas where China has been lagging relative to advanced and other middle income countries).

How about the impact on export sectors? Here again, our analysis shows that exporting sectors do not bear a disproportionate share of the tax burden compared with other sectors. Moreover, compensation for these industries would again use up a minor fraction (at most 10 percent) of carbon tax revenues. Any compensation should be temporary however, as firms that cannot compete with energy efficiently priced should eventually cease operation. And the needed compensation could be smaller if more countries follow China’s and others’ lead to mitigate emissions.

To tax or trade?

As China continues its transition to a sustainable growth path, a carbon tax can be a powerful policy to support economic re-balancing and improve the environment.

It is true that China has already committed to introducing a nationwide emissions trading system (ETS) in 2017 for large industrial sources. A carbon tax is still imperative, however, because by comprehensively covering fuels and emissions, it has about twice the environmental and revenue impacts of an equivalently scaled ETS. There is no reason the tax cannot be introduced in tandem with the ETS for the interim (perhaps allowing carbon tax refunds for entities required to obtain emissions permits), as what matters is establishing a robust and far-reaching emissions price to reap the badly needed health and fiscal benefits—while at the same time taking a major step forward in addressing the global environmental challenge of our time.