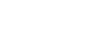

Maya Forstater: The Truth About Illicit Financial Flows

Maya Forstater says illicit financial flows are not easily found in macroeconomic statistics because people go to great lengths to hide them. (photo: iStock by Getty Images/Aslan Alphan)

In This Episode

Illicit financial flows have been under the spotlight recently. Both the Panama and subsequent Paradise papers exposed large amounts of money held in tax havens—some under questionable circumstances, and the United Nations has included tackling illicit financial flows as a target within its Sustainable Development Goals. In this podcast, the Center for Global Development’s Maya Forstater talks about how much or how little we really know about illicit financial flows. Forstater was invited to speak at the IMF as part of the Developing Economies Seminar Series.

Join Us on Every Major Platform

Latest Podcasts

BEHIND THE MIC

Bruce Edwards

International Monetary Fund

Bruce Edwards produces the IMF podcast program. He's an award-winning audio producer and journalist who's covered armed conflicts, social unrest, and natural disasters from all corners of the world. He believes economists have an important role in solving the world's problems and aspires to showcase their research in every IMF podcast.

Rhoda Metcalfe

RHODA METCALFE is an independent journalist and audio producer.