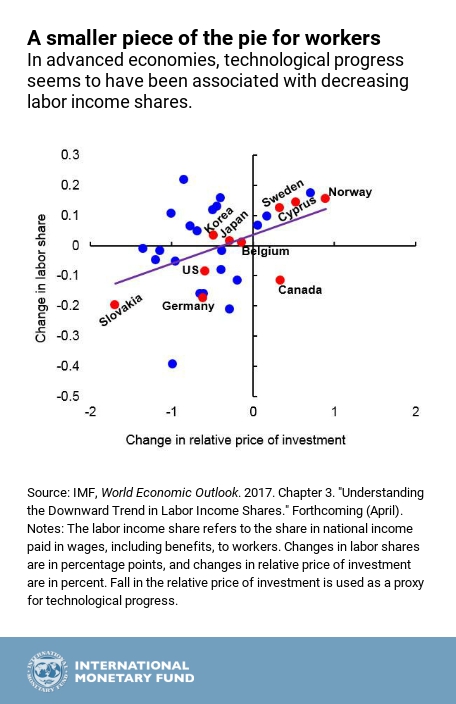

As discussed in the IMF’s G20 Note, and a blog last week by IMF Managing Director Christine Lagarde, a forthcoming chapter of the World Economic Outlook seeks to understand the decline in the labor share of income (that is, the share of national income paid in wages, including benefits, to workers) in many countries around the world. These downward trends can have potentially large and complex social implications, including a rise in income inequality.

This chart shows that advanced economies that experienced a larger decline in their price of investment goods (such as computers, and other information and communications technologies), relative to consumption goods, saw a larger decline in their labor share of income. Declines in the relative price of investment goods across countries were, to a large extent, driven by rapid advances in technology. But these declines varied across countries depending on their investment and consumption patterns, including their reliance on commodity trade.

For example, the decline was larger in countries with a higher share of machinery and equipment in their overall investment (e.g., US and Germany), while it was smaller in countries reliant on service industries, particularly tourism and finance, such as Cyprus, Belgium, and Sweden, or on commodity exports, such as Canada and Norway. A larger decline in the relative price of investment goods in turn, presented firms with stronger incentives to replace jobs with machines, more so in countries and sectors with a higher share of so-called “routine” occupations, particularly in the manufacturing sector.

The chapter also looks at strategies policymakers can consider to support displaced labor. Some policies may be temporary in nature, for instance unemployment benefits, or active labor market policies, such as job training or subsidies. However, policymakers need to also consider policies of a longer-lasting duration, including retooling of income policies and tax systems. Further, redesign of education and training policies to prepare people for rapid technological changes will be key.

See recent blog on Maintaining the Positive Momentum of the Global Economy by the IMF Managing Director, Christine Lagarde, and the IMF G20 surveillance note.

Stay tuned for the launch of the World Economic Outlook Analytical Chapters on April 10.