July 13, 2017

Versions in عربي (Arabic), Bahasa (Indonesia), 中文 (Chinese), Español (Spanish), Français (French),

日本語 (Japanese), Русский (Russian)

A trader in Seoul, South Korea: Asia is the largest contributor to global growth (photo: Ryu Seung-il/Polaris/Newscom)[/caption]

A trader in Seoul, South Korea: Asia is the largest contributor to global growth (photo: Ryu Seung-il/Polaris/Newscom)[/caption]

Asia today is the fastest-growing region in the world, and the largest contributor to global growth. It has six members of the Group of Twenty advanced and emerging economies, and its economic and social achievements are well recognized.

But 20 years ago, July 1997 marked the beginning of the Asian Financial Crisis, when a combination of economic, financial and corporate problems triggered a sharp loss of confidence and capital outflows from the region’s emerging market economies. The crisis began in Thailand on July 2, when the baht’s peg to the dollar was dropped, and eventually spread to Korea, Indonesia and other countries.

The 20th anniversary of the Asian Crisis is a good moment to ask whether the region is better prepared today to address another major economic shock. I would offer a “Yes, by all means.” Of course, important vulnerabilities remain, especially the elevated levels of corporate and household debts in some countries. But the overall picture is one of greater resilience. Let me explain why.

The Asian Crisis was unprecedented in its nature and intensity. It was marked by abrupt swings in external current accounts, deep recessions, surging unemployment, and sharp drops in living standards, especially among the poor.

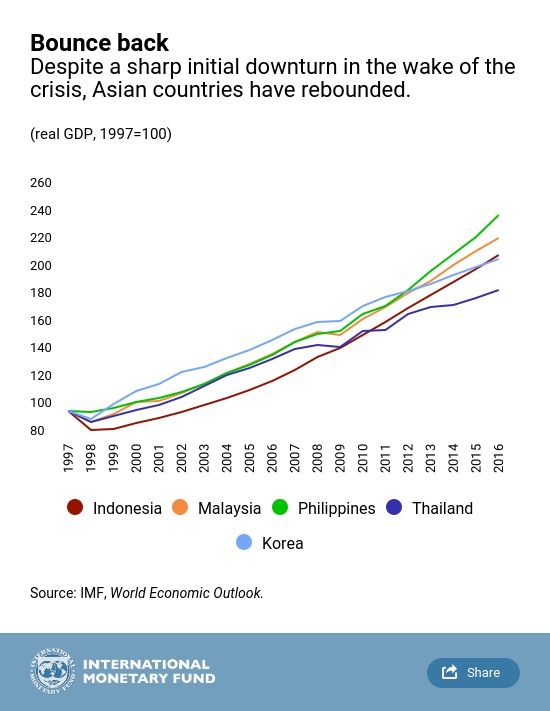

For example, Indonesia lost over 13 percent of its output within one year. As the graph below shows, while the initial downturn in most countries was very sharp, the bounce back was nothing short of impressive. Asia weathered the storm to emerge as a major engine of global growth over the past decade.

The region now is much better prepared to face financial turbulence. In fact, a major global financial crisis already occurred, and the region was well placed to ride out the downturn. The 2008 global financial crisis hit hard in the US and Europe, but Asia experienced only a mild slowdown. Growth remained positive and quickly accelerated again after a small dip.

What was different a decade later? In response to the 1997 crisis, Asian countries undertook strong reforms and addressed the root causes: many adopted more flexible exchange rates; reduced external vulnerabilities; overhauled financial sector regulation and supervision; resolved the private sector debt overhang; and developed domestic capital markets. These reforms clearly made Asia more resilient in 2008.

The IMF and the international financial system also evolved after the crisis. When the Asian crisis hit, the international community, working through the IMF, mobilized around the rescue programs. It is true that the initial design of those rescue packages had to be adjusted as the situation evolved; for instance, after a period of tightening, fiscal policy was eased to cushion the sharp downturn. The crisis response and extensive reforms undertaken by the countries helped restore confidence and lay the foundations for a rapid and sustained recovery.

In subsequent years, we undertook a serious effort to learn from these experiences and improve our policies and toolkit. The effort resulted in extensive reforms of how the IMF assesses fiscal, monetary and financial vulnerabilities, and how country programs are structured. These lessons were subsequently applied during the 2008 and Euro Area crises.

For example, we now devote a lot more attention to assessing financial vulnerabilities on a national, regional, and global scale. Our lending programs are more streamlined, focusing on what is critical for resolving a crisis, and place a high priority on safeguarding social spending to protect the poor and vulnerable. The IMF also reformed its governance, increasing the voting share and representation of Asian countries.

The global financial safety net has also been strengthened, through bilateral swap lines and regional financial arrangements. After the 1997 crisis, Asian countries played an important role by boosting their economic defenses and putting in place a regional safety net, of which the best-known part is the Chiang Mai Initiative Multilateralization (CMIM). The Fund also has been working continuously to strengthen the global financial safety net by working closely with the ASEAN+3, CMIM, and other multilateral organizations. Our member countries have also committed additional bilateral loan resources to the IMF to boost its lending capacity to almost $1 trillion.

While Asia is much more resilient to shocks compared to 20 years ago, it also faces new challenges including high corporate and household leverage and rapid population aging in some countries and risks from more inward looking policies in the advanced economies. In this environment, Asia needs to continue its reforms and invest for the future to build resilience. Here, the IMF is actively supporting member countries’ efforts to strengthen their policy frameworks and pursue more inclusive economic growth. At the same time, Asia should continue to foster closer trade and financial integration within the region and with the rest of the world to ensure that it remains a major contributor to global growth and stability.

While more work remains to be done, we’re also sure that Asian economies are better prepared and in a stronger position to weather new financial storms, thanks partly to Asia’s tremendous sacrifices and reform efforts in response to its own financial crisis twenty years ago.